- Tariffs are both threat and opportunity

- Not everyone needs to reshore their manufacturing

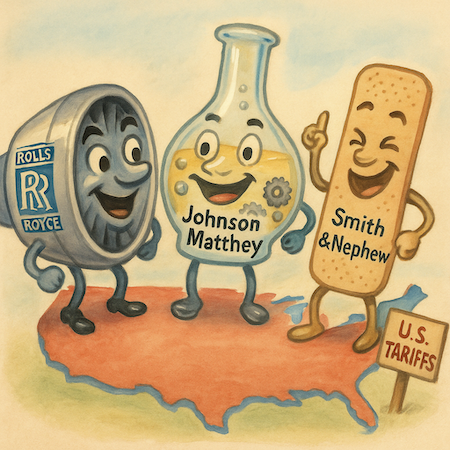

- Three LSE listed tariff dodgers to consider

Trump’s tariffs are back in the news with a bang. On Friday, they triggered a market meltdown. By Monday, it was all just a storm in a teacup after all…

Whatever your take on the trade war, Trump’s tariffs are having a substantial effect on company investment too. Countless stocks have issued announcements about investing inside the US’ borders to dodge tariff barriers.

Many are forgoing investment in the UK at the same time. UK-based pharmaceuticals especially, are shifting their attention out of the UK and into the US.

Coincidence? I think not.

But not everyone needs to reshore their manufacturing. Some companies never left the US…

How to profit from trade wars

There are several ways to profit from Trump’s tariffs. The obvious one is to invest in the US companies on the New York Stock Exchange that’ll benefit most from protectionism.

After all the fearmongering about tariffs in the media since April, that might sound controversial. But the truth is that tariffs create both winners and losers.

Japanese, South Korean and Chinese stocks all boomed on the back of their tariff protections in the past. America became an industrial superpower on the back of the tariffs that protected its industries too.

Instead of debating whether tariffs are good or bad overall, investors should be focused on which companies benefit instead.

What few will realise is that such companies also exist right here in the UK, on the London Stock Exchange. And that means you can invest in them in a convenient and cost-effective way. You just need to know which ones.

The LSE’s “All American” Companies

It’s always made me chuckle, but my English dad is an “All-American”. So says the certificate on his wall, anyway.

An “All-American” is a sporting award given to collegiate athletes in the US for extraordinary achievement. In my dad’s case, swimming at American universities.

Just as my dad became an “All-American” without having to be American, so too can LSE-listed stocks. All they need to do is follow Trump’s orders: run their manufacturing, mining and other operations in the USA instead of importing and selling.

After all, Trump is being protectionist, not nationalistic. The purpose of tariffs is to move foreign production to the US, not transfer ownership of the means of production to Americans.

So, foreign companies with operations in the country stand to benefit from his policies too. Their mines will be approved, their factories subsidised, their refineries favoured and their operations supported. As long as they’re American enough to dodge tariffs.

So, which companies are American enough to become Trump’s LSE-listed darlings?

Here are three to consider…

1. Rolls-Royce Holdings plc (RR.L)

Rolls-Royce manufactures its jet engine components and runs its maintenance operations in Indiana and Mississippi. “More Rolls-Royce products are built in Indianapolis than anywhere else in the world,” the corporate website proudly declares.

Its Power Systems Division has facilities in Michigan and manufacturing in South Carolina and Minnesota. It also has a product training centre and distribution centre in Michigan.

2. Johnson Matthey plc (JMAT.L)

This engineering and chemicals company may not have the branding President Trump would approve of. But it does far more than push the green energy transition. It’s also active in platinum group metals and petrochemicals.

More importantly, it manufactures catalytic converters and battery materials in Kentucky, Pennsylvania, and Michigan. If Trump wants to revive the US auto industry using locally manufactured goods, this British engineering company will benefit.

3. Smith & Nephew plc (SN.L)

This company does the UK proud with its cutting-edge medical products…many of which it produces surgically in Memphis, Tennessee. Its Advanced Wound Management Division is based in Texas.

The CFO just moved across the Atlantic to reflect the company’s growing priorities there. So, we can expect an expansion inside the US’ borders.

Tariff dodgers are turning chaos into opportunity

These three stocks all have substantial operations and manufacturing in the US. That dramatically reduces their exposure to tariffs. If the trade war accelerates, they’ll fare better than companies having to move and set up operations from scratch.

But there are many more opportunities like them waiting to be discovered.

Until next time,

Nick Hubble

Editor at Large

P.S. Trump’s tariff threats may rattle markets — but they also create a window of opportunity. As the article shows, some UK-listed firms are already positioned to benefit by operating inside the US. This aligns exactly with what James Altucher’s Wealth Window is all about: finding the real winners in a changing world. If UK capital is flowing west — and UK companies are following — it’s worth asking: is your portfolio prepared? Get the details here.