Latest News

Is AI warfare the next big defence stock opportunity?

3 March 2026

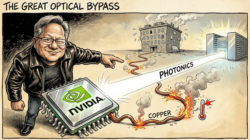

Nvidia no longer has a demand problem

2 March 2026

Nvidia dominating earnings is as predictable as the sun rising

28 February 2026