In 1999, David Elias wrote and published a book called Dow 40,000.

In 1999, David Elias wrote and published a book called Dow 40,000.

The subtitle was ‘Strategies for profiting from the greatest bull market in history.’

Elias, according to the book’s inside back cover, was the president and chief investment officer of Elias Asset Management Inc.

He had more than 25 years of experience. He appeared regularly on CNBC, CNN, and the Nightly Business Report.

He also contributed to or was quoted in various business publications.

In other words, he was no clown.

Not only did Elias predict the Dow Jones Industrial Average would hit 40,000 points. He predicted it would get there by 2016.

That was just 17 years from when he published his book in 1999.

You don’t need a first-class honours degree in history from Oxford to know what happened to the markets next.

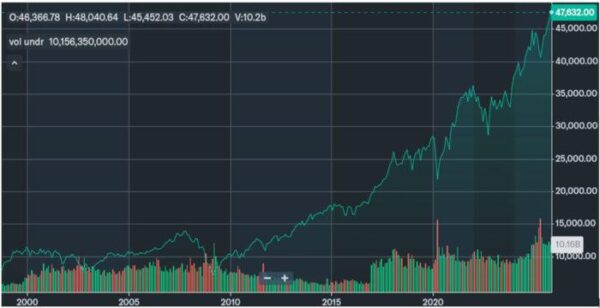

But to refresh your memory, the market climbed to around 11,000 points the following year, before falling into a bear market that lasted until 2003.

For a while, Elias’s prediction became a bit of a joke among some folks. They saw him as a shill for the stock market… the kind of CNBC self-promoter who believed stocks could only ever go up.

After all, to publish a super-bullish book in 1999, just before a major bear market was… well… bad timing.

As a reminder, at the time, the Dow was around 10,000 points and would only rise another 10% or so before the fall.

That’s far from the fourfold increase he predicted.

And yet, when considered with the benefit of hindsight, Elias wasn’t far off the mark. And his prediction wasn’t as outrageously bull-market-bonkers as his critics would claim.

On page 10 of his book (your editor owns a copy), he displays a table showing the average annual returns required each year to hit certain levels.

To get from 9,000 points in 1998 (we assume that’s when he actually wrote the book and did the sums) to 40,000 points in 2016, the Dow Jones Industrial Average would need an average annual growth rate of just under 9%.

If it had achieved a growth rate of 12%, the Dow would have hit 69,210 in 2016. As it turns out, the Dow barely managed to get to 19,000 points by the end of 2016.

A big miss, right?

Well, from 1998 to 2016, the average annual growth rate was just 4.24%. But from 1998 to when it actually hit 40,000 points in 2024, that was an annual growth rate of 5.9%.

So, was he overly optimistic? Clearly.

Was he right – eventually – about the Dow hitting 40,000 points? Yes.

Did it achieve that goal despite the dot-com crash, the economic meltdown in 2008/2009, the Covid crash, recessions, wars, and bailouts?

Yes, it did.

So why did so many people doubt the possibility?

So, here’s where we’re taking you. We’ve mentioned in recent weeks that the best thing any investor can do is to keep things simple.

Don’t mess around with trying to pick individual stocks or even individual sectors for the majority of your portfolio.

You should invest the lion’s share of your liquid wealth in low-cost index funds or exchange-traded funds. We assume you have a bias to UK stocks, so we recommend you invest most in a UK and/or European ETFs.

You should also allocate a reasonable and meaningful percentage into US index ETFs.

The reason we suggest this is that we’re going to one-up David Elias. We forecast the Dow Jones Industrial Average hitting 120,000 points over the next 16 years.

That would achieve an average annual growth rate of 7.1%. If we’re wrong, and it only hits 100,000 points, that’s still a 5.89% annual growth rate.

Does that sound outrageous? It doesn’t to us.

And next week, we’ll show you why.

Cheers,

Kris Sayce

Editor & Publisher, Investor’s Daily

P.S. If a steady 5% annual gain can turn 9,000 into 40,000 over time, imagine what happens when an entire financial system gets rewritten almost overnight.

That’s what James Altucher believes is happening in crypto right now: a once-in-a-generation transformation of money itself. He’ll be explaining it all during his live broadcast Tuesday, including which coins could lead the next decade of compounding growth.

It’s free to attend, but registration closes tomorrow at 4 PM GMT. Reserve your place before it’s too late.

What you may have missed…

AI is going off grid, with or without you

Is the climate panic over already? We’ve barely gotten started on net zero! What form of alarmism could possibly be next? Actually, a very energy hungry one… Read more here…

Fringe Theories for a Faulty Financial System

Volatility is back with a vengeance. Stocks, bonds, gold, crypto — everything’s moving, often in opposite directions. But beneath the surface, something bigger is happening. Read more here…

AI’s power problem rests in the hands of “transitioning” miners

When Satya Nadella says Microsoft has enough GPUs but not enough power, you know we’re about to enter a new phase of hype cycle. Read more here…

Can the UK economy still be saved from its government debt?

The trouble with fiscal delusions is that they can last dangerously long. By the time a Chancellor realises they’re wrong, they’ve long since retired. On a snazzy pension, of course. Read more here…

The Great Divergence and Why Fear is the Real Bubble

There’s a chart doing the rounds this week that says more about the state of global innovation than a thousand political speeches. Read more here…