Is the UK Heading for a Recession?

Is the UK Heading for a Recession?

That’s the question doing the rounds — in headlines, economic forecasts, and investor inboxes.

It’s not impossible. And given how often it’s mentioned, it’s no wonder people are worried.

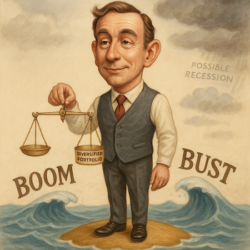

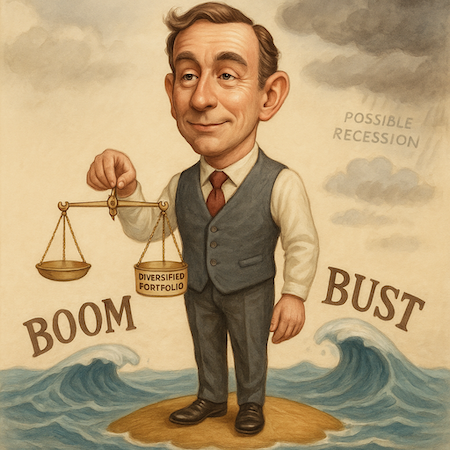

But whether or not a recession officially arrives, there’s a bigger point worth making: downturns are a normal part of the economic cycle. They are not rare. And they should never come as a surprise.

The UK economy last entered recession in 2023. Before that, it was 2020 — during the peak of Covid. Some may recall 2008. Others, the early 1990s.

What do all of those periods have in common?

They came. They passed. And markets recovered — usually strongly — after each one.

Which is why it’s so important to resist emotional decisions in the moment. Panic-selling or over-correcting your portfolio at the first sign of bad news often causes more damage than doing nothing at all.

This Time Might Be Different (But It Usually Isn’t)

Recession fears are reasonable. Inflation remains stubborn. Interest rates are still high. And household debt — particularly for mortgage holders — continues to bite.

But every recession is different. Some are deep and painful. Some are mild and short-lived. No one knows exactly what form the next one might take. That makes it all the more important to focus on what can be controlled — namely, your own investment approach.

3 Things You Can Do Now

If you’re concerned about recession, here are three smart steps to take. regardless of what happens next:

- Reassess your portfolio structure.

Make sure you’re not too exposed to one sector, region, or asset class. A well-diversified portfolio is your best long-term defence against volatility. - Focus on quality.

Companies with strong balance sheets, pricing power, and steady cash flow tend to hold up better during downturns. Now is a good time to check what you’re holding and why. - Use volatility to your advantage.

Recessions can bring opportunity. Sharp market drops often result in attractive entry points, particularly for long-term investors. If your portfolio is solid, consider using pullbacks to add to positions you believe in.

Recession Isn’t the End — It’s Part of the Process

Economic cycles are inevitable. The UK economy, like every other developed economy, will go through periods of growth and contraction.

That shouldn’t frighten anyone. It should focus your attention.

If you’ve been sitting on the sidelines… waiting for the “right time” to invest… or unsure how to respond to all the headlines — now is the time to revisit your strategy, not abandon it.

The last few recessions have taught investors a simple truth: the best way to prepare is to stay disciplined, stay diversified, and stay invested.

Cheers,

Kris Sayce

Editor & Publisher, Investor’s Daily

P.S. Whether the UK is heading into another recession or not, one thing is clear: markets always move in cycles. That’s why James Altucher believes now is the time to take advantage of what he’s calling a “Wealth Window” — a rare alignment of market forces creating a unique opportunity for British investors. If you’re revisiting your portfolio, this is one shift you won’t want to miss. See what’s opening.

What you may have missed…

Superintelligence is Beyond Reach

AI is everywhere. But is it everything investors hope it will be? This article breaks down the real limits of artificial intelligence—why superintelligence remains a fantasy, why profits are elusive despite billions in spending, and why small language models (SLMs) may be the tech story no one’s watching… yet. Before you chase the next big AI stock, read this. Read more here…

Gold is warning you about dovecote parliaments

The gold price is going bonkers. Up almost 50% this year. How can an inanimate object surpass stocks, bonds and bitcoin? The answer is fairly simple… Read more here…

Hardline sceptic to stablecoins “as a matter of principle”

Bank of England Governor Andrew Bailey has abruptly shifted his tune on cryptocurrencies. For years, Bailey and the FCA led Britain’s “broadly anti-crypto” stance, warning that bitcoin has “no intrinsic value” and urging people to “only buy if prepared to lose all their money”. Read more here…

We’re all Keynesians now and again

Politicians are back to spending like drunken sailors with access to counterfeit money. Despite bond markets warning them loud and clear not to. Read more here…

Rivers of Money

Cycles…cycles…cycles. Cycles of debt. Cycles of inflation. Cycles of power. And cycles of corruption. Sleep cycles. Wash cycles. Motorcycles. Read more here…