In today’s issue:

- As we know, public sector finances are deteriorating rapidly

- But what about the private sector?

- A new Bank of England lending facility may provide some clues

As the chancellor made clear in her Spring Statement yesterday, not all is well on this Sceptred Isle. Public finances are deteriorating at an alarming rate.

That has partly to do with the rising cost of borrowing. The bond market vigilantes are on the march, pushing up yields.

But that doesn’t affect only public sector finances, but the economy as a whole. Private investment institutions such as insurance companies, pension funds and other investors have seen the value of their bond holdings fall as yields have risen.

Back in 2022, the sudden yield spike following the Truss-Kwarteng “mini-budget” led the Bank of England to intervene on behalf of such institutions, taking a substantial amount of new debt onto its own balance sheet.

Earlier this year, the Bank introduced a new emergency lending facility, the Contingent Non-Bank Financial Institution Repo Facility, or CNRF, designed to address that sort of thing, should it again become necessary. Here’s how the Bank describes it:

The CNRF is a contingent facility, which aims to address episodes of severe dysfunction in the UK sovereign debt (gilt) market. In particular, the CNRF will address gilt market dysfunction arising from system-wide shocks that temporarily increase non-bank financial institutions’ (NBFIs) demand for liquidity, when that demand is outside the reach of the Bank’s existing Sterling Monetary Framework (SMF) liquidity facilities. The CNRF is not intended to provide liquidity support to NBFIs facing idiosyncratic liquidity or balance sheet pressures, or liquidity demands arising from other market events which do not result in gilt market dysfunction. The CNRF will not be activated outside of periods of severe gilt market dysfunction.

When activated, the CNRF will lend cash, against gilt collateral, to participating insurance companies, pension funds and liability-driven investment funds for a short lending term. [Emphasis added.]

While central banks do have the power to print money to purchase whatever qualifying assets, there is no free lunch in economics. For every purported “benefit” there is also an associated cost. Here’s a brief excerpt of what I wrote during the consultation phase last year:

While the Bank has the power to stabilise the bond market by taking ever more securities onto its own balance sheet, that doesn’t do anything to support healthy, sustainable economic growth. Indeed, one could argue it does exactly the opposite, by denying those sectors of the economy that are productive from being able to access whatever funds they would need in order to grow, or they do so at higher cost.

Economists call this “crowding out”, a situation in which relatively unproductive economic sectors receive favoured access to funds. But this is a recipe for long-term economic stagnation.

The UK has already experienced years of economic near-stagnation. By some measures, the economy has actually shrunk since 2008 once you adjust for population growth. (This growth is something the Office for National Statistics has some difficulty in measuring accurately, as recent, large revisions suggest.)

It may be some time before it becomes clear that Labour’s tax increases have failed to generated additional revenue and that government borrowing is rising above forecast. But this is going to be a big topic this year and one that the mainstream financial media are going to find impossible to ignore.

Well, that has all now become rather clear, hasn’t it? We didn’t need to wait so long after all.

By the way, it’s worth noting that participants in the CNRF are to remain anonymous:

In the event that the CNRF is activated we will publish total aggregate borrowing from the facility, but will not publish individual firm-level activity. This is in line with our long-running approach to disclosure for the Bank’s other market operations.

Perhaps the Bank is concerned that revealing whether a given insurance or pension institution is in financial distress might cause members of the public to switch providers, as they are of course allowed to do by law.

But no, we can’t have that now, can we? Best to keep the public in the dark in the event that things really do get dicey as bond yields rise.

I’ve written frequently in recent years that, due to chronic financial repression, bonds are no longer a legitimate long-term store of value. Rather, they are a mechanism for wealth appropriation via inflation.

That insurance companies and pension funds are required by Asset-Liability-Matching (ALM) regulations to hold bonds is a key means of transmission. But as with all transmissions, if mishandled you can grind the gears and damage them to the point they no longer work.

We can’t have that now, can we? Imagine the public waking up and realising that their insurance policies and pension funds are worth only a fraction of what they were told, if not in nominal, then at least in real, purchasing-power terms?

That would really spoil the party.

But as with all parties, this one will come to an end. I can’t predict precisely how, although I do have some ideas.

What I can do is tell you that there are things you can do with your wealth to protect it from such shenanigans or, if you prefer French to Gaelic, legerdemain.

If you haven’t already done so, I strongly recommend you buy gold. While you’re at it, you might also want to buy some mining and royalty companies.

And if you’re looking for an income stream that will at least keep up with if not always exceed inflation, buy basic industrial companies with high dividends. Those remain a legitimate, long-term store of value even if their share prices fluctuate from time to time.

No, they’re not eligible to participate in the CNRF, but that’s entirely the point now, isn’t it?

Until next time,

John Butler

Investment Director, Investor’s Daily

Captain Confusion

Bill Bonner, writing from Baltimore, Maryland

The first 100 days of a new administration are said to be the most important. That is when the new team has the most momentum and enjoys most support. People expect change… and want to see what happens.

So, with more than two-thirds of Trump’s first hundred days already digested, it might not be too early to guess about how the entire meal is likely to go down.

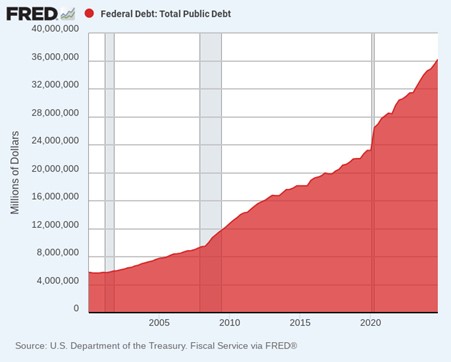

What we noticed in his first time in the kitchen was that the basic menu didn’t change much. Everything when he left was about the same as when he arrived – only worse. The swamp was deeper. The debt was higher. The power of the federal government was greater. And the reach of politics was further. The simplest measure of the totality of it was probably the federal debt itself, which rose from $20 trillion in 2016 to $28 trillion in 2020.

This time, both supporters and enemies say Trump ‘hit the ground running’ with a flurry of executive orders. How many will withstand judicial review? How many will make any difference? What is amazing is how little ground has actually been covered.

Mr. Trump promised to end the war in the Ukraine and the killing in Gaza immediately. Both are still going on. News reports tell us that the Trump Administration is actually deporting fewer dangerous aliens than Biden did.

Sidekick Musk has made some remarkable headlines. But what good does it do to disclose waste and inefficiency if there is no real plan to do anything about them? Was not Team Trump aware that it had to work with Congress to make structural budget changes?

And where are the much-awaited audits of the Pentagon, the CIA and the Fed? Will they ever happen? Everyone knows that a serious look at the military would reveal trillions in waste; why then does the Trump Administration give the green light to spending a hundred billion more?

The most urgent issue facing the Trump Team is bringing federal spending under control. Annual deficits are rising to $2 trillion. The cost of debt service – interest payments – is already over $1 trillion. And at the current rate, total debt will bound over $40 trillion before the end of Trump’s third year. At today’s 10-year bond yield, that would mean a financing charge of around $1.6 trillion – or about twice the entire military budget.

Mr. Trump said he would balance the budget. But there is no sign of it. Nor even a discussion of it. Instead, there is much discussion of Venezuela.

Venezuela must be a sore subject for the president. What he has against the country, we don’t know. But he’s proposing a 25% tariff against anyone who dares even to trade with it.

More broadly, Mr. Trump seems eager to expand US influence… if not US territory. He wants to take back the Panama Canal…to take over Greenland… to absorb Canada as the 51st state. Even his most loyal supporters wonder ‘what’s this all about’ since the whole program seems at odds with his ‘America First’ agenda. Adding Canada to the United States, for example, would make the US a very different country.

So far, the hallmark of Trump II is confusion. Tough guy talk has been leveled at Hamas, the Houthis, college protesters, and anyone who opposes the Trump Regime. But where’s the tough guy talk against what really matters to Americans – their purchasing power? When does the president tell Congress to stop spending money it doesn’t have?

And when do we find out what’s in the still-classified Jeffrey Epstein documents?

Captain Confusion fires volleys to the left… volleys to the right… and volleys in front of him. What are his real strategic objectives? It would be nice to know. And to see an actual plan for achieving it.

DOGE has saved billions… millions… or maybe nothing at all. Where’s that $5,000 DOGE dividend check? Thousands of useless federal employees have been fired. Wait… they are being re-hired. The Republicans are cutting hundreds of billions out of domestic spending budgets… but spending is still going up.

In the absence of any visible, coherent program…observers are trying to insinuate one. Some say the smoke is to hide a Mar-a-Lago Accord, in which the debt is erased and a new currency introduced. Some say the tariffs are just mirrors…to put the rest of the world off balance.

The confusion, they say, will allow us to sell more debt at low interest rates…or maybe just flood the world with dollars. Or maybe the real goal is to set off a real trade war and a depression, knowing that the chief loser will the biggest trader in the world — China.

In a world of chaos, we try to find a theory… a plan… an idea that makes sense of it. Is Mr. Trump playing ‘three-dimensional chess?’ Four-dimensional chess? Chinese checkers?

Regards,

Bill Bonner

Contributing Editor, Investor’s Daily

For more from Bill Bonner, visit www.bonnerprivateresearch.com