In today’s issue:

- The EU and US have entered into major disputes in trade and defence

- Britain appears to be siding with the EU

- That could be a historic mistake

Last year, the British government shifted to the left. Earlier this year, the US shifted to the right. Meanwhile, the EU centre held.

Historically, trade and defence issues do not sit consistently on the left vs right political spectrum. In the 1960s and 70s, trade protectionism and anti-war positions were more associated with the left. But for the past decade or so, they’ve been more associated with the right.

This might help to explain why the US and EU are suddenly at such loggerheads. Not only has the US shifted to the right, but positions on trade and defence policy have shifted with them.

What makes the current situation all the more volatile is that President Donald Trump is conflating the two, quite possibly as a deliberate negotiating tactic to get his way in both.

He’s demanding that Europe pay more for its defence while supporting his efforts to end the war in Ukraine and achieve a general détente with Russia. He’s also demanding fairer terms of trade.

And Europe is pushing back, hard. Sure, they’ll pay more for defence, but they see that as part of standing with Ukraine against Russia. And they say that they will meet any US tariffs or other trade restrictions with retaliatory tariffs or restrictions of their own.

There hasn’t been such a large breakdown in US/European relations since before WWII. What’s happening, for better or worse, is historic.

So far, the current British government is clearly siding with the EU in all this.

That could be a huge mistake.

Why? Because it imperils the “Special Relationship” that Britain has enjoyed with the US for over a century.

Last year, following Trump’s decisive victory in the US elections, including flipping the Senate to Republican control, I wrote the following:

While Brussels might try to treat trade and defence as entirely separate issues, I doubt that Trump will see things the same way. In his mind, Europe has been “free-riding” on US defence spending in much the same way that he sees many countries “free-riding” on exports to the US.

When negotiating on trade, defence may well come up as a topic. Is Brussels really prepared to have a falling out with Trump over both trade and defence at a time when its economy is dead in the water and the Ukrainian resistance to Russia is crumbling?

No, I don’t think so. Brussels will likely seek to do deals on both trade and defence. They just can’t go it alone without US support. Not now. These concerns become all the more immediate now that the German ruling coalition has collapsed. The next government is likely to shift to the right and have a Eurosceptical stance on multiple major issues.

The UK thus has a decision to make: take the initiative now and establish a good working relationship with the US on both trade and defence, or risk isolation from both the US and EU.

Notwithstanding Trump’s support for the “Special Relationship”, some Labour members might be inclined towards the latter course. Regardless, let us hope that they choose wisely.

Well, we’re about to find out whether I’m right. Will Brussels indeed cave to Washington? So far, they appear to be doing the opposite.

And so, Trump has now employed a classic negotiating tactic to break the deadlock: accelerate the timeline.

That’s the implication of Trump switching off Ukraine’s access to US intelligence, including missile targeting and defence systems.

All of a sudden, the Ukrainian army is deaf and blind. They have no way of knowing what Russia plans to do next. Nor any way of defending themselves with any of the Wunderwaffen the US and NATO members have made available for their use. All those systems, some of which probably offered Ukraine important advantages on the battlefield, have been rendered useless.

Previously, European leaders probably believed that the Ukrainian army would be able to hold the line for long enough to secure a settlement more to their liking, one for which they would eventually get US backing.

No longer. Months have turned into days. The Ukrainian army is operationally kaput. Even an orderly retreat becomes challenging when an army lacks intelligence and can’t use its most advanced defence systems.

The British military must know this. Presumably they’ve let the government know. Will Prime Minister Keir Starmer still support putting British “boots on the ground and planes in the air” to support a Ukrainian army that has now been rendered all but incapable of fighting?

Probably not.

All of this puts the government in a difficult position. Is it really prepared to risk the century-old “Special Relationship” with the US over the hopeless situation in Ukraine?

Is it prepared to enter into a major trade war with the US at a time when the economy is already either teetering on the edge of recession, or already in it?

That’s the likely cost of shunning the US and cosying up to Brussels, which brings no clear benefits at all.

The EU economy has been weak for years and, absent cheap Russian gas, relies on expensive LNG and oil imported from abroad. Germany has gone back to burning dirty, lignite coal.

Now bond yields have soared on expectations of massive new government debt issuance. The risks of a further economic downturn are rising.

Should Britain handcuff itself to a corpse?

Of course not. It should leverage its unique position vis-à-vis both the US and EU and work to negotiate a general transatlantic free-trade deal, while recognising that it remains dependent for its security at home and abroad primarily on the US, not the EU.

A transatlantic free-trade deal would be a massive economic boon for all parties involved. It would help to pull the UK and EU out of their economic stagnation.

If combined with a peace settlement in Ukraine, cheap Russian gas might again begin to flow. European “de-industrialisation” would cease.

Nor would Europe need to fear Russia. If transatlantic trade ties were strengthened by a trade deal, then the US would be far more inclined to continue providing for European security, as long as the US believed Europe was paying its fair share.

It is a time for choosing. Let up hope Britain chooses wisely.

Until next time,

John Butler

Investment Director, Fortune & Freedom

March to Bankruptcy

Bill Bonner, writing from Baltimore, Maryland

It is a confusing time. But this week should clarify things.

The basic direction – both the Primary Trend in politics as well as in capital markets – appears to be unchanged.

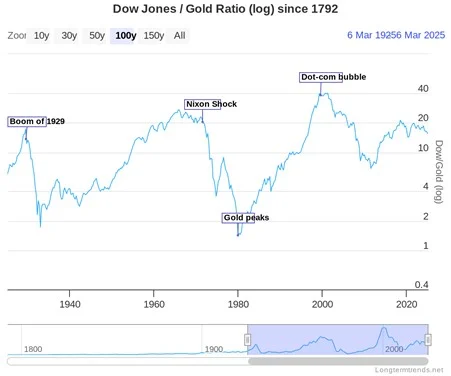

US stocks have been in a long decline since the beginning of this century – peaking out at 40 ounces of gold to the Dow in 1999… and now down to just 14. Typically (though there are only three examples in the last 110 years – before 1924, during the 1930s, and the ten-year period, 1978-1988) the price of stocks keeps going down until it finally reaches its bottom below five ounces.

Our Law of the Conservation of Value tells us that shares don’t go up forever. They go up… and down. From a peak of 40 ounces of gold (registered only once in the last century) to a trough below two ounces (in 1933… and again in 1980).

Since they go up and down, we see no point in buying them when they are expensive. Buy and hold only works if you buy cheap. If we wait, they’ll be cheaper. And that way we’ll avoid the Big Loss.

But what if we’ve got the Primary Trend wrong? In the news there is a lot of talk of ‘disruption’ and ‘change.’ Secretary of the Treasury Scott Bessent, for example, seems to be serious. Bloomberg:

Bessent Warns of ‘Detox Period’ for Economy

Treasury Secretary Scott Bessent warned that the US economy may see some disruption as the Trump administration shifts the basis for growth away from the government and toward the private sector.

Asked about whether President Donald Trump would shift his policy moves to prop up the stock market, the Treasury chief said that there is no such Trump “put,” as stock analysts say.

“There’s no put,” he said. “The Trump call on the upside is, if we have good policies, then the markets will go up.”

If that were true, it would be a very different financial world than we have known in the last thirty years. Until now, the feds have kept an implicit ‘put’ option in the drawer. In the event of a crashing stock market…or recessionary economy (or even some non-economic emergency)… they would rush out the stimmies, like a quack doctor administering nitroglycerine to a napping patient.

But that was before Trump II. The first time around, he was diddled and dazzled by the power elite. This time, Donald Trump has everything under control; or so many people believe.

The Big Man aims to reduce the size and scope of the federal government, they say. And he’s backed by loyal Republican majorities in the House and the Senate.

Here’s the latest presidential post:

“Democrats will do anything they can to shut down our Government, and we can’t let that happen. We have to remain UNITED — NO DISSENT — Fight for another day when the timing is right. VERY IMPORTANT. MAKE AMERICA GREAT AGAIN.

Yes, the battle lines are clear. Republican vs. Democrat. Good vs. Evil. And now, Republicans stand tall… shoulder to shoulder – no dissent!

The trouble with this view is that every one of the abuses and imbecilities perpetrated by the feds over the last 25 years was financed by government spending… and had the active support of both parties. Bush II set the pace, with $6.3 trillion added to the wrong side of the nation’s ledger.

Then came Obama, who burdened the nation with $8.3 trillion more. Donald Trump managed almost as much damage in four years as Obama in eight, with an increase to US debt of $8.2 trillion. And then along came Biden and another $6 trillion.

We don’t see much difference. The march to bankruptcy continues under Republicans as well as Democrats.

But maybe now MAGA Republicans have seen the light…and are ready to shoulder their traditional responsibility to restrain the Democrats? Or are the reformers simply running into the unstoppable momentum of the $6.7 trillion spending machine that they created?

We should know soon. The feds are running out of money. Several stopgap measures have been proposed. Mr. Trump says he favors the House’s ‘big, beautiful bill.’ But the House’s budget measure shows little sign of any serious cost-cutting. The Hill:

House Republicans on Saturday unveiled a six-month stopgap government funding plan, which seeks cuts to non-defense programs while boosting funding for defense.

Increase spending on defense? Reduce it on non-defense? Net savings = not much.

There’s some discussion of ‘House committees seeking spending cuts;’ they’re unlikely to find any. The machine is meant to spend, not to save.

But we’ll see.

Stay tuned.

Regards,

Bill Bonner

Contributing Editor, Fortune & Freedom

For more from Bill Bonner, visit www.bonnerprivateresearch.com