In today’s issue:

- Quantum is coming, is it wise to have exposure?

- AMD and Nvidia of a decade ago?

- Why are the tech giants all developing this tech?

I’ve been covering quantum computing for a while. It’s one of those real game-changer technologies (like AI) that can spark an acceleration of how our world works at unprecedented scale.

But it’s a rocky road, and the companies at the heart of it, are volatile to say the least.

Many had been research companies, private companies, and then in the market euphoria of 2021 many listed on the stock market via the special purpose acquisition company (SPAC) route.

And many tumbled in price through 2022 and 2023. You have to treat these companies for what they are, edge of the bell curve, development, research companies with the potential to change our world.

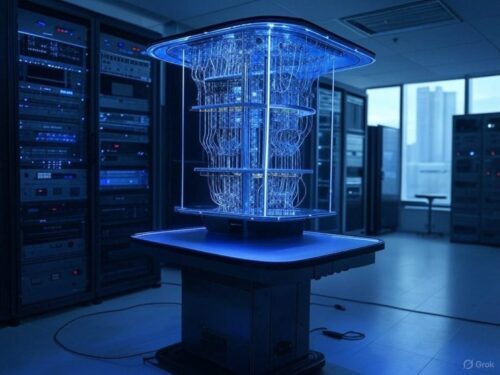

And when you look through the three most prominent publicly listed pure play quantum companies, the long term chart doesn’t make for some wild viewing.

D-Wave traded under 50 cents in early 2023, IonQ got down to around $3 around the same time and Rigetti stock was languishing at about 30 cents – all in early 2023.

So, today at $11, $25 and $11 respectively is this the beginning or the end for these hugely volatile companies? Here’s my take on it all… Remember on 17 December 2024, when I wrote:

…AI and quantum computing go hand in hand – and it will change everything.

In fact, with increasingly good QCs, we’ll see an acceleration in AI – and with an acceleration in AI, we’ll see increasingly good AI.

I bring up quantum computing, because while everyone is still talking about AI, I think that it’s quantum computing companies that could end up being the darlings of the market in 2025.

That was off the back of Google announcing a major development in their own quantum chip program.

And then a little more recently on 24 February when I wrote about Microsoft’s approach to their quantum chip program:

It feels like this quantum story is going to be one of the defining market stories for 2025. And that could mean some of the quantum computing plays in the market end up as some of the most exciting stocks in 2025

Well, the simple question for me comes down to why does Microsoft and Google even have a quantum chip program to begin with?

They’re of course not the only big tech players in quantum. Amazon is developing their “Ocelot” quantum chip and IBM has been developing quantum chips too.

Then there are the other listed players as seen above, D-Wave, Rigetti, IonQ, and then at least a half dozen or so smaller, private companies all working towards the same outcome, fault-tolerant quantum computing chips.

I don’t believe this level of activity, investment and commitment is done without the valid expectation that quantum chips are closer to commercial reality than far away.

It’s why my expectations are that if you have a long term investment horizon, and you have the time to ride the waves and volatility, then buying long term quantum investments today could be like the early days of investing in a company like Nvidia or AMD a decade ago.

It means that companies like Amazon, D-Wave, IonQ, Microsoft, Alphabet, Rigetti, IBM as quantum computing plays may be a smart, long term (and high risk) way to play quantum.

We’ll of course know more over time, but if you’ve got the risk appetite for it, there’s a lot to like about this segment of the market, that I still think is under-appreciated.

Boomers & Busters 💰

AI and AI-related stocks moving and shaking up the markets this week. (All performance data below over the rolling week).

Boom 📈

- Intel (NASDAQ:INTC) up 28%

- Micron (NASDAQ:MU) up 18%

- Palantir (NASDAQ:PLTR) up 14%

Bust 📉

- Teradyne (NASDAQ:TER) down 14%

- Apple (NASDAQ:AAPL) down 6%

- IBM (NYSE:IBM) down 1%

From the hive mind 🧠

- I wrote you about this a couple of weeks ago. Who makes the AI chips controls them. China clearly wants to be the leader in this space. Taiwan is up for grabs, it’s now on the US to get the fabs built and the job done.

- AI that can match humans at any task… any task? Let’s say what we’re all thinking then shall we? Mmmm, maybe not any task.

- This is a big bet by Intel’s new CEO. Maybe it comes off? The chips (excuse the pun) are stacked against them, but maybe an aggressive new approach is exactly what’s needed.

Weirdest AI image of the day

What if Nursey Rhymes were in the modern era…

ChatGPT’s random quote of the day

“Programs must be written for people to read, and only incidentally for machines to execute.”

– Harold Abelson

Thanks for reading, see you next time.

Sam Volkering

Contributing Editor, Investor’s Daily

Now You See Me…

Bill Bonner, writing from Baltimore, Maryland

‘Do you believe, like I believe, in magic?’

– Lovin’ Spoonful

Poor Elon. He deserves some sort of prize. He is both the brightest… and the dimmest… person ever to sully his hands in national politics.

His SpaceX played a vital role in bringing astronauts back to earth. Millions of people rely on his Starlink system for their communications. Over six million people drive his automobiles. Over 600 million use his X. He is a genius and genuine wunderkind.

By most measures, he must be the most successful human who ever lived. He is Augustus after defeating Antony. Napoleon after crowning himself in Notre Dame. Hitler after his triumphal entry into Paris. On top of the world.

After such blinding victories in the commercial space…surely he would have the same stellar success in politics.

But in politics, he acts as if he were born yesterday. The Irish Star:

Appearing on Fox News… “It’s come as a shock to me. This level of hatred and violence from the left… I thought the Democrats were supposed to be the party of empathy and caring, yet they’re the ones firing bullets.” “Tesla is a peaceful company, we’ve never done anything harmful. I’ve never done anything harmful, I’ve only done productive things. I think we have a deranged mental illness thing going on here because this doesn’t make any sense.”

Hello, Elon?

What do you think politics is all about? Who do you think the Democrats are?

Politics has nothing to do with peace. Or doing productive things. It is a dirty business, with confrontations, calumnies, lies, war… murder… prisons… taxes… fraud and bamboozles, including inflation and tariffs. It is not a way to increase wealth, but merely to redistribute it… from the public, to the insiders.

In its tame and respectable form, elections, parliaments and a spirit of consensus make it tolerable. But take away the threadbare cloak of civilization…and all you have is naked violence and hatred.

In its respectable form, too, federal finance is based on taxation and borrowing. But there’s a deeper, nastier aspect. Here’s another revelation from Elon. CoinTelegraph:

US government cost-cutting czar Elon Musk claims to have found at least 14 “magic money computers” in the federal government with the ability to send money from nothing. Musk said the computers, which exist in several federal departments, including the Treasury, Defense, Health and Human Services departments, can essentially issue payments and send money from nothing.

Where did he think the money comes from?

Elon is trying to cut ‘waste’ and introduce more efficiency to federal finances. Democrats scream about budget cuts in their favorite programs. You might think the magic money situation was finally improving. It is not.

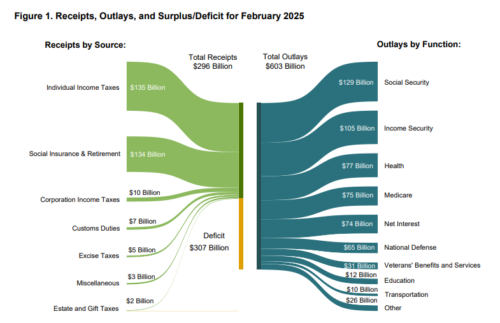

In this regard February was a record setter. The month’s federal accounts showed total revenues of $296 billion. But expenses were twice as much, leaving a deficit of $307 billion. As far as we know, this is the first time that the feds have spent more than two times what they received. For every dollar of revenue, they spent two dollars and change.

Source: US Monthly Statement of the Treasury

Source: US Monthly Statement of the Treasury

The gap was filled, of course, with borrowed money. But without pixie dust the whole fandango would fall on its face. Magic money feeds the stock market… it enables trillion-dollar deficits… it juices the economy with debt and flatters corporate profits.

Were it not for the magic money the $37 trillion national debt couldn’t exist… the Dow wouldn’t be over 40,000…and the feds would have to abandon many of their extravagant boondoggles – including, perhaps, even the empire itself.

The problem with ‘magic money’ is the ‘magic’ part. It can appear… out of nowhere… ‘printed’ up by the feds on demand.

But it can go ‘poof’ too. Over the last five years, trillions of dollars’ worth of real value – in asset prices, and even in the national debt – vanished, thanks to inflation. And there’s a lot more where that came from.

Watch out.

Regards,

Bill Bonner

Contributing Editor, Investor’s Daily

For more from Bill Bonner, visit www.bonnerprivateresearch.com