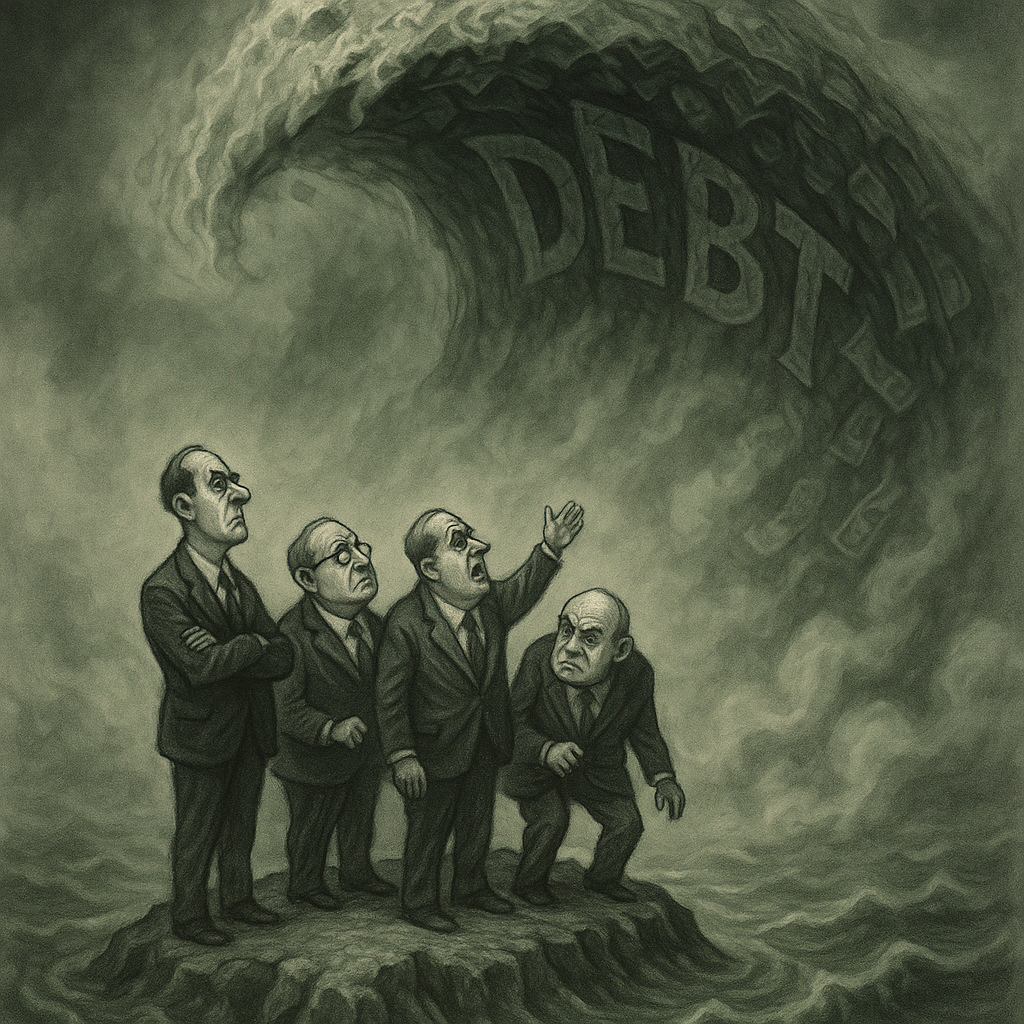

Publisher’s note: This is what fiscal “leadership” looks like in America right now: $60 trillion debt projections, tax cuts for cash tips, and a frontrunner who tells Congress not to “f*** with Medicaid.” Markets are watching. So are we

Publisher’s note: This is what fiscal “leadership” looks like in America right now: $60 trillion debt projections, tax cuts for cash tips, and a frontrunner who tells Congress not to “f*** with Medicaid.” Markets are watching. So are we

In today’s note, Bill Bonner doesn’t just highlight the absurdities—he tracks the deeper trend. The Primary Trend. The one that’s been quietly moving gold, pressuring bonds, and undermining trust in the global monetary system. If you care about the long-term value of your savings—or the stability of any asset priced in dollars—this is essential reading.

Bill Bonner, from the ranch at Gualfin

‘Don’t f*** around with Medicaid…’

–Donald Trump to House Republicans

We remind readers that we do not take sides…nor do we imagine that we know the future. Our goal is merely to try to understand the Primary Trend and thus avoid the Big Loss.

Being on the right side of the Primary Trend is the real key to increasing long-term wealth.

So far this century, investors beat the stock market (the Dow) three to one, just by being in the best, safest asset class — gold. Can that go for another 25 years? We don’t know…that’s why we’re paying attention to the farce now playing out on Capitol Hill.

We also remind ourselves that the Primary Trend is not determined by what people want…or what they expect. Instead, they get what they deserve… shaped by patterns of history rather than the conscious efforts of those who live in it.

In the news yesterday… Barrons:

The bond market’s May meltdown has taken a turn for the worse.

Long U.S. bonds sold off Wednesday, pushing their yields through their 5% ceiling…. Bond yields and prices move inversely. The rise in yields was exacerbated by a disappointing 20-year U.S. Treasury auction.

That 5% level has been the general cap on the 30-year for about two decades, and the security hasn’t closed above it since October 2023. The 10-year Treasury’s yield, at 4.539% on Wednesday, has moved past its own psychological threshold of 4.5%.

Why are bonds selling off? Congressman Thomas Massie told us yesterday. Bond buyers have eyes and ears. They see Congress recklessly passing another big spending/big debt budget…and they “realize we aren’t fiscally responsible.”

Bloomberg:

Congress Pulls Tax Cut All-Nighter With SALT Fight Unresolved

Once the House passes the bill, the Senate could take weeks — if not months — to revise and approve the legislation.

The Republican budget proposal…already more than 1,000 pages of exceptions, qualifications, ifs and maybes… is getting more complicated all the time.

We can simplify. The idea is to pass a ‘big, beautiful bill’ that changes everything… but nothing. Some spending will be cut. Some will increase. Some people will get a juicy plum (keep reading)…others will get lumps of coal. The ‘all nighters’ determine which group has the stamina, insomnia, or lobbyists to get what it is after.

Here’s another headline from yesterday. USA Today:

Senate unanimously approves bill to create tax deduction for cash

The deduction would only apply to cash tips and could be claimed by people who earn up to $160,000, which would rise along with inflation.

Wow. Not a single member of the Senate thinks that tips should be treated like any other form of income. Not a one of them, apparently, is worried about raising deficits by reducing taxes.

This is a sign of a country that is not ready for a major change in direction…one that is not desperate for reform.

And how about this? Donald Trump went over to Capitol Hill. His mission: to make sure Republicans didn’t actually try to cut spending. In addition to telling them not to ‘f*** with Medicaid,’ he told them that he didn’t want ‘anything meaningful’ cut, but was instead focused on ‘waste, fraud and abuse.’

This is what you’d expect…from a leader who is not interested in real disruption. No need to make sacrifices. No need to change course. No need to cut ‘anything meaningful’. Things are basically OK; just trim out the ‘waste, fraud and abuse.’

Are we already headed to a $60 trillion national debt…with interest payments that will take up half of all tax receipts? What’s the big worry? We’ll cut taxes on tips…and make the deficits even larger.

Have Medicare rolls doubled…to 80 million people (Trump himself added 10 million of them during his first term) since Obama expanded the program? Do they not cost $11,600 per person? And couldn’t $4 trillion be saved by turning back the eligibility standards to the pre-Obama era?

Couldn’t America really be made Great Again if some fundamental changes were made?

Nah, never mind…don’t f*** with it.

Regards,

Bill Bonner

Contributing Editor, Investor’s Daily

For more from Bill Bonner, visit www.bonnerprivateresearch.com

What you may have missed…

A memecoin dinner to monetary strategy. Is Trump crazy, or strategically brilliant?

At first glance, $TRUMP looks like a joke—just another memecoin riding the election cycle. But peel back the layers, and you’ll find something far more serious: programmable stablecoins, tokenised assets, and the foundation of an Alt-Stack being quietly built behind the scenes. This isn’t about crypto hype. It’s about reshaping the financial rails before anyone realises they’ve changed. Read more here…

Quantum Isn’t What They Told You

Quantum computing isn’t just science fiction anymore. It’s real, it’s weird, and it could break the internet as we know it. In this episode, we talk to two quantum insiders—one physicist, one founder—about the truth behind the hype, the risks to crypto, and why your passwords may not be safe for long. Read more here…

Jim Rickards joins Steve Bannon to reveal the real reason behind Trump’s Saudi Arabia visit—and why a “Petrodollar 2.0” might be the most important economic shift of the decade. From oil diplomacy to dollar dominance, this interview explores how a new U.S.-Saudi alliance could reshape currency markets, pressure China, and create ripple effects for investors around the world—including in the UK. Read more here…

America’s ‘national’ debt rose from less than $6 trillion in 2000 to over $37 trillion now. The US trade deficit rose to $1.1 trillion over the last 12 months — 10 times more than it was 2000. Read more here…

OpenAI’s $6.5 billion buy isn’t about a device. It’s about robots.

Everyone’s talking about OpenAI’s new device. But when I saw they paid $6.5 billion to bring Jony Ive’s design studio in-house, I didn’t see a gadget—I saw a robot. In this piece, I break down what I think OpenAI’s really building, why it could challenge Elon Musk’s Optimus, and how this new AI arms race might redefine everything from your tech portfolio to your home. Read more here…