What would you do,” was the question on deck.

What would you do,” was the question on deck.

The question was pitched by a Dear Reader, and the batter…your very own editor…took a swing at it.

And not just a theoretical swing. As it happened, he had recently come into a little money and actually did have to make an investment decision.

Today, we take a break from our usual macro rants to look at something specific: what to do with your money now.

Our preference is always to buy land…or private businesses. But you can’t buy either willy, nilly. You need to have a reason…a plan…a purpose…some way to manage it and make it pay. And since time and energy are limited, and your attention is fully engaged elsewhere, you can’t often do it.

A private business is best. Businesses — both private and public (those traded on the stock market) — are where the real money is. You can hold an ounce of gold or a bitcoin from here ‘til kingdom come; you will still just have an ounce of gold or a bitcoin.

A house is much worse. In order to still have a house in 20, 50 or 100 years, you need to keep it up — insurance, taxes, new roof, new carpet. You get a place to live…not an investment.

Businesses give you something more. They combine labor, skill, luck, and resources — all of which come at a cost — and offer a product or service that is worth more than the ingredients that went into it. That is the profit that is at the heart of capitalism and material progress. It is also how most people get rich. They dip their cups into that stream of profits…and fill their own pools of wealth.

In this regard, private — tightly controlled — businesses are much better than ‘public’ companies. That way, you get to enjoy the income, the corporate perks, and tax deductions yourself.

Wall Street companies are rarely profitable for outsider investors. Instead of getting 100% of the profits from a private company, you’ll be lucky to get a 3% dividend yield. And maybe the stock will go up. Or maybe it won’t.

In a large company it is very difficult to hold down costs. And at the top, there is simply too much temptation to spend money on empire building, new technology,unnecessary employees, incentive compensation, pensions, acquisitions, deluxe headquarters, corporate jets and so forth. There are also the unavoidable legal, accounting, and public relations costs of being public. Unless management is diligent and determined, the costs will rise to meet the level of income (or rise above it!) and the employees will soon be taking off for Juneteenth, whatever that is.

Archer Daniels Midland, however, turned a $1 dollar investment in 1925 into more than $50,000 today. And John Deere returned more than $70,000 on a $1 investment. But a finance professor from Arizona concluded that more than 50% of stocks “had negative cumulative returns” over the long run. And studies show that very few companies actually produce life-changing gains for outside investors.

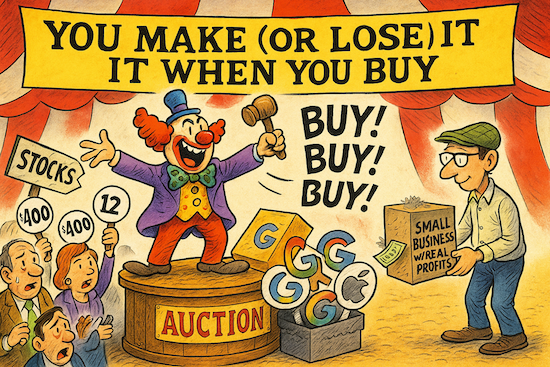

It’s almost miraculous that any of them do. The pool of private capital — managed by serious professionals — is as wide as the Atlantic. Owners take their companies public only because they believe that amateur investors will pay more for them than the pros. So, the shares often are purchased at prices above what they are really worth.

There’s a saying on Wall Street that “you make your money when you buy.” Trouble is, you also lose your money when you buy…when you pay too much.

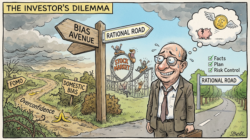

Nevertheless, profit-making, wealth-increasing companies are where we really want to be. The trick is to get them at reasonable prices. And for that we look for exceptional situations…where additional research into a poorly analyzed sector uncovers rare opportunities. (This is what Tom does with shipping stocks, for example.) Or, more broadly, we rely on our Dow/Gold trading model to tell us when stocks, generally, are cheap enough to buy.

From an allocation standpoint, we’ve been sitting on the sidelines for nearly three decades — watching the Dow/Gold ratio fall from over 40 down to 12.5. During that time, we missed the tail end of the Dot.com bubble…then we missed the bubble in housing in 2007/2008…and the final Everything Bubble after the Covid spending spree. Stocks shot up…fell…and shot up again. “Buy the f**king dip,” said the speculators. Stock market investors, who held on through thick and thin now have assets worth about four times as much as when they started (in 2000).

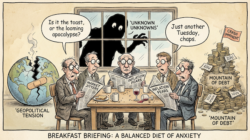

What has really happened, of course, is that the dollar has gone down. In terms of the goods and services they offer, the companies listed on the stock exchanges are not really worth much more than they were in 2000. Gold is still Number 79 on the periodic table; it hasn’t advanced either.

And we are still waiting for the Dow/Gold ratio to sink to five. Either the price of gold doubles…or stocks get scissored in half…or they meet somewhere in the middle.

Waiting is not very exciting. After all, we could have bought Nvidia! But we’ve been paid well for waiting, so we don’t mind. Gold has gone up about 13 times (in dollar terms) since 2000, more than three times as much as stocks.

In the meantime, where to invest new money? Stocks are so pricey, the gains are likely to be small, or negative, over the next ten years. And gold has already run up from around $270 to $3,382 today. Would it be ingratitude to expect more?

Regards,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily

P.S. If you want to know where the real profit engines are being built — not just in theory, but with policy support, executive power, and legal teeth behind them — don’t miss the full breakdown of Executive Order 14179. It’s not just a U.S. story. It’s a generational turning point in global markets. And it closes June 25th. See what this order means for your money.