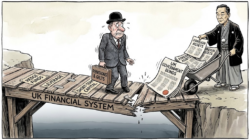

Editor’s note: While this piece is written from an American perspective, British investors should pay close attention. The same forces Bill Bonner describes — runaway deficits, rising interest rates, and overvalued markets — are very much at play here in the UK. In fact, the Bank of England is grappling with similar dilemmas around inflation, bond yields, and fiscal drag. So when Bill asks “what should you do with your money now?” — it’s a question every UK investor must answer too. Stay tuned for more insights in the days ahead.

“What would you do,” was the question on deck.

Your editor took a swing at it yesterday. He tries another pitch today.

Yesterday, we opined that the best place for money is always in a business — as close to you and as tightly controlled as possible. In the financial world, proximity is prosperity. The more you know about a business…and the closer you are to it…the more money you are likely to make from it.

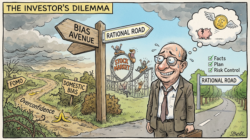

But such opportunities are not available to everyone…and not available all the time to anyone. Most of us don’t have a friend, working out of his parents’ garage, who is making something he calls a “personal computer.” So, we have to go into the ‘public’ markets…and make ‘allocation’ decisions. That is, we have to choose a broad category of investments in which we, as public market investors, can participate. Stocks? Bonds? Gold? Commodities? Real estate?

Our instinctive preference is for farmland. But again, you have to know what you are doing…and be prepared to manage it in such a way that it is profitable. Not easy!

In the US, cropland sells for an average of about $5,500 per acre. Cropland rents are small, reportedly under $200/acre, leaving the owner with a small return on his money. To do better, he must go into the farming business, a notoriously low-return, high risk industry…and for the amateur, almost always a way to lose money.

“It’s the eye of the owner that fattens the cows,” say the ranchers of Argentina. Whether he is investing in mining companies…IPOs…or Kansas farmland, it’s the investor who is on-site…who has years of experience…whose eyes rarely leave the ball…who will do well.

Farming, perhaps more than other industries, is a “losers’ game.” Amateurs lose because they don’t know what they are doing. But the way to win in farming is simply not to lose. It is an enterprise in which flashes of brilliance and thinking ‘out of the box,’ are unlikely to pay off. There are few ‘box office hits’ in the wheat fields.

The successful farmer is the one who stays in the box…sticks with the tried and true…and doesn’t make mistakes. He takes care of his equipment. He rises early to tend crops. He is never a day late…and never a dollar short. Then, if he is lucky, prices for his output go up, just before he sells them.

How about commercial property?

We became heavily invested in office space by accident. When our business was expanding, we often found it cheaper to buy than to rent. Then, when the Covid hysteria hit the US in 2020, the buildings emptied out. And now, five years later, there are still many — at least in Baltimore — that are as vacant as a beggar’s purse.

Commercial property in most US cities is still cheap. Owners sit tight — if they can afford to — and hope the market will turn around. But the value of commercial buildings depends on rents…and rents are still down, perhaps permanently.

Again, commercial real estate, like farmland, is a very local matter. If you can find a good building, in good shape, with a reliable tenant, and decent cash flow — where you can keep an eye on it — it could be a good place for your money.

And what about stocks and bonds?

Remember that as far as Wall Street is concerned, we are all absentee landowners. Big banks, brokers and hedge funds have billions of dollars. They can buy what they want. So, whatever they are selling you is what they don’t want for themselves. It is unlikely to be a good deal.

But let’s look more closely. Bonds?

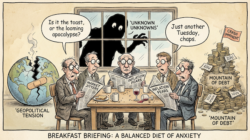

The problem with US bonds is that they are denominated in a currency whose custodians have a growing interest — if not an imperative — to destroy it. The dollar is likely to be the primary victim of the coming credit crisis.

This is like a poker game where we see the other fellow’s hand reflected in the window behind him. We know the biggest borrower in the world will have to borrow more.

We are only seven months into this fiscal year. The deficit is already near $1 trillion. And more borrowing is to come. Along with refinancing existing debt, this will mean almost $10 trillion in funding needed for the next twelve months.

And just as the old economists predicted — federal borrowing is now ‘crowding out’ private borrowing. Steve Hanke:

In the past year, ~50% of all new fixed income issuance has been US Treasuries. Uncle Sam is crowding out the private sector. IT’S TIME TO DUMP TRUMP’S BIG BEAUTIFUL BILL AND CUT GOV’T SPENDING.

Interest rates will have to go up. This will put more pressure on the feds to ‘print’ money…and thereby reduce the value of their own bonds.

We saw how much, and how fast, bonds could lose value after the bond market turned down in July 2020. It was the biggest loss ever suffered in the Treasury market. Most likely, it was just the beginning.

In the short run, of course, anything can happen. A recession could take the pressure off of interest rates…and perhaps lead to a boom in bonds.

But it would be a speculation, not an investment.

And what about stocks? What about gold? What should you do with your money now?

Stay tuned next week as we aim for the bleachers and take our third swing.

Regards,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily

What you may have missed…

The Dorm Room That Ate Wall Street

Michael Dell built a company in his dorm, battled Carl Icahn, and took Dell public twice. But in our latest conversation, he says everything so far was just the warm-up. From AI and blockchain to cancer cures and cybersecurity, Dell reveals what’s coming next — and why it will reshape everything. Read more here…

Thrive Long and Prosper

Forget ChatGPT and robot art. The real AI revolution is happening inside your body. In this episode, I sat down with Hamed Shahbazi, CEO of WELL Health Technologies, to talk about how AI is transforming healthcare — extending lives, preventing burnout, and personalizing treatment like never before. This isn’t a future dream. It’s happening now. Read more here…

The “altstock boom of 2025” is taking off

Forget altcoins — public “altstocks” are where the action is in 2025. From Circle’s IPO to stablecoin-powered toy companies, the crypto takeover of public markets is here. Here’s how it’s playing out… and where the biggest profits may be hiding. Read more here…

Everybody Loves a Parade

Aristotle believed that people turned to tyrants when the elites became contemptuous of them and the government became largely dysfunctional. Read more here…

Power Politics

A society only produces so much wealth. It can then consume it. Or, it can save and invest…so as to produce more in the future. The real ‘political’ question is: who decides? Read more here…