Last week, we did something a little different.

Last week, we did something a little different.

If you missed it, you can catch up here.

If you can’t be bothered, to summarise, we explained why we (as in your editor) won’t follow the advice in the new trading service we’re about to launch.

Not because the service has a terrible track record – it doesn’t…it’s among the best we’ve seen in 20 years publishing financial content the world over.

And it’s not because the strategy sucks. Again, it doesn’t. It’s a fine strategy – a strategy that many investors should use.

Our simple rationale for not using it for our own investments is that your editor doesn’t have the right temperament for it.

Trading is all about temperament. It’s about knowing or learning or following a system, and then following it rigidly.

Your editor can’t do that. We’ve tried… many times. There’s just something in our DNA that makes us want to go ‘off piste’ when it comes to trading – and that’s never a good thing.

The fortunate thing is that we recognise that, and so we’ve gotten out of the trading game. If you have the same tendencies, you should follow your editor’s lead and also give our new trading service a wide berth.

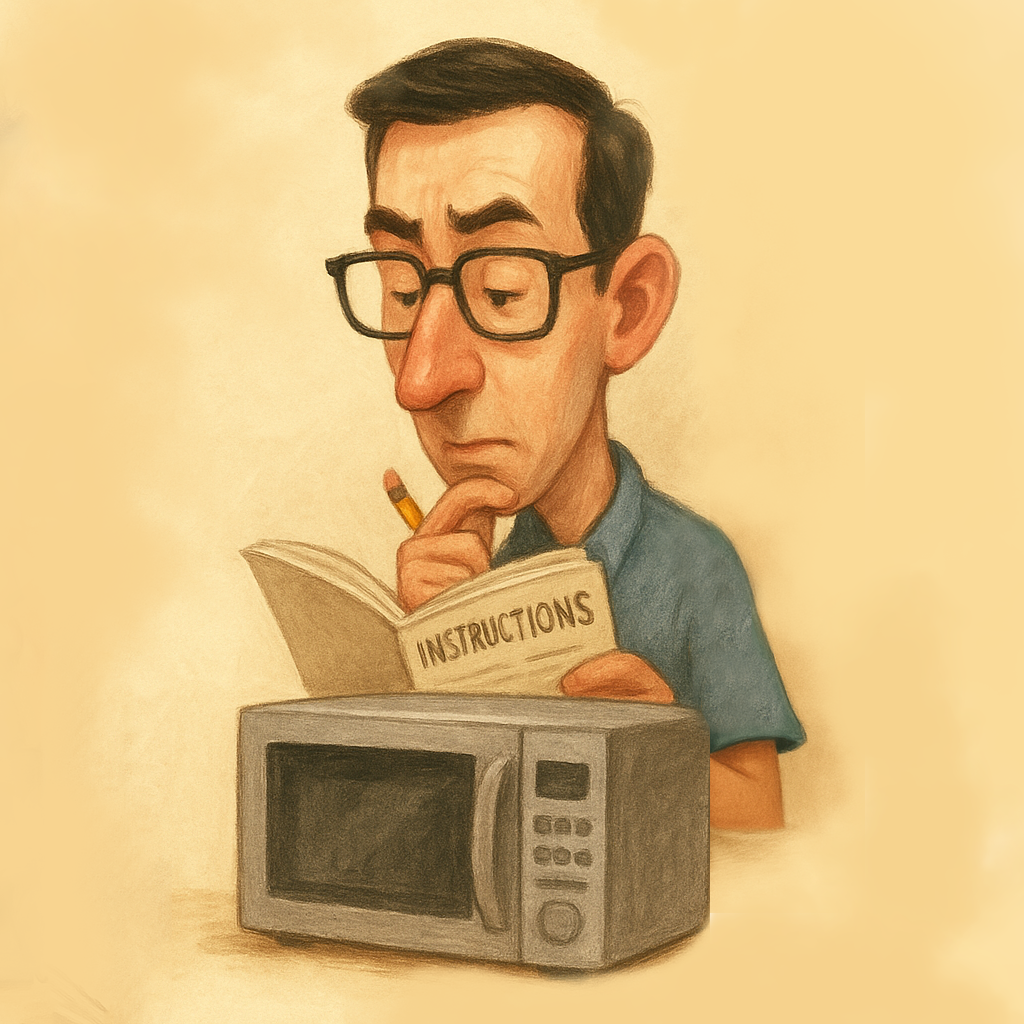

By the way, if you want a simple test to figure out if trading in general is for you, consider the following. We call it the ‘Instruction Manual test’.

Your editor is the type of person who can’t bear to read an instruction manual when we buy a new appliance. We just flick all the buttons, press things, flick switches, and so on.

In the end, we figure it out.

Compare that to our late father-in-law. When he bought a new appliance, he would read the instruction manual from cover to cover, make notes, and underline important points with a pencil.

By the end of it, he would have figured it out, too.

In fact, it probably took us both a similar amount of time to work out how the thing works… one by trial and error, the other by reading and applying.

In our view (and experience), trial and error doesn’t work when it comes to trading. You lose too much money along the way, and you don’t really learn anything while you’re at it.

That’s because the markets change. What you learned from trial and error in February isn’t relevant to the market in September.

But having a proper system and strategy and then following it to the letter… that does work.

That’s the type of person you need to be in order to successfully follow any trading system, not just the service we’ve just launched. You have to ‘read the manual’ to understand what’s going on, and to know what to do.

Cheers,

Kris Sayce

Editor & Publisher, Investor’s Daily

Editor, Investor’s Daily

What you may have missed…

Nvidia’s Next Big Move: The secret signal Wall Street doesn’t want you to see

There’s a secret pattern hiding in plain sight. A “tell” that shows up quietly… before some of the biggest stock surges in history. I call it a Blue Spike. And in back tests it appeared before 21 of the last 22 buyouts made by Nvidia, the hottest company on Wall Street. Not after the headlines… Not when the deal goes public… Before. Read more here…

Nvidia’s Next Big Move: How a tube of Pringles turned into a 10,300% gain

Rice Krispies. Corn Flakes. Pringles. Kellanova (NYSE: K), maker of all three, wasn’t exactly on anyone’s hotlist last year. In fact, its stock was bleeding. Until Alpha-3, the AI I use to help identify potential announcements in the stock market, detected a “Blue Spike”. And two weeks later? Boom. A news bombshell dropped… and the stock launched. Read more here…

Time-sensitive: NVIDIA’s next buyout could be days away

This is it. The same AI system that in back tests would have predicted 21 of Nvidia’s last 22 buyouts has just triggered again. A new “Blue Spike”. A new company. A new trade window… and it’s closing fast. Read more here…

There’s no excuse for your obsession with the stock market anymore

I’ve never understood warnings about derivatives. You can use them to reduce the risk of your portfolio just as you can use them to add risk and return. Read more here…

If AI Fails, So Does Humanity

From resumes to approval processes, we’ve been trained to wait for permission. But real freedom—and real innovation—starts when we stop asking. In this episode of The TAO Pod, we dive into Bittensor, permissionless AI, and what’s at stake if we don’t rewrite the rules. Read more here…