It was perhaps nearly 20 years ago that your editor wrote what turned out to be one of the stupidest things we’ve ever written.

It was perhaps nearly 20 years ago that your editor wrote what turned out to be one of the stupidest things we’ve ever written.

We don’t have the full quote. Thankfully, the essay in question has probably been yanked from the internet.

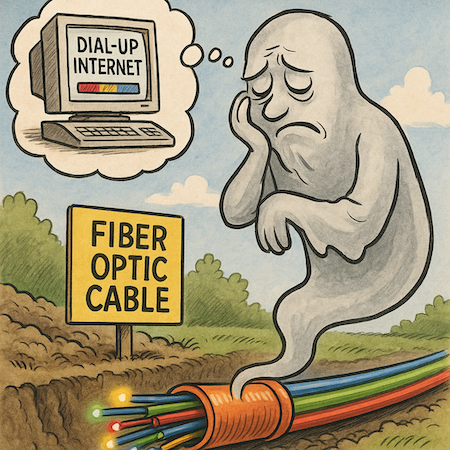

But it was around the time when the Australian government was starting to rollout optic fibre cabling so households could get faster internet speeds.

Naturally, your editor was critical of government spending taxpayer money on something best left to the private sector.

Rightfully so.

So, that wasn’t the stupid bit.

We also mentioned (as we recall) that in due course the fibre optic cabling would be a waste of time and money anyway, as mobile/wireless data would supersede fixed cables.

We weren’t wrong about that. We got it pretty much spot on.

So, that wasn’t the stupid bit either.

The stupid bit was when we claimed people wouldn’t care if a video downloaded in five minutes or 25 minutes… what does it matter?

What a blunder!

Of course there’s a difference. Right now, like most folks, if the video doesn’t play immediately, we get mad. So, the idea of waiting 15 or 25 minutes for a download is obscene.

Now, it’s fair to say there’s a bit of chicken and egg situation. Your editor wasn’t the only one to pour scorn on the idea of super-fast video downloads.

That’s because even then, 15 years ago, there wasn’t a big supply of downloadable video content to warrant fast download speeds.

Much of the long-form content was only really downloadable through pirate websites. Even by 2010 Netflix hadn’t completely proven its business model… although the trend was clear.

Well, we have a similar feeling towards AI. Except that now, we appreciate our own ignorance. By that we mean that we know AI has big potential, we just don’t know exactly where.

And if we’re honest, we’re not sure that most of the self-professed AI ‘experts’ know for sure either.

As we see it, it’s the similar chicken-and-egg situation. There are plenty of businesses and tech entrepreneurs playing around with it, but they don’t know exactly where the big breakthrough will emerge.

AI software such as ChatGPT and others have drawn most of the attention, as has some of the work being done by firms like Tesla in how to use AI in their self-driving technology.

But is internet search, customer service bots and self-driving cars really the full extent of what AI can achieve?

If it is, that would be a major disappointment.

Now, anyone who’s been in the markets long enough has made a bad call or two. But the one that still makes me wince is from nearly 20 years ago — when I questioned why anyone would ever need faster video downloads.

At the time, fibre-optic internet seemed like a bloated, overfunded project. We mocked it. Called it unnecessary. What was the rush?

Turns out, the rush was the point.

The infrastructure came first. Then the boom followed — Netflix, YouTube, streaming as a service, video as currency. What once seemed excessive became essential.

I can’t help but feel we’re standing at a similar point again — only this time, it’s AI. Everyone’s dazzled by the front-end applications: ChatGPT, autonomous cars, virtual assistants.

But the real story is what’s powering it all beneath the surface.

AI is starving for energy, data, compute. There’s simply not enough infrastructure to support the exponential demand we’re seeing.

That’s where Nick Hubble’s idea comes in. He’s found what we’d call a “picks and shovels” play — a $38 investment tied directly to the backbone of AI’s expansion. Not a trendy app or a speculative startup, but a core piece of the system that every AI company needs to scale.

And here’s where it gets even more interesting.

The Federal Reserve is widely expected to cut interest rates on 17 September. Not in six months. Not next year. This month.

The CME’s FedWatch tool is putting the odds of a cut at nearly 98%. Markets are already moving. Precious metals are climbing. Rate-sensitive assets are flashing green. And when you combine that with AI’s insatiable infrastructure demand?

You get the kind of asymmetric setup that doesn’t come around often.

Nick calls it the “Ultimate Rate Cut Trade.” Because it’s designed to benefit on two fronts:

- From the Fed’s decision to cheapen money (again), and

- From the global arms race to build out AI’s foundation.

It’s not a moonshot. It’s not hype. It’s a calculated play on how the next market narrative is already taking shape — quietly, structurally, beneath the headlines.

Nick lays it all out in his new briefing. You can view it here.

Cheers,

Kris Sayce

Editor & Publisher, Investor’s Daily

P.S. The AI boom isn’t slowing down — and with a Fed rate cut all but locked in for 17 September, we could be on the cusp of something big. Nick Hubble’s latest strategy is built for this moment — a way to ride both trends with one simple move. See how it works here.

What you may have missed…

3 Stocks Ayn Rand Would Buy Now

Is our political news sounding strangely familiar? Then you must’ve been reading Atlas Shrugged. But what if that book also tells you how to invest? Read more here…

Guaranteed money making every time Nvidia posts earnings?

Nvidia keeps smashing earnings — and the stock keeps dipping before climbing to new highs. Here’s why that “slowdown” Wall Street fears still hasn’t arrived. Read more here…

Motoring Through France

Like a homeless man looking for a half-eaten sandwich, we range far and wide today. The declining empire, the magic of marriage, and the coming stock market collapse – they are in every dumpster. Read more here…

Mortgage fraudsters are inflating a stock market bubble, again

The US property market is having a heart attack. And we all know what that can mean for the rest of us, don’t we? But are we really on the cusp of another 2008? Read more here…

“Bigger Than Oil” – How the UAE and Saudi are going all-in on AI for 100 years

When you think of the industry that emanates from the United Arab Emirates or Saudi Arabia, what’s the first thing that comes to mind? Read more here…