In today’s Issue:

- Milton Friedman wasn’t cross eyed

- Keynes warned you about inflation

- Tytler knew where this is going 200 years ago

The furore over the coming budget continues. But it’s all as fake as a BBC news story about transgender activists on the Gaza Strip. Our politicians and civil servants know very well what’s needed. Alas, they can’t bring themselves to even mention it.

Former President of the EU Commission, Jean-Claude Juncker, explained this best during the European Sovereign Debt Crisis: “We all know what to do, but we don’t know how to get re-elected once we have done it.”

Sure enough, it was the unelected European Commission led by the unelected Juncker that imposed austerity on Europe. Greece submitted to the inevitable in 2015 and Italy in 2018.

This exposed the truth: spending cuts are all that really matters. Politicians know it. Once removed from democratic accountability, they do just that.

Milton Friedman was even more emphatic about this message than his usual rant:

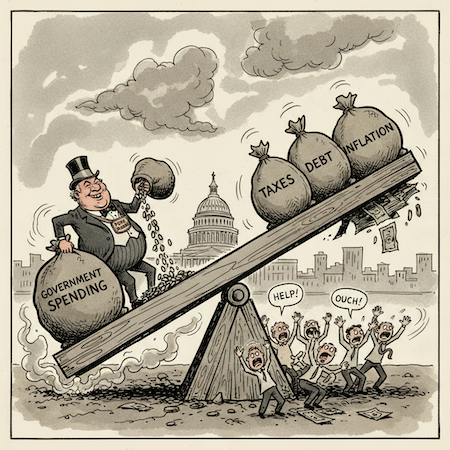

“Keep your eye on one thing and one thing only: how much government is spending. Because that’s the true tax.

“Every budget is balanced. There is no such thing as an unbalanced budget. You are paying for it. If you’re not paying for it in the form of explicit taxes, you’re paying for it indirectly in the form of inflation or in the form of borrowing.

“The thing you should keep your eye on is what government spends, and the real problem is to hold down government spending as a fraction of our income, and if you do that, you can stop worrying about the debt.”

We all feel taxes. But the whole point of politics is to get someone else to pay for what we want to consume. Otherwise, we’d just pay for it ourselves, without needing a civil servant middleman in between.

So, taxes defeat the entire purpose of democracy. The alternatives are preferable…

But the fact that voters don’t associate inflation and government debt with government spending doesn’t make them less of a burden to the economy.

Government borrowing robs us of productive capital and costs interest.

Inflation is merely taxation in disguise. And it has all sorts of nasty side effects. John Maynard Keynes added them up and this was the subtotal:

“There is no subtler, no surer means of overturning the existing basis of Society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

Having read this passage warning about inflation causing the total and sure destruction of society, our central bankers and politicians focused on the last bit: “not one man in a million is able to diagnose.” And promptly decided to impose a 2% inflation target…

But do you see how easy it is to go off on a tangent? Milton told us not to bother with tax, debt or inflation. They’re all just symptoms of the real problem.

So, how are things developing by Milton’s measures?

Hey, big spender!

Our government spending is about 45% of GDP. At least, it was…

The Telegraph reports:

But a year ago, the Chancellor changed her borrowing rules in order to spend an extra £70bn. Not in total, but every single year for the rest of this parliament.

In the words of Richard Hughes, the chairman of the Office for Budget Responsibility (OBR), the Budget delivered “one of the largest increases in spending, tax and borrowing of any single fiscal event in history”.

Yikes.

This is what happens when you put a former central banker in charge of the Treasury. It’s like having a coin clipper in charge of the gold standard. You can’t blame former money printers for acting like money can be printed. They know.

Not that we’re the only ones doing this. Central bankers have a habit of being appointed to fiscal positions around the world lately…

One day, voters will clamour to have a gaggle of Goldman Sachs alumni back in charge of government finances instead. Or someone from accounts…

But inflation remains subdued for now and the bond market has stopped crashing. And so spending cuts are the only thing not being discussed in Parliament. It’s not even on the political menu.

Presuming Labour are perfectly aware that spending cuts are all that matters, where does this leave us?

Deliberate dishonesty? A flaw in the nature of democracy? A lack of real leaders? Maybe we should’ve stayed in the EU to get access to our own austerity treatment by an unelected government.

Expensive entertainment

What makes the debate about the coming budget, so intriguing is that Labour’s published diagnosis has it precisely backwards. The government is criticising past spending cuts as the source of its fiscal black hole.

Not only does this not make sense, but the opposite is true. The new government is unable to spend more money because the Conservatives spent too much, not too little, under “austerity.”

This is deliciously ironic because the error is then compounded. The Conservatives marketed persistent deficits, and spending increases as “austerity.” So now Labour has concluded that, given the Tories must be wrong, even more must be spent!

It requires a crisis to impose austerity

Both debt and inflation are worse than taxes. But only in the end. In the long run, all political careers are dead. So, inflation and debt it is, for now.

Don’t forget the Greeks explicitly voted against the EU’s austerity plan. Not that referendums have much oomph inside the EU, of course…

The Italian government didn’t bother with a referendum because its government was so overwhelmingly anti-euro and anti-austerity already. But national governments inside the EU and eurozone don’t really get a say on policy.

The point is that, in the end, the problem with democracy is that you eventually run out of other people’s money. We’ve known this for centuries. Alexander Fraser Tytler put it best:

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship.

“The average age of the world’s greatest civilizations has been 200 years. These nations have progressed through this sequence: From bondage to spiritual faith; From spiritual faith to great courage; From courage to liberty; From liberty to abundance; From abundance to selfishness; From selfishness to apathy; From apathy to dependence; From dependence back into bondage.”

Bondage? Ironic we call government debt a “bond”…

And UK government bonds are called gilts…

Not to forget that the German word for debt is the same as the one for guilt…

Best of all, a German apology is literally just the word “undebt”…

So, perhaps all Labour need do is apologise and all the gilts will go away.

If you don’t believe me, it might be time to prepare for a fiscal crisis.

Until next time,

Nick Hubble

Editor at Large