In our Southbank Editorial Slack channel, I posted an article link to something Ford just announced (more on that in a second). It inspired a little back and forth with Nick Hubble.

I posted it knowing Nick has been all over the idea that Net Zero is a fast-track to “economy zero,” meaning the idea in theory is noble, but in practice has crippled the British economy.

I posted it because it’s within the car industry that we are finally seeing signs of governments and entire industries waking up to the fact that you cannot run your economy into the ground for Net Zero while your biggest competitor, China, does not give a flying fruitcake about it at all.

And the irony is that China’s “zero F’s given” attitude to Net Zero flies in the face of their automotive industry which is world leading in electric and battery technology and is the reason the rest of the world’s car industry is dying on its feet.

So… what are we to make of it all? And if the likes of Ford or Mercedes or Volkswagen face a slow and painful death at the hands of China, is there a single stock on the planet aligned to the car industry worth owning in your portfolio?

Well, yes, but they might not be a car company for much longer…

Ford’s horrific mistake

In 2021, Ford decided they were going to do one of the most audacious (and clearly stupid) things in their history. The F-150, always at the top of the world’s best-selling vehicle list. was going to go electric.

Cut a long story short, this week they announced that saga is coming to an end.

They’ve now killed its all-electric F150 and announced that future truck production in its huge BlueOval City plant will revert to combustion engine- powered models. https://headlight.news/2025/12/15/ford-making-major-shift-in-ev-strategy-taking-nearly-20-billion-in-charges/.

I mean, how they could have been so disconnected from what their core customer wanted, I’ll never know.

But at least they’re now trying to fix it.

It’s not a full wind back to internal combustion engines. The company’s new strategy will focus on hybrids and extended range electric vehicles (EREVs). These are cars/trucks with a battery and an onboard gasoline generator for recharging.

But as they do this, Ford will take a $19.5 billion hit, dissolve a battery joint venture with SK On, shift a battery plant to energy storage applications and scrap several unprofitable EV models.

It’s said the company sold F‑150 Lightnings at a loss of $37,000 per truck.

Yikes!

The timing of this I do find interesting because it comes while over in Europe, the European Commission is about to scrap a ban on the sale of new combustion engine cars from 2035, just two years after the policy was adopted.

It might happen this week.

The big European carmakers, Volkswagen, Mercedes, Renault, BMW, have been pushing for flexibility on this impending ban because they’re just not seeing the demand for EVs, and for what demand is there, it’s a preference for other makers, namely those that are cheaper and better made from China.

Net Zero cut the Western car industry off at the knees, allowed China to step into the mix and now, they’re taking over. And winding back these Net Zero policies is good… but too little too late.

Then again, don’t mistake the European and German car makers are being purely European. BAIC owns around 10% of Mercedes, as does the founder of Geely who has around 10% of Daimler stock also.

China is coming from the outside in and from the inside out to dominate the global car market.

And dominate they will.

What was once poorly made, poorly designed automotive garbage is now premium, well made, reliable and frankly, good looking cars.

Even Elon Musk can readily admit Chinese cars are much better than they used to be.

Chinese brands now outpace the foreign incumbents in launching new models, thanks to state backed overcapacity. And the country’s car makers have capacity to produce twice the 27.5 million vehicles they sold last year.

That means they can come in cheaper which in the current global macroeconomic environment is a very big selling advantage.

Let’s be honest, for most people, when buying a car, you want it to be reliable, fit for purpose, packed with as many features and creature comforts as possible for a reasonable price.

Europe can’t achieve this in the same way China can… at least not today.

China figured out how to compete, and now they’re in takeover mode.

The Chinese juggernaut helps to explain why Europe and the United States are squashing their automotive NetZero ambitions.

I can’t see this shift reversing. And it means as a consumer it’s more than likely you’ll be owning a Chinese made car in the near future. It’s a travesty for domestic manufacturing, but it’s also a win as a consumer because what China is producing now is just better.

Robots versus reality

That said…

There’s also a good chance car ownership will be radically different in a decade as well.

While Ford takes a $20 billion hit and the Western car maker industry is decimated by China, Tesla continues to push the boundaries of what cars can do.

On Tuesday, Elon Musk confirmed that Tesla’s robotaxi service in Austin, Texas (launched earlier this year with human safety monitors) has started testing vehicles with no occupants.

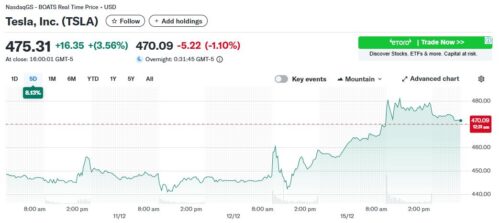

And to give you some show you how the market reacted to this news…

Tesla’s progress stands out because other U.S. players are scaling back.

Name me one other successful U.S. based global EV maker.

It’s ok, I won’t wait. There isn’t one.

Rivian is trying, but they’re closer to bankruptcy than global domination. And they can’t compete with China anyway.

The reason Tesla can compete with China and does successfully is that they figure out you have to make them like China. Robotic, automated factories, complete vertical integration (or at least as much as possible) not a car assembler masquerading as a car maker, but everything from the sheet metal pressing through to the software.

Tesla also figure out that cars of tomorrow need design and testing and delivery today. And they’ve been at the forefront of the autonomous car revolution. They’re even ahead of China on this one.

And that makes Tesla like Ford was at the turn of the 20th century.

At the turn of the 22nd century, maybe Tesla is like Ford is today? Or maybe they’re not even a car company anymore. Maybe cars aren’t even a thing. Maybe we all just get around in self-flying aerial vehicles.

Either way, if you like cars and the auto industry as I do, then you’re witnessing radical change in it all. Yes, the legacy makers are cheap and have been for a while… but for good reason.

And if you want exposure to this all, and the idea of the Chinese car makers isn’t all that appealing, it’s hard to look past Tesla, even if they trade like a meme stock sometimes.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily