Back in September 2018, I recommended a little-known stock to a cohort of my readers.

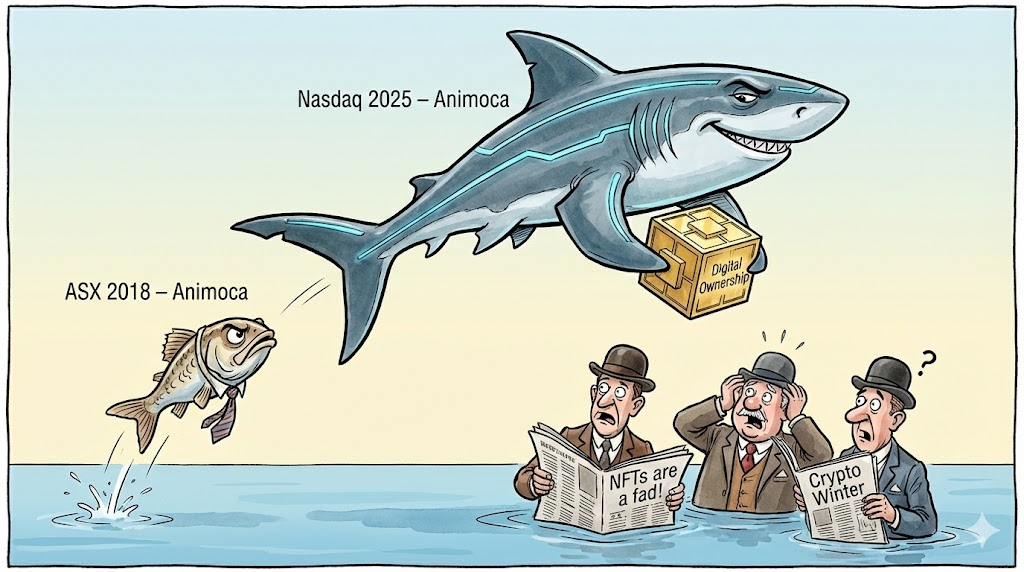

At the time, it traded on the ASX with a market cap of just AU$41 million – about US$29 million.

It was a Hong Kong-based mobile game developer dabbling in blockchain and NFTs (non-fungible tokens), including early blockchain projects like CryptoKitties and an emerging virtual world called The Sandbox .

Back then the crypto markets had run hot in 2017 and into 2018. And there was an explosion in particular of NFTs and blockchain based gaming. Many sceptics had levelled harsh criticism at it all, ranging from accusations of fraud to comparisons with speculative fads like Beanie Babies.

Remember the ’90s Beanie Babies?

Folks piled in spending fortunes on these stuffed little bears, convinced they’d strike it rich and values skyrocketed and supply couldn’t meet demand for some of the rarer kinds.

I could see the parallels.

This time, the winners wouldn’t be novelty products themselves, but the companies building the infrastructure behind digital ownership.

That line of thinking led me to a tiny Hong Kong-based ASX minnow: Animoca Brands.

$86 million in virtual land… in one week

Many dismissed it as too risky.

Crypto was now in a “winter” by the time I unearthed this play and blockchain gaming and virtual worlds owning virtual land sounded like a gimmick.

But my take was that digital ownership of assets, be it virtual or real world representations was the future.

If you could own virtual assets like real property, new economies would emerge. And if you could expand that out to real world assets, well you’d be sitting on the proverbial gold mine.

Animoca was building that bridge between games, blockchain and real-world value.

Animoca was delisted from the ASX in 2020 amid heightened regulatory scrutiny of crypto-linked businesses.

It went private, weathering the storm while others folded. But Animoca kept investing, developing, growing and expanding their reach within the crypto industry.

Today, the company holds stakes in more than 600 Web3 projects, along with a treasury loaded with BTC, ETH, SOL and their own SAND token.

There was always something big underneath. Those CryptoKitties, well in 2017/18, it congested the Ethereum network under the weight of demand.

Animoca was behind it, proving digital collectibles had legs. Then came The Sandbox acquisition in 2018 for $4.9 million. That sparked a chain reaction of a digital land grab.

By 2021, The Sandbox and rivals like Decentraland exploded into the metaverse hype.

Virtual land sold for millions. Big names like Adidas, Warner Music, PwC all jumped in. In one week, The Sandbox processed $86.56 million in virtual land sales.

Animoca didn’t just ride the wave; they built it before Facebook ever decided to rename to Meta.

And even though NFT mania died away (again) all through the 2022 bear market, while crypto licked wounds, Animoca continued to build and stack assets.

I almost had a chance to dive deeper into this with Animoca’s co-founder, Yat Siu, for my book The Crypto Handbook. I reached out to interview him on digital property rights and Web3’s future, but sadly, we couldn’t get it across the line. Still, his vision shone through in everything Animoca did.

By January 2022, Animoca’s valuation hit US$5 billion after a capital raise. From that AU$41 million ASX cap in 2018. That represented roughly a 169-fold increase in valuation in under four years.

But Animoca is far from done…

Stock listing on the big cat boards

Animoca is back in the spotlight looking to undertake a reverse merger into Nasdaq-listed Currenc Group (CURR).

It’s a full-circle moment for me.

They first went public on the ASX via a reverse merger with a defunct mining shell. Now, Animoca shareholders will own 95% of the combined entity, with the deal set to close this year.

Estimated market cap for this Nasdaq debut?

Around US$9 billion, based on recent private valuations and merger buzz. That’s a staggering rise from US$29 million in 2018, a whopping 30,934% rise in market cap in only six and a half years.

It’s not unexpected to me. From even before Animoca ever was on my radar, it was important to me to be able to identify the biggest thematic ideas that would reshape our world.

Then finding the stocks that were small enough to go from minnow to tech-titan was the next logical step.

And while not all of these tiny titans will be successful, when you see examples like Animioca that are, or like Archer Materials that I wrote about on Wednesday, you can see the huge power of spotting tiny stocks at the core of explosive trends.

This isn’t about gambling on hype. It’s about conviction even through times when you question your own sanity.

I’ve invested for 32 years in stocks and 16 years in crypto. In my experience, the biggest risk is often doing nothing at all.

My belief is still that if you’re hunting big wins, look beyond blue-chips. The next Animoca is out there. Maybe it’s in AI, metals, space tech, defence, or again in the crypto markets..

Either way, if you’re not looking for them, you’ll never find them.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily