When you think of the industry that emanates from the United Arab Emirates or Saudi Arabia, what’s the first thing that comes to mind?

When you think of the industry that emanates from the United Arab Emirates or Saudi Arabia, what’s the first thing that comes to mind?

Probably oil rigs, tankers, Dubai’s skyline (or man-made palm-shaped islands glittering on petrodollar wealth).

The oil money has served them well over the last 100 years in building their kingdoms. But it is not their long-term future. They won’t be building their future man-made islands and 100km long mirrored cities with oil money…

It’ll be built on compute money. On AI wealth.

And the process, or conversion, or transition from oil to compute is already taking place at a scale hard to fathom.

This is something that is happening, will not deviate from its course and it’s going to drag a handful of companies from underneath Nvidia’s shadow to soar towards the trillion-dollar-club.

The world’s biggest AI campus

According to reports this week, Abu Dhabi’s G42, the AI powerhouse backed by the UAE’s ruling elite, is actively looking to diversify away from Nvidia as it builds out a colossal AI campus in the desert.

That’s a big deal.

For years Nvidia has been the undisputed king of AI chips.

But when the Emiratis, who have cash to burn and big AI ambition to match, start sniffing about elsewhere, you know two things…

- demand is insatiable, and

- they want independence from just a single supplier.

This isn’t a snub of Nvidia’s technology, they’re still a technology leader. For now, at least. But it’s also risk management on a national scale. The UAE doesn’t want its trillion-dollar future tied to the supply whims of a single American company.

And the Americans are playing this game too with their recent “investment” in Intel. The “gift” of 10% of the company to the US government, is more about strategically protecting semiconductor supply chains than it is anything to do with turning a profit.

The UAE however is already building what will be the largest AI campus on the planet.

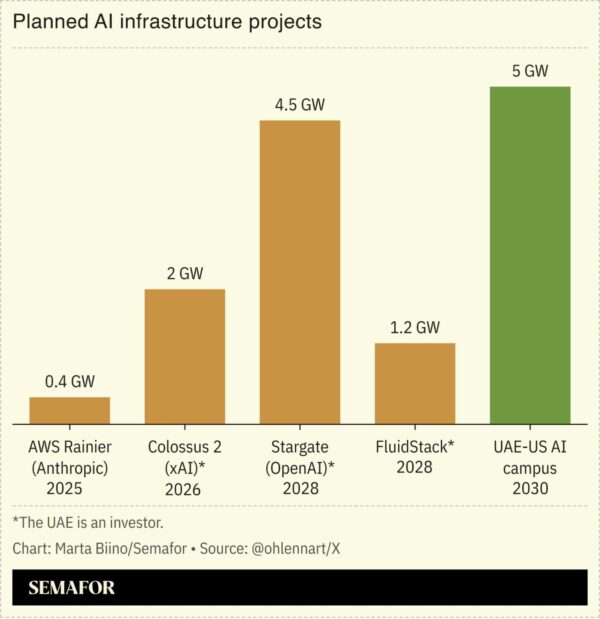

It’s set to be a 5-gigawatt behemoth of compute power that dwarfs anything in the U.S. or Europe. For context, five gigawatts is enough energy to power millions of homes. And they’re pointing it straight at AI.

It makes Elon Musk’s Colossus 2 look paltry in comparison. And even the Saudi/UAE/US backed trillion-dollar Stargate is well short of the 5 GW mark.

While the “West” bothers itself on tariffs, taxes and tying up immigration issues, the UAE and Saudi are pouring petrodollars directly into silicon, servers, and software.

They must see what’s going on everywhere else and just laugh at the shortsightedness and stupidity of it all.

Saudi Arabia is doing exactly what the UAE is too. They’re more or less moving in lockstep.

Its sovereign fund’s AI arm, HUMAIN, has already sold out of its entire data centre capacity before the doors even open.

Imagine selling out a music festival before even announcing who’s playing… that’s how rabid the demand is for AI compute in the Gulf.

I think that when the next 100 years plays out history will look back and talk about AI bigger than oil in its importance to the Middle East.

Now, I should say, I’m not suggesting they’re going to stop making trillions from oil.

Oil isn’t going away tomorrow.

But the sheikhs can see that long term, there’s a bigger and arguably more valuable opportunity for the next 100 years they simply can’t ignore and have the wealth to drive forward.

The new oil is data, energy, compute and AI. Whoever controls that controls the pipelines of the digital economy. It’s not crazy to think of the Middle East ending up as the “hub” of the AI world as much as it’s a transportation hub today.

And that’s where the UAE’s play is fascinating. They’re not talking about buying a bloody subscription to ChatGPT for every citizen like some Sam Altman fanboy, they’re laying down the critical infrastructure that the world’s biggest AI firms will be forced to rent.

A multi-decade bull market

What also helps this AI compute conquering quest is the Trump administration is also very aware of the situation and wants to ensure that it too works in lockstep with the UAE and Saudi.

This is done through Trump’s attempts to redollarise the world through digital rails and also feeding that through AI infrastructure.

In order to do that effectively, he’s pushing like all hell to get the Fed to tee up rate cuts. That will allow him to refinance a bunch of debt but also supercharge investment into AI as money gets back to those insatiably cheap levels the world got used to.

What I’m saying is that when the Fed cuts, and you combine that with strategic moves to dominate AI infrastructure, and you get the recipe for a multi-decade AI bull market.

I think it will be bigger and even longer than what we’ve seen with the internet boom of the 1990s through the early 2020s (before AI took over the show).

In other words, we’re not at the end of this cycle. We’re at the beginning of something that could run for decades.

I’ve been speaking with fellow Investor’s Daily editor Nick Hubble about this for a long time. And we agree the direction this is all heading is very much to the benefit of investors.

But that doesn’t mean there aren’t some things that will cause some headaches along the way.

You only need to look at the fact Nvidia can’t sell chips into China and that Taiwan Semiconductor has just had their licence to ship products from the US to China revoked.

But Nick’s saying there’s a different aspect to all this that isn’t getting the coverage it should. He laid it out beautifully in his latest broadcast (I’m not sure if you’ve seen it or not yet) on the AI Masterkey. He said,

“Everyone’s hyping Nvidia and ChatGPT… but there’s a piece of the story the mainstream isn’t covering. AI has a fatal flaw: it’s running out of power. And the only solution may lie in an overlooked $38 ‘Master Key.’ It’s already up 31% this year — and with a major Washington decision due on September 17th, it could be about to surge much higher.”

Nick is spot on. You should definitely see what he’s saying if you haven’t yet.

He really captures the truth in a succinct way, AI is capacity-constrained.

Chips, data centres, and power are some of the bottlenecks. And the countries solving them, like the UAE, are setting themselves up as the landlords of the AI century.

Follow the money

I don’t think you need to be an AI engineer to see what’s happening here. You don’t need a PhD in machine learning to understand that demand far outstrips supply.

What you do need to do is just follow the money.

Look at the biggest AI campuses like the chart from earlier. Track where the billions (which add up to trillions) are flowing. Watch who’s striking sovereign-level deals.

And for the companies that could soar towards that trillion-dollar club as the UAE looks to diversify away from Nvidia.

Well, the report from Semafor gives a look at some of the likely candidates they might turn to. Some are already in the trillion-dollar club… some aren’t.

“AWS, Google, Meta, Microsoft, and Elon Musk’s xAI are among those in discussions, with Google and Microsoft — a G42 shareholder — the furthest along in negotiations to offtake computing capacity, the person said.

“G42 is also looking to US chipmakers AMD, Cerebras Systems — in which G42 holds a stake — and Qualcomm to supply some of the computing capacity at the campus…”

If anything, that’s a pretty good roll call of stocks to have closely on your radar. And maybe the most important companies in the AI world outside of Nvidia for the next 100 years.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

P.S. The UAE is spending billions to build the world’s largest AI campus. Saudi Arabia is doing the same. And behind all that infrastructure is a single constraint: compute power. As Nick Hubble explains in The AI Master Key may be the key to unlocking it — and a Washington decision on September 17 could send it soaring. See why here.