Fifteen percent revenue cuts to Washington.

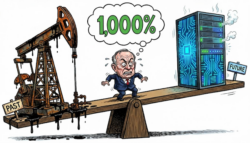

And still… Wall Street is not phased, just wondering how much higher the AI chip kings can fly.

Welcome to Trump’s new semiconductor reality. To really see (tongue in cheek) what it’s like as an analyst dealing with Trump-world, check out this quite funny post on X.com.

But this week, the White House rolled out an all-out assault on imported chips, a 100% tariff on every semiconductor entering the U.S. Unless, of course, you’re building them in America.

For Apple, which just pledged another $100 billion in domestic manufacturing (and a gold Apple custom trophy-thing), that means exemptions.

Source: CNBC

For everyone else? Either shift production to U.S. soil or swallow a tariff bill big enough to choke out a whole room of analysts on a TSMC earnings call.

But what really came from left field was the price to pay for selling chips back to the Chinese market.

If you’re Nvidia or AMD and you want to keep selling your high-end AI chips into China, you can… but only if you agree to pay Trump’s fee of 15% of their Chinese revenue for the privilege.

Think of it as a licence fee for market access, except the “licence” is a cheque written straight to the Trump administration.

The China trade-off

It’s a high price to pay. So, the question is, is it worth it?

For Nvidia, the Chinese market isn’t just a “nice to have.” Chinese sales were around 13% of total sales last year.

AMD’s footprint is smaller in scale, but still a massive chunk of their business. Estimates are China accounts for around 24% of revenues.

So, is it worth it?

Well, it has to be. AMD can’t turn off China; they’d kill a major part of their business. And even for Nvidia, it’s a big price to pay, and one they must pay.

Even after coughing up this 15%, the margins on those chips are enormous we’re talking 70%-plus gross margins for Nvidia’s technology. Losing the China market entirely would be a deeper wound than parting with a slice of revenue.

Strategically, it’s trickier. Every chip sold into China is one that helps Chinese AI development catch up, no matter how “neutered” the export model is.

Washington is betting that the 15% fee will both slow Chinese progress (via higher costs) and fund domestic AI supremacy.

For the chipmakers, it’s an uneasy marriage of convenience. They want China’s demand. Trump wants their money. Both sides will take the deal… for now. But you can bet in boardrooms, they’re wondering when it will end, if it ends at all under this administration.

Valuation vs opportunity

Which brings me to the question that even with the huge AI chip demand, add on tariffs, “licence” fees, and geopolitical risk where you cannot predict what’s coming next week, let alone next month or next year, how much more juice is left in Nvidia and AMD’s share prices?

How high can they go, or is there better value in the chip market elsewhere?

One consideration is that you can still generate oversized profits from Nvidia or AMD, but you need to take a more indirect route to get there.

That, of course, is something that over the last week you’ve probably seen in our editorial. James Altucher has just seen the “blue spike” on his Alpha-3 system light up and it’s telling him Nvidia could be on the verge of a massive buyout. Investors that are willing to take on a bit of risk and use the right trading tools could stand to profit big if this deal hits.

Consider Nvidia’s already over $4.4 trillion in market cap. Even if Jensen Huang is right and humanoid robots, AI data centres, and autonomous systems push the company to another $4 trillion, that’s “only” a double from here. AMD, at around $280 billion, arguably has more headroom, but it’s still priced for a near-flawless AI execution.

There’s no doubt the AI chip market will be vast, and Nvidia and AMD will dominate the premium tiers. But dominance doesn’t always mean the best stock returns from here.

Where the better value might be hiding

If you’re hunting asymmetric upside, the kind Nvidia delivered from 2015 to 2025, the better targets may be further down the semiconductor food chain:

- Marvell Technology (NASDAQ: MRVL) — With a market cap of around $65 billion, Marvell is a behind-the-scenes AI enabler. Its custom application-specific integrated circuits (ASICs) and high-speed networking chips are increasingly embedded in hyperscale AI data centres. As cloud providers race to upgrade infrastructure for AI workloads, Marvell’s niche makes it a leveraged beneficiary without the headline-level export headaches of Nvidia.

- Micron Technology (NASDAQ: MU) — Valued at roughly $130 billion, Micron sits at the core of AI’s hunger for memory. Its high-bandwidth memory (HBM) chips are already winning design slots in next-generation AI accelerators. While cyclical in nature, memory demand in the AI era looks less boom-bust and more sustained-upcycle, making Micron a more accessible way to play AI infrastructure.

- Lattice Semiconductor (NASDAQ: LSCC) — At a market cap over $8 billion, Lattice is a smaller, specialised player. It builds low-power, programmable chips that act like the “AI glue” in edge devices, industrial automation, and automotive electronics. As AI inference shifts from cloud-only to billions of connected devices, Lattice’s role in integrating AI logic into the physical world could see explosive demand.

Nvidia and AMD remain the primary beneficiaries of the AI chip boom. They’ll likely keep printing profits, sucking up tariffs and coughing up these “licence fees”. But the law of large numbers is real, and a one trillion-dollar gain means less percentage upside when you’re already worth as much.

Your test as an investor is to decide; do you want the known quantity of a mega-cap tech player, or the asymmetric potential of a smaller fish that’s on the way up?

My take, the AI chip revolution isn’t slowing down. But some of the sharpest returns from here may come from the companies you don’t see on the front page of Yahoo! Finance.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily