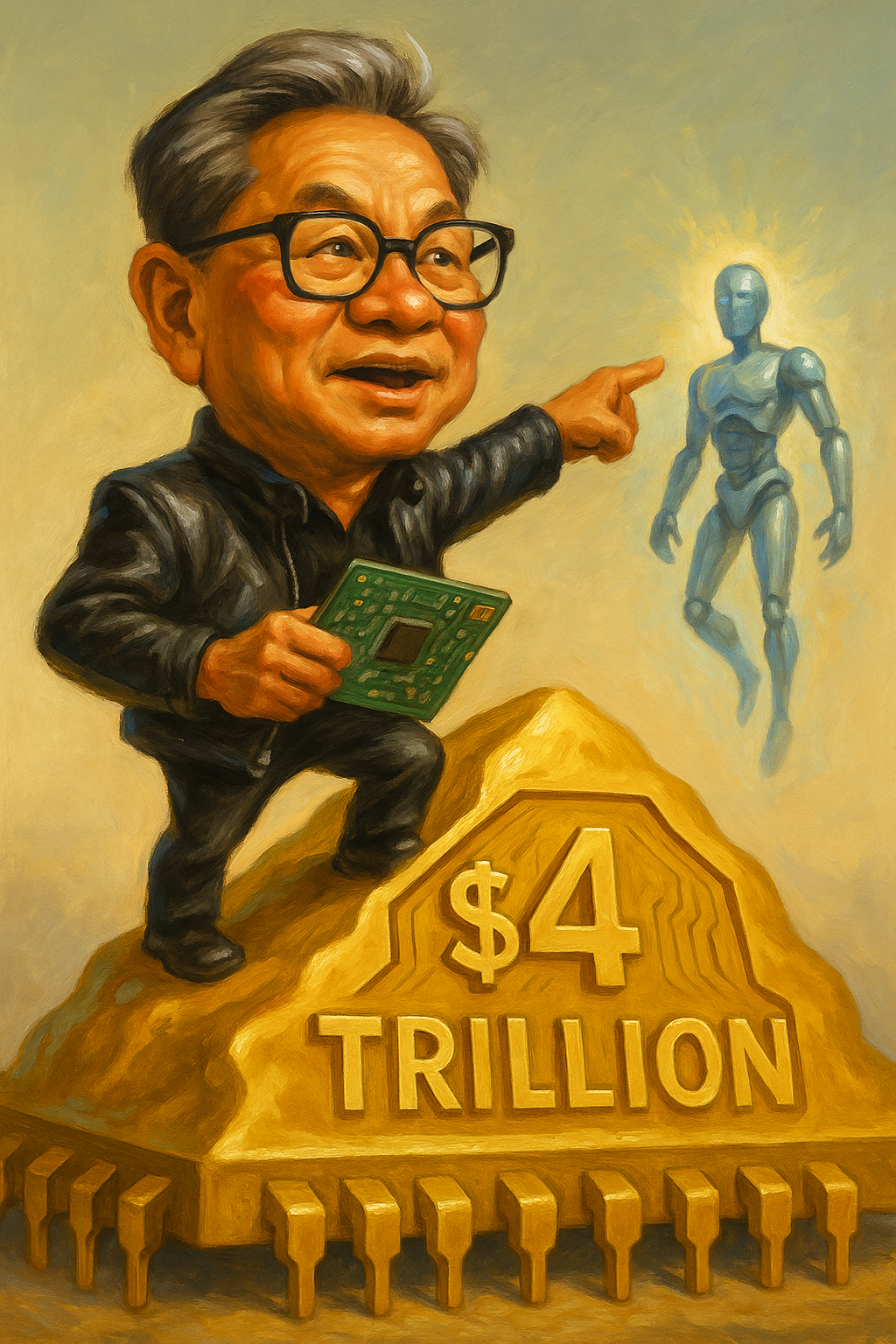

Nvidia sits atop a $4 trillion mountain of value. It has overtaken the GDP of entire nations, left Apple in its wake, and further emphasised the singular importance of this chipmaker in the future of global technology.

Nvidia sits atop a $4 trillion mountain of value. It has overtaken the GDP of entire nations, left Apple in its wake, and further emphasised the singular importance of this chipmaker in the future of global technology.

But with such size comes a question: how high can it go?

A 100% gain from here would require Nvidia to add another $4 trillion in market cap, a feat no company has ever achieved.

That doesn’t make it impossible. But it makes it difficult to argue Nvidia is where you’ll see and gather outsized returns from.

However, you could still use Nvidia to potentially make 200%, 500% returns.

But it takes a degree of knowledge, the right tools, and a deep understanding of where Nvidia’s next $4 trillion or $6 trillion comes from and how they get it.

Good news is, I’m going to tell you how it all fits together now…

Humanoids, and the next $4 trillion

Jensen Huang has made it abundantly clear from his presentations this year at Nvidia’s own GTC2025 through to big tech shows like Computex in Taiwan in May.

Humanoid robots (aka humanoids) are no longer some sci-fi side quests; they’re the main event and Nvidia is going “all-in” on humanoids.

“I think [humanoids] is likely to be the next multi-trillion-dollar industry.”

Words directly from Huang.

But this isn’t a casual guess from a hopeful CEO. He’s putting Nvidia’s cash where his mouth is.

Already, Nvidia chips are powering Optimus, Tesla’s humanoid robot now operating inside Tesla factories and even Tesla’s new diner.

Nvidia is developing its GR00T platform with the Nvidia Jetson Thor physical AI chips. It’s for a world of smart, autonomous vehicles (self-driving cars) and humanoids.

If Nvidia’s first $4 trillion came from digital AI, the next may come from physical AI.

Humanoid robotics, intelligent, responsive, adaptive machines, could redefine the nature of work, caregiving, logistics and manufacturing. I expect it to be the biggest hardware revolution since the smartphone.

And Nvidia is poised to power nearly every single one.

But even if Nvidia captures that future and adds another $4 trillion in value… that’s still “only” a 100% gain from here.

Sadly, that means you’re not early to the Nvidia story anymore.

But smart money knows you can still use Nvidia to be early and to make outsized gains. And it boils down to a simple question…

Who might Nvidia need to buy next to keep winning?

Nvidia has never been shy about acquiring the talent, tools, and tech it needs to win.

And with a war chest the size of most nations’ GDPs, it can move fast.

That means the real play to big profits from Nvidia is identifying who Nvidia might scoop up, invest in, or even buy out next.

Because when Nvidia moves, it moves big.

James Altucher and Zach Scheidt believe they’ve found the next target, a potential company Nvidia may buyout. But this is no finger in the air, which way is the wind blowing guess.

This is a data-backed opportunity flagged by a proprietary, patent-protected toolkit designed to detect M&A activity before it happens.

Their tool has already identified numerous small companies at the buyout stage, before it happens, and they’ve got one of the best track records I’ve ever seen to prove it.

They’ve also identified another small company they believe fits Nvidia’s acquisition pattern perfectly. And they’ve just compiled the details into what they’re calling:

The idea is simple. While the crowd chases Nvidia’s next 100%, if this plays out as they expect, you could position yourself for an extraordinary run if this buyout hits.

The gap between “owning Nvidia” and “owning what Nvidia might buy” is often the difference between decent and life-changing returns. And I’m backing these guys with what I’ve seen of their intel.

Huang’s next big company changing bet

If Nvidia does add more beef to its operations, I expect it’s for a very good reason.

Jensen Huang saw AI coming long before the market did. While everyone else was still talking cloud and social networks, he was rebuilding Nvidia from the ground up to be the foundation of artificial intelligence over a decade ago.

That bet has paid off spectacularly.

Now, he’s making his next big bet.

Humanoid robots.

Fully dexterous machines that live and work in the real world, in society, even in your home.

And if he’s right, Nvidia isn’t stopping at $4 trillion.

It’s on track to be what I think may be the world’s first $10 trillion company.

But if you want the kind of asymmetric upside Nvidia delivered back in its $10 billion days, you need to stop looking at Nvidia and start looking at who it might buy.

The next great AI play won’t come from the top of the S&P 500.

It’ll come from an under-the-radar company Nvidia can’t afford to ignore.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily