Yet already this year, global mergers and acquisitions activity has hit $2.6 trillion. Trillion with a capital T folks!

It’s a scorching pace that is looking like 2025 will break every record in the book for dealmaking.

What’s fascinating about it is that the actual number of deals is 16% less. But the value of those deals is 28% higher.

And yes, there’s still five months left (counting the rest of August) to ratchet that number even higher. And you can bet your bottom dollar (or pound) that number is guaranteed to go higher!

The numbers currently getting bounced around are utterly mind-bending…

Just last week, rumour hit that Anthropic, the AI company founded by OpenAI founders-now-dissenters, Dario and Daniela Amodei, is lining up another raise, this time at a staggering $170 billion valuation.

What makes that so astounding is that it’s less than six months after raising capital at a $61 billion valuation. That’s nearly a 3x jump in less than half a year. Even by Silicon Valley standards, that’s outrageous.

But that was quickly eclipsed by talk surrounding OpenAI. According to reports, its latest employee share sale is setting a valuation north of $500 billion, making it the most valuable private company in the world.

But is this all a bubble?

Yes, of course it’s a bubble. A bubble that’s expanding faster than ever before, pumped full of oxygen, helium and money…so, much, money. Oh, and this bubble isn’t going to pop… at least not for a long time yet. And if it ever does, those valuations don’t go to zero, they just trim 30% to 40% which is pretty much how most tech stocks behave anyway.

So, if you ask me, this is a bubble you don’t want to be sitting on the sidelines watching expand before your eyes, year, after year, after year.

Where’s the Alpha then?

Here’s what investors miss when they roll their eyes at these eye-watering numbers. And dismiss this all as a bubble, imminently about to burst.

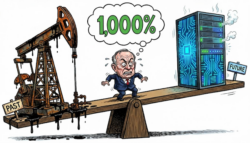

AI isn’t just “a tech trend” anymore. It’s a permanent staple of our lives. It is at every layer of investment, and in every industry imaginable.

Mining? Uses AI.

Oil and gas? Uses AI.

Marketing and advertising? Uses AI.

Banking and finance? Uses AI.

Everything you can think of is integrating AI. Energy, healthcare, telecommunications, retail, sports, AI is everywhere.

Because of this you’re not just watching tech companies scramble to buy AI startups. You’re watching entire industries reposition their future around artificial intelligence.

That’s why this wave of deal activity includes:

- Strategic acquisitions (Google buying Wiz for $32 billion)

- Massive infrastructure takeovers (CoreWeave trying to buy Core Scientific for $9 billion)

- And speculative mega-bets (like OpenAI’s $6.5 billion acquisition of Jony Ive’s studio)

And that’s also where it gets interesting…

Because these deals aren’t just about cost savings or growth. They’re predictive. They’re signals of where capital is going and where future alpha is hiding for investors to profit from.

Which brings me to something you might have seen a bit this week in our editorial.

James Altucher’s “Alpha-3” tool just might be the most powerful investment tool in the market.

Not all AI investments are equal. Some are hype. Some are distractions. And some are outright generational trades hiding in plain sight. Some telegraph their moves well ahead of a stock exploding higher in value.

James Altucher has been quietly building a predictive research tool to separate the noise from the action and making huge calls ahead of stocks making big deals and big acquisitions.

He calls it Alpha-3, and here’s what it’s already done in back tests:

- Identified 21 of Nvidia’s last 22 acquisitions

- Flagged an outsized, AI-driven spike in an unexpected “junk food” stock

- Surfaced an average of 84.7% of the largest M&A trades in four years, before they were announced

(Simulated past performance is not a reliable indicator of future results).

Let that sink in. The very deals driving this AI M&A supercycle? He uses this system to help flag them ahead of the market.

Now, for the first time, James is making this tool available to UK investors.

You can find out exactly what it is, how it works and why it’s just flagged a massive “blue spike” on a small chip company indicating to James that Nvidia could be on the cusp of their biggest buyout yet.

More to come…

The second half of 2025 could unleash the biggest AI profits yet

With OpenAI closing a $500 billion valuation, Anthropic eyeing $170 billion, and xAI (Elon Musk’s Ai company) said to be in the region of raising at a $200 billion valuation, we’re entering “the Super IPO era”.

And the list of private AI unicorns rumoured to be considering public offerings this year reads like a fantasy draft of the next generation of FAANGs:

- Groq, whose novel inference chips threaten Nvidia’s dominance in inference

- Cerebras, building the world’s largest AI wafer-scale processors, again with speeds faster than anything Nvidia can deliver right now

- xAI, which could spin out from Musk’s empire at a $200B+ float

- Mistral, the French open-source AI darling backed by Andreessen Horowitz

- And even Scale AI, which has quietly become a critical cog in the AI data engine

If even two or three of these go public before December 2025, won’t just be the year of AI M&A, it’ll be the year of AI IPO mania.

And for investors? That means opportunity.

These aren’t plays to buy at nosebleed valuations on day one. But it is time to get smart about where this money is flowing, what smaller listed companies are being acquired, and what signals point to the next high conviction move.

That’s what Alpha-3 is designed to do. Spot the next big AI move before it hits the front page.

Because if 2023 was the year AI entered the boardroom…

And 2024 was the year AI reshaped the markets…

2025 is the year AI moves the entire world.

From gigantic valuations to IPOs, big money buyouts to mass adoption, this is your moment to act.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily