There’s a chart doing the rounds this week that says more about the state of global innovation than a thousand political speeches.

There’s a chart doing the rounds this week that says more about the state of global innovation than a thousand political speeches.

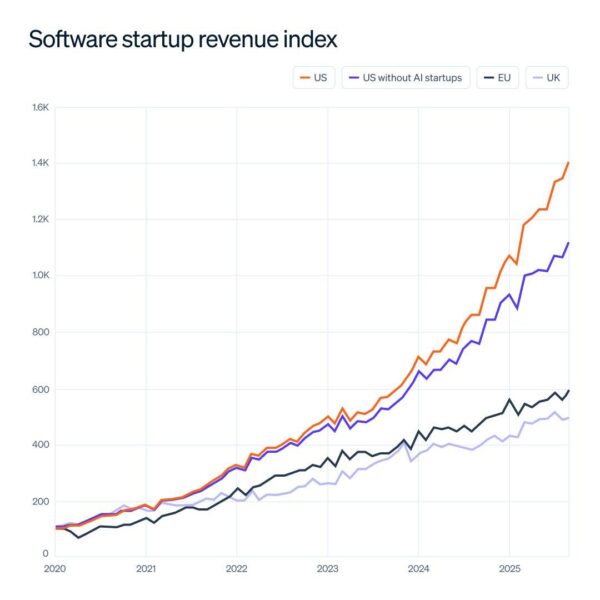

It comes from Stripe co-founder Patrick Collison, real, tangible, in your face data they’re getting from their payments and monetary networks.

It’s hard to argue with empirical revenue data from tens of thousands of startups running through Stripe’s platform.

And the findings are eye-opening, and also an indication of where we’re heading.

Since mid-2023, U.S. software startups have significantly accelerated and widened the gap from UK and European peers.

Even when you strip out AI companies, the gap keeps widening at what looks like an exponential rate.

The working thesis in the Stripe office is (according to Collison),

“Our leading hypothesis is that US startups (even those that aren’t AI companies as such) are adopting new technologies (AI, stablecoins, etc.) faster than companies elsewhere.”

He also notes this was the case with the internet decades ago. And look how that turned out…how many of the Magnificent 7 are European or British based?

It comes as we look at global markets and ask why all the action is in the US right now. And don’t get me wrong, I’d love to see the UK and European lines trending towards the US one, but that’s simply not the case.

Hence, this is as much a story about the failures of the British and European start-up and innovation cultures as it is a warning light for anyone betting against the U.S. market right now and to say if you’re not investing in the U.S., you’re missing a huge opportunity that appears like it’s only going to get bigger.

Why the U.S. is pulling away

In 2024, late-stage venture rounds made up just 20 % of UK venture funding compared to 35 % in the U.S. The average deal in Britain was about $50 million, half the American norm. And while not a single UK fund raised over $2 billion, ten U.S. funds did.

That matters because it’s scale-up capital, not seed money, which turns a good startup into a global company.

Without it, UK founders end up taking U.S. money, moving across the Atlantic, and widening the same gap Collison’s chart exposes.

Zoom out and the macro picture looks the same.

The Federal Reserve noted this year that U.S. GDP per capita has widened its lead over major European economies to nearly 40 % since 2000. This is driven largely by higher investment in productivity boosting equipment and faster tech adoption.

Again, it’s that story of faster tech adoption that seems to rear its head every time.

Furthermore, productivity per hour in the euro area has risen by just 28% since the mid-90s. In the U.S., it’s up roughly 50%.

Europe loves regulation. GDPR, MiCA, the AI Act, the Chat Control Bill, each noble in theory, each a bureaucratic nightmare in practice. And for tech and emerging startups, it’s enough reason to just pack up and jump ship.

The market mirror

All of this is happening while investors are convincing themselves that a “tech correction” is inevitable.

Last week’s selloff saw the Nasdaq post its sharpest drop since October. I’ve lost track of the number of analysts and commentators warning of a “bubble.”

Then the Magnificent Seven slipped, Palantir trimmed off a few billion, Micron, AMD… It’s a long list, all AI-related, all heading south.

But here’s the irony: it’s the fear of correction that often causes it.

Markets are a mirror of investor psychology, and when enough people expect a pullback, they’ll sell pre-emptively and make it real.

However, strip away the mood, and the fundamentals are still rock solid. Earnings have been dominating this week over the market “expectations”.

The Fed is hinting at cuts. AI infrastructure spend is accelerating. Nvidia not only smashed earnings, but now it looks like China might be back open for business to them.

Everything is pointing to even more acceleration of U.S. stocks, U.S. startups and U.S.- focused opportunities.

It’s not to say the UK can’t be great again, close that gap, and deliver some of the world’s best companies. As I wrote the other week, it has the tool, knowledge and history for it, but it needs radical change to right that ship.

And when you look at Collison’s post again, this is a clear indicator that until that ship does get back on track, it’s impossible, irresponsible not to be focusing predominately on the U.S. markets.

So, when the market wills a correction into existence, don’t buy the fear, just look at the data and look at those who see it happening in real time.

The story hasn’t changed: faster adoption leads to higher productivity, and higher productivity leads to wealth.

And right now, America’s leading the way by a massive margin, so that’s where we’ll continue to focus our attention.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily