In today’s issue:

- Hold that painting for me

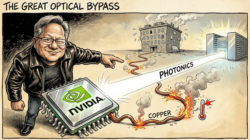

- Here’s a leather jacket

- The humanoid boom and bust cycle

Since the Volkering family moved house, we’ve been going through the process of moving furniture into the right spots, reassembling things, and then putting the various pictures and artwork on the walls.

It was while doing that last task that I had a hallelujah moment.

We had a large piece of art we’d picked up in Portugal that needed to find a new home on a wall in the new house. We found a spot. But, of course, you can’t just go and plonk it anywhere. It needs to find the right height the right angle, and it needs to be straight.

So that meant getting our home robot to hold the artwork up against the wall while Mrs. Volkering looked at it, looked some more, a little up, a little left, a little right, down a bit, looking some more…

By this point the robot’s arms were getting VERY tired (the robot by the way is me). Fatigue kicked in, the artwork progressively got lower and lower and the request to lift it higher started coming in.

It was at that point that I thought to myself, boy, I wish I had a robot standing here doing this…

The robot in the video link above is the NEO Gamma from 1X Technologies. You might have seen it last week at GTC 2025 where it gave Nvidia CEO Jensen Huang a new leather jacket.

The NEO Gamma is going to begin “home trials” this year.

I’m utterly convinced 2025 is going to be the year of the humanoid robot. That companies involved in their creation will list on the market and that companies that are already in advanced development will release consumer versions (namely companies like Tesla and Xpeng).

Then we’ll begin to see humanoid robotics increasingly used in industry. A great example of this was recently posted with the Boston Dynamics’ Atlas robot in use as a cameraman.

To give you some examples of how likely robotics like this will be used in something like filmmaking, we turn to…

Jeremy Clarkson.

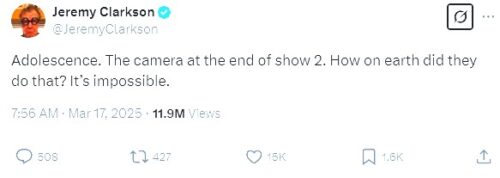

Commenting on a scene from the recent Netflix hit, Adolescence, Clarkson said:

Source: Jeremy Clarkson via X.com

Source: Jeremy Clarkson via X.com

Not impossible. In fact, possible – but only thanks to the use of drones.

Drones in filmmaking have completely changed how movies are made. They can deliver camera angles and shots that no human could possibly achieve.

Humanoid robotics is much the same. In the way that drones have changed filmmaking, so will humanoid robots. They’ll never tire, never need a break, won’t need to be fed or paid and will physically do things humans simply can’t, with accuracy humans can’t achieve.

And if it’s filmmaking, then it’s also a warehouse, a production line, an oil rig, a construction site… you probably start to get the picture here.

So where are the opportunities going to come from? How can you invest in this? Well, if it was possible, Boston Dynamics would be high up the list. It doesn’t really do big flashy marketing videos. Every now and then it posts a soundless video of its latest robot doing incredible robot things:

https://youtu.be/I44_zbEwz_w?si=imbqVCGV2urNZmY8

Others, like 1x and Figure (and many, many more) are heavy on the fancy promo video. So much so that you can already start to see where the market is heading.

The Humanoid Hub recently posted this gem:

Source: The Humanoid Hub via X.com

Source: The Humanoid Hub via X.com

That’s saying something. And it’s a great indicator of what’s coming for the humanoid robot market. Invest options at the moment are slim. As I say, the best exposure right now is through a company like Tesla or Xpeng. Both just happen to be EV makers too… and developing their own AI for their cars and robots.

But when the capital gates open for a flood of money into smaller companies, and the IPOs start, then we’ll see a boom in robot stocks. I do expect a lot will be garbage and that only a handful will be worth any meaningful amount long term. However, it’s going to be one of those market booms and busts that you want in on, on the way up, and then out of with a profit as the garbage starts to fail.

When it happens, we’ll be right there. But for now, patience is key. Keeping track of the fast developments in humanoid robotics is the best place to be.

Boomers & Busters 💰

AI and AI-related stocks moving and shaking up the markets this week. (All performance data below over the rolling week.) [Figures correct at time of writing.]

Boom 📈

- Tesla (NASDAQ:TSLA) up 17%

- Palantir (NASDAQ:PLTR) up 10%

- AMD (NASDAQ:AMD) up 10%

Bust 📉

- Intel (NASDAQ:INTC) down 5%

- JD.com (NASDAQ:JD) down 6%

- Baidu (NASDAQ:BIDU) down 6%

From the hive mind 🧠

- You can sense the US is trying to strongarm any country that might allow high-end AI chips to squeeze through into China. This choking of supply might dent China’s pace of development short term, but only accelerates its own domestic development and damages US companies in the long term.

- It probably doesn’t help that I watched The Big Short last night, but record loans, a debt-fuelled data centre boom… what could possibly go wrong…?

- I’m pretty happy so far with my Nvidia RTX 4060 Ti GPU, but now I’m one of those people that’s going to always want to upgrade to the new shiny thing when it comes out – and the 5060 Ti is the newest shiniest thing.

Weirdest AI image of the day

1980s public television children was something else.

ChatGPT’s random quote of the day

“Code never lies, comments sometimes do.”

– Ron Jeffries

Thanks for reading, see you next time.

Sam Volkering

Contributing Editor, Investor’s Daily

The Dumbest Investment in the World

Bill Bonner, writing from Baltimore, Maryland

‘One thing I like about Argentina. They cook with salt. That’s it.’

– Robert Duvall

Well, you never know, do you?

Recall that the Argentines introduced a “century bond’ in 2017. At the time, we were not alone in considering it the ‘dumbest investment in the world.’

Who would lend the Argentines money for 100 years, we wondered? Statistically, the odds were that Argentina would default seven times before the bond matured. And then, when the government defaulted just three years later, and the century bond was down 75%, we all laughed with a self-satisfied chuckle; we were right!

Well guess what? The Wall Street Journal:

Investors who stuck with the country are having the last laugh. The bonds they were given in the default, plus the fat coupons on the original century bond, are now worth more than the original investment. Not just that: They are worth far more than if the dollars had been invested in “safe” U.S. Treasurys.

So far, US 30-year Treasuries have lost about 10% of their value over the period. The Argentine bond has lost value too – about 25%. But the yield was so high (intended to compensate investors for the risk of default) that the overall gain is above 50%.

So ha ha to us!

And to the entire community of smart-ass investment analysts who were so sure the Argentine bond was a loser. We all should have been more ‘cynicalist.’ That is not to say that we should have accepted the promises of flakey, unreliable governments.

Argentina was a serial defaulter. No one could doubt that it wouldn’t default again.

Instead, our cynicalism should have been directed at ourselves. We should have realized that analysts – seeing a risk so obvious and unavoidable – would over-rate it.

Investment yields are set by investors, not by governments, nor by analysts. Investors – taken as a whole… and over a long period – are not morons.

Bond investors, especially, are not idiots. If they were to buy the Argentine debt, they would need a genuine hope of making a profit on it. And as it turned out – they had it. The WSJ:

Josefin Meyer and Christoph Trebesch of the Kiel Institute for the World Economy and Carmen Reinhart of Harvard showed a few years ago that since 1816 the bonds of almost every risky country had long-run returns higher than the U.S. or U.K., despite frequent defaults. Just as with stocks or junk bonds, there is reward for risk, and the average return works out better than for the safest assets, U.S. Treasurys.

Say what?

Yes, it turns out that the rickiest sovereign credits (government debt) are also the most rewarding. The safest – namely, US Treasury bonds – are therefore less rewarding. How much less rewarding they are likely to be is, vaguely, today’s subject.

What makes $&!#hole credits so profitable is not the fact that they are sponsored by $&#%hole countries. It’s that they are recognized as unsafe… and often considered even riskier than they actually are. Investors demand protection… high yields, just in case something goes wrong, which it surely will.

What makes top ranked, super-safe credits un-rewarding, on the other hand, is that they are perceived to be so secure that investors see no reason to protect themselves at all. US Treasuries are thought to be the safest credits in the world. Because the US has the strongest economy… the longest-lasting democratic government… a court system that generally works… a military that can’t be beat… and a printing press that allows it to ‘print up’ more money at will.

What it has not… and cannot give to investors… is a guarantee that its money will be as valuable when its notes and bonds mature as it was when they were issued. That risk proved to be decisive over the last eight years.

And so now, when we look around the world for the ‘dumbest investment’ now, our eyes are drawn not to those $#&%hole countries with high yields and low ratings, but to that bastion of safety and prudence, the US… with yields so low that any surprise on the downside could be devastating.

An investor buying a 30-year US Treasury today can expect to earn a 4.6% yield. And yet, at the current rate of increase, assuming no major increase in the rate of added debt, he can also expect that the US will have a national debt of more than $100 trillion when his bond matures.

The two things seem incompatible. A country with $100 trillion of debt hardly seems like a good credit risk.

And since it can ‘print’ money at will, the danger is that the money it prints to keep up with its huge debt will be considerably less valuable in 2055 than it is in 2025. Already, it’s hard to imagine the circumstances in which the US could fully honor its current financial commitments. Adding another $60 trillion would not improve the situation.

What will happen? Perhaps Team Trump’s Mar-a-Lago Accord will replace US Treasury obligations with some sort of perpetual debt – that never needs to be refinanced. Or, perhaps today’s 30-year Treasurys will expire worthless. Or… who knows… like Argentina, some Milei-style miracle could put things back on a sound footing.

We don’t know, but our guess is that there is a gap between the real risks of US Treasury debt and the perceived risks. Which is another way of saying, the real value of Treasurys could be much less than the face value. A further guess is that Treasury investors will eventually write off the difference.

Regards,

Bill Bonner

Contributing Editor, Investor’s Daily

For more from Bill Bonner, visit www.bonnerprivateresearch.com