There’s a funny thing happening in the markets right now.

There’s a funny thing happening in the markets right now.

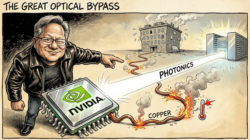

Everyone is staring at the AI stage show, its blazing lights, fireworks, pumped up music and spectacular for the ages.

The market oohs and ahhs with every new model release, every record-breaking quarter, every whisper that Nvidia might be able to sell back into China again.

The show is loud and bold enough to drown out everything else. In fact, it is drowning out everything else.

Except there’s one problem with that.

Something else equally as consequential is now unfolding almost unnoticed, with little attention or fanfare… yet.

While the market obsesses over compute, datacentres, and frontier model supremacy, the Trump administration is performing its best trick yet.

The stealth market pump.

This sleight of hand is perfect, because while your attention is over there (AI), under the deserts, and under the Pacific Ocean there’s a renaissance underway over here.

The irony is that the very boom investors believe is defining this era of market action is itself dependent on what Washington is now preparing to unleash.

A preview of what the renaissance looks like

Artificial intelligence is consuming metals at a rate not seen in modern history.

Every server rack needs copper, every energy storage system needs nickel and manganese, every large-scale compute deployment leans on cobalt, graphite, and rare earths.

Strip the metals from AI, and the entire sector collapses back into nothing but software. And even then, it’s all still based on physical hardware that’s made from…metals.

The problem, however, is that for the really important stuff, China controls the majority of supply. And the United States can’t build a multi-trillion-dollar AI infrastructure layer while reliant on an unpredictable adversary holding raw materials hostage.

The White House is at least cognisant of this predicament.

Which is why on 20 March and 24 April earlier this year, Trump signed two executive orders that may define the next decade of American industrial power.

The first being Immediate Measures To Increase American Mineral Production. As a matter of national emergency, the administration wants America to produce minerals on domestic soil.

That includes uranium copper, potash, gold, “critical minerals”, and just about any other metal involved in essential functions of energy technologies.

The second is the Unleashing America’s Offshore Critical Minerals and Resources order.

This one is fascinating as it looks to unlock deep sea mining for critical metals that are just sitting there, ready for harvesting on the bottom of the Pacific Ocean.

We got our first glimpse of how powerful these Eos were when The Metals Company (NASDAQ:TMC) went vertical almost instantly after the second order dropped in April.

The company is an early (and highly controversial) first mover in deep-sea mining of polymetallic nodules. Note: these nodules are rich in rare earths and critical minerals the US is so desperate to get its hands on.

TMC isn’t at scale, it makes next to no money and is even what you’d call experimental.

But with an EO aimed directly at their target market, the stock exploded.

What changed was that Washington pointed to the seabed and said in effect: this is an important thing for us now. When a small miner overnight becomes the front runner for critical metals on the sea floor that now has national strategic interest, fortunes can be transformed instantly.

But… this was just a preview of what’s to come.

The biggest winners may never pick up a shovel

There’s a viewpoint in the more thoughtful corners of the resource world, one that Jim Rickards (former advisor to the CIA, Pentagon, and White House) is adamant about, and it’s worth taking seriously right now.

His take is that the best opportunities in the new mining renaissance won’t come from the companies spending billions to drill, blast, scrape, or vacuum. The giants will do that part. Instead, the real asymmetric upside sits with the gatekeepers, the companies that hold claims, data, rights, geological intelligence, mapping assets, and regulatory footholds… without ever breaking ground.

These are the modern-day prospectors, and history tells us they often make more money than the miners themselves.

If Trump is laying the groundwork for a mining and minerals renaissance that will underpin a US Sovereign Wealth Fund, then these are the kinds of companies you’d want to own.

And make no mistake, this isn’t some side mission the administration is taking while the AI engine grows GDP.

This is a key part of the success of Trump’s second term, which he will very clearly measure by the performance of the stock market.

AI has centre stage right now, and it deserves it. It’s clearly the headline act.

But investors who are curious as to how that trick works, and bother to look over where no one else is, will see the whole spectacle rests on physical inputs the US is suddenly racing to control, monetise, and weaponise as a source of national wealth.

It’s the proverbial boom behind the boom.

Where this goes next, I think, is logical to see.

Investment, capital expenditure, support, loosening of bureaucracy and red tape will unleash conditions for miners where (at least on domestic soil) they can run free.

Then you’ve got the boundless potential of deep-sea mining and other more out-there ideas (like asteroid mining, even).

But the real fortunes may accrue to the companies sitting on rights, data, permits, and claims long before a single shovel hits the earth.

And if there’s one person who’s right at the edge of where all this is happening, it’s Jim Rickards.

I would say, enjoy the AI boom, there’s plenty of money to be made there. But don’t forget what built it.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

P.S. The market is dazzled by AI — but the real power shift is happening underground, in the metals and claims that will fuel the next decade of US growth. Jim Rickards has been tracking this from the inside, and he says Phase II of America’s $150 trillion mineral endowment could begin soon. In an upcoming exclusive event, he will walk through the catalyst, the timeline, and the companies best positioned. We’ll share more details early next week. Watch this space.