- Are you prepared for the failure of the welfare state?

- Reeves can’t tax your know-how

- How to generate income without taxable assets

All around the world, politicians are realising that they can’t afford welfare programs.

It must be mortifying for the elites. Their electability is based on dishing out cash. But the political system can only live beyond its means for so long.

The German Chancellor admitted the welfare state “can no longer be financed.”

The Japanese Prime Minister pointed out his country’s finances are worse than Greece’s…before resigning.

The US Social Security Trust Fund runs dry in 2033. Benefits will be cut more than 20% once the program can only pay out what taxpayers put in.

The UK is getting sucked into fiscal black holes. It can’t cut anything without an epic backlash, no matter how terrifying the forecasts are for spending.

And all this after absurd levels of immigration that were supposed to provide copious amounts of taxpayers.

In hindsight, statistics agencies have discovered the opposite. Immigrants actually cost the Treasury money…

Whoops.

The lack of shoulders is making the taxpaying burden a heavy one. Dependency ratios are rising fast. Old-age dependency ratios especially. But people are less willing to finance the lifestyles of the old. Nobody’s granny is as cute as their toddler.

The actual incomes and lifestyle provided to welfare recipients is proving astonishing. The UK pays terrifying sums of money to taxi the vulnerable across the country. The Australians are facing an epidemic of worklessness as a result of their new National Disability Insurance Scheme payments.

In some countries, the figures have reached the absurd. French pensioners have a higher income than French working age adults. Spain and Italy aren’t far behind.

Wealth is highly concentrated amongst the elderly too. Mostly thanks to housing that became steadily less affordable.

Retirement savings are a truly vast pot of assets. But tax breaks persist for those who saved the money.

Wasn’t the whole point of saving for retirement to lower the burden on the age pension, instead of supplementing it? Otherwise, why did we provide tax incentives?

Tytler was right

The number of welfare dependents is now large enough that they can vote their own largesse at the expense of the state.

It’s as Alexander Fraser Tytler pointed out about 200 years ago:

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy.”

Worst of all for the politicians trying to keep the show on the road is that their best taxpayers are hitting the road. High productivity labour is more mobile than ever before. And countries are actively competing for their tax revenue with all sorts of programs.

Having abolished all sense of patriotism or cultural obligation, governments are discovering young taxpayers won’t stay in an abusive relationship with their state. They’d rather move to the safety of petro-state Dubai…

Just when welfare is weighing heavily on the budget, Russia and the US are demanding Europe and Japan begin to spend on guns too.

The welfare state can’t go on forever. So it must eventually stop. But how?

How the end of the welfare state will look

There are several plausible ways for politicians to default on their promises.

They could give the people what they want. Simply print the money to pay for political promises.

It’s not like the majority of the electorate knows where inflation comes from.

We could cut welfare radically. Default on our political promises and basic services.

For example, the quality of the NHS could erode even further. Forcing you to seek private or overseas healthcare to get basic procedures done properly in a reasonable amount of time.

Unless you elect for euthanasia. No doubt that’ll get done quick smart…

According to the Telegraph, this transition is already occurring. Taxpayers are paying ever more to fund an ever worse NHS. And paying for private care on top of that too. The private health industry is booming in the UK.

But healthcare may only be the beginning. Waste disposal, utility connections, public transport and more could fall by the wayside as “unaffordable” for the government. Meaning you need to pay up to sort it out yourself. That’s not a direct tax, but a default on what you were promised in return for your taxes.

Severe means testing is especially likely, in my view. Especially if it frees up a lot of housing by making people downsize.

Governments could tax wealth heavily. After all, we’re all in this welfare crisis together…

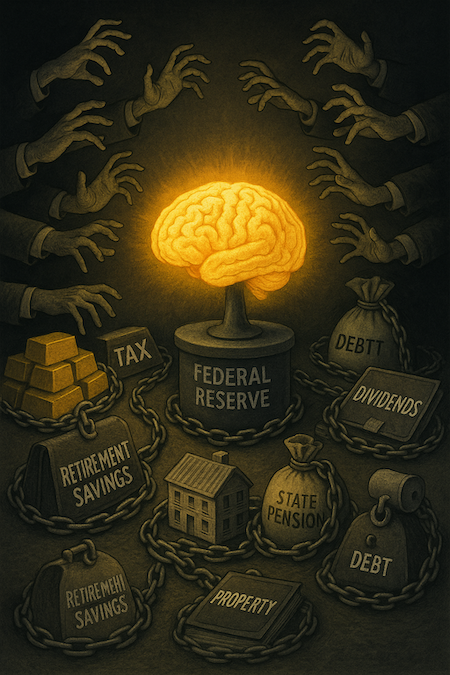

But there is one small part of your assets HMRC and inflation can’t steal.

Your brain.

How to generate income without assets

The point I want to make you aware of today is a simple one.

Assets are taxable. Knowledge is not.

If you have a method of generating income, that will be disproportionately valuable in coming years. Because governments will find it very difficult to crack down on or tax the asset value of a method of generating income.

Imagine a dividend or bond portfolio that pays you £40,000. Its value would be around a million pounds.

In the future, the government will try to tax your million pounds. They might tax the passive income it produces. Or means test the state pension.

They might wealth tax its capital value. Or force you to invest in government bonds, which earn lower rates of return.

They might even confiscate your assets and hand you a type of annuity instead.

Who knows what the quangos will come up with? They’re paid to be creative. And they get paid a lot – £391 billion last year according to the Taxpayers’ Alliance.

But the government can’t tax know-how. It doesn’t know how to.

If you know how to squeeze the same £40,000 from financial markets in a convenient way each year, the government will find it far more difficult to crack down on you in the future.

In a world where assets that provide an income are taxed, it will become far more valuable to know how to generate that income using your ability instead.

That’s why we’re revealing such a technique tomorrow. If you’ve not signed up, you can here.

Until next time,

Nick Hubble

Editor at Large

P.S. The welfare state is on borrowed time — and with it, your retirement plans may be too. But there’s one thing governments can’t confiscate, inflate away, or means-test into oblivion: your ability to generate income using your own skills. That’s exactly what Sean Allison is about to show you. His step-by-step method for extracting consistent income from the markets — without needing a huge portfolio — is being revealed tomorrow. Make sure you’re tuned in.