- Labour is only digging a bigger black hole

- The uncertainties of a Reform government matter now

- Only a crisis will wake up the electorate

Bond markets around the world are wobbling. Governments are having to pay dangerously high rates of interest to borrow money.

France and Japan are only the most recent examples. Soaring yields on UK bonds were a lead news story for months. Mainly because someone came up with the term “moron premium” for journalists to get excited about…

So far, the world is laying the blame for the bond selloff on government policies.

Trump’s deficits, France’s inability to cut pensions and Japan’s lack of immigration, for example.

In the UK, Labour is unable to cut spending. Tax hikes aren’t bringing in more revenue.

Even the Treasury has figured out that immigration was a net negative for the public finances.

The UK issued so many inflation linked bonds that it can’t even inflate its way out of debt.

There aren’t many options left to deal with the debt burden. And so the bond market is getting worried.

That hasn’t stopped the Labour government from making things worse. Especially on energy policy.

And so the bond market is punishing them for it by demanding higher yields, right?

Well, all this may be entirely correct. It probably is.

But there’s another possibility. One that’s rather disconcerting …

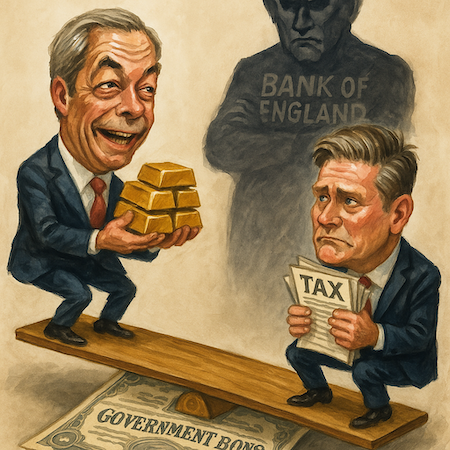

What if the bond market is already anticipating Reform?

The chances of a Reform government are rising. Both in the polls and the probabilities of an early election.

What if this is what’s actually behind the bond market’s recent manic moves?

Sir Keir Starmer’s mounting scandals could matter more to economic policy than the Chancellor’s budget if she won’t be around to deliver many of them…

Other countries with rising bond yields face similar political uncertainty. Japan’s prime minister just resigned. The French government just fell. Trump’s economic policies are proving to be unpredictable. The far right is rising across much of Europe.

The future of many governments’ economic policies is highly uncertain. We don’t know much about a Reform government’s economic policy either. They could be libertarian, Thatcherite or even left-wing, like France’s supposed far-right party.

One thing I suspect is that political commentators are radically underestimating Nigel’s understanding of financial markets. He was a metals trader and established his own futures firm. The civil service may be in for a surprise if they try to run rings around him like they do recent Chancellors.

We do know what the bond market thinks of cutting taxes to raise more revenue. Liz Truss and Kwasi Kwarteng kindly showed us. Bonds are too impatient to wait for the Laffer Curve to work its magic.

We can argue about what exactly happened in September 2022. I pointed out months before the media caught on that the Bank of England was behind the bond market plunge. Since then, my theory has become mainstream belief.

But if you think the Bank of England will be more friendly to a Farage government than a Liz Truss government, you’d be delusional.

Maybe that’s what the bond market is pricing in. Farage’s “Liz Truss moment” at the hands of the Bank of England.

Bank of England governor Andrew Bailey would be keen to show Nigel that he doesn’t deserve his “out to lunch Bailey” nickname after all!

Whatever you think of Reform’s economic credentials, it’s clear they represent a high degree of uncertainty. Even if only for whether the civil service will actually back them.

A few political commentators are claiming Nigel’s intended reforms will be exceptionally difficult to actually carry out. He’d certainly have to change a lot to put the country back on track.

Personally, I suspect his energy policies alone would put the UK’s finances on a dramatically more sustainable course. But it’s not up to me. It’s up to the bond market…and the Bank of England. Which isn’t exactly populated by climate change sceptics…

There’s some technical evidence that my theory could be correct. For example, it’s the long end of the bond curve that’s struggling in most countries. This means investors are demanding much higher yields to lend to governments for long periods than for short periods. They anticipate a high risk of crisis, but at some point in the future, not anytime soon.

That signals it’ll be a crisis about future long-term government policies, not current government delusions. Labour seems unlikely to stay in power for long. Their shenanigans matter little.

Secondly, for bonds to sell off, they must be expecting a lack of support from the Bank of England. That’s unlikely to happen under a Labour government.

With the latest GDP figures coming in at 0% growth, the Bank will be pondering whether it’s time to change tack on its bond selling programs. Looser monetary policy will become the priority,

But under a right-wing government that threatens the Bank of England’s independence and credibility, the bond market would be allowed to sell off good and hard.

Only a crisis can wake up an electorate

I’ve seen two recent references to a very human idea. Some call it “accelerationism”. The idea that if you need a crisis to wake people up, the sooner the better.

This makes Labour’s messed up economic policies precisely what the country needs. And the bond market plunge is what voters need in order to realise their welfare is at risk of cuts imposed by the IMF, if they don’t yield to market pressure first.

But this old-Maid version of politics is risky. Liz Truss and Kwasi Kwarteng showed us why on that count too. You never know which way the blame will flow. It depends on when the crisis strikes.

And that’s largely up to central banks. Because they have the unlimited power to forestall a crisis in the short run by buying bonds. They can pick and choose whose watch the pent-up chaos hits the fan.

Until next time,

Nick Hubble

Editor at Large

P.S. The markets are shifting fast — and today at 1PM, Sean Allison will show you how to use that volatility to your advantage. If you want to learn a strategy that could turn uncertainty into opportunity, don’t miss this live session. You’ll get a full trade set up example, risk management framework, and two simple rules the pros use. Join the live masterclass here.