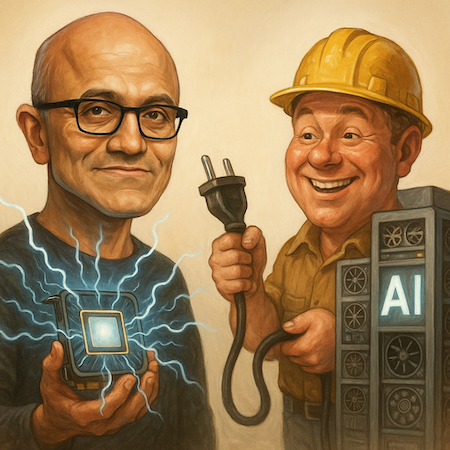

When Satya Nadella says Microsoft has enough GPUs but not enough power, you know we’re about to enter a new phase of hype cycle.

When Satya Nadella says Microsoft has enough GPUs but not enough power, you know we’re about to enter a new phase of hype cycle.

On the BG2 podcast this week, Microsoft’s CEO admitted that the $3.8 trillion giant is sitting on chips it literally can’t plug in.

“The biggest issue we are now having is not a compute glut, but it’s a power and it’s sort of the ability to get the [data centre] builds done fast enough close to power,”

And that, in a single sentence, explains why the hottest real estate in AI is coming from the “neocloud”…

These “neocloud” providers already built years ago what hyperscalers like Microsoft and Amazon now desperately need… cheap land, massive substations, and megawatt-scale high-tech, innovative, cooling.

These upstarts aren’t some fly-by-nights out of left field nobodies; they’ve been neck deep for years in “proof-of-work” but realised over the last 18 months that “proof-of-compute” is one of the most extraordinary business opportunities they and the market have ever seen.

And not only is it sending their stock prices through the roof but it’s also helping to unlock a quadrillion-dollar market opportunity.

The rise of the “neoclouds”

Take Iris Energy, which you will now find on the market data sites as just “IREN” (NASDAQ:IREN).

Born as a bitcoin miner in 2019, it just signed a $9.7 billion AI compute deal with Microsoft.

That contract, prepaid in part, effectively makes IREN a shadow extension of Azure’s data-centre empire. Remember the two biggest cloud providers in the world, which combined control around 50% of the internet and cloud services are Microsoft (Azure) and Amazon (AWS).

For Microsoft, they can’t scale their AI dreams fast enough, even with their own existing infrastructure. That’s why this deal involves IREN buying $5.8 billion worth of Dell-supplied Nvidia GPUs for its 750 MW Childress, Texas site.

Interesting, isn’t it, from bitcoin blocks to AI clusters in five years flat.

Worth noting, they still mine bitcoin, which means they’re still part of the decentralised fabric of the world’s most important digital asset.

As Nadella battles to keep his chips powered up and online, companies like IREN are putting their hands up to say, hey, we’ve got exactly what you’re looking for.

IREN’s deal isn’t an outlier either.

Microsoft is on a $33 billion spree across what the market now calls “neoclouds.”

Smaller, power-dense operators like CoreWeave (former crypto miner), Nebius, Nscale (spinoff from a crypto miner), and Crusoe (former crypto miner) have become critical to expanding AI capacity without breaking hyperscaler balance sheets.

CoreWeave is another example, now valued over $62 billion and leasing GPU clusters to everyone from OpenAI to Meta.

In September, Meta and CoreWeave announced a $14.2 billion contract running through 2031 to supply Meta with compute power.

That’s the same CoreWeave once mining Ethereum and Bitcoin in New Jersey warehouses.

Then there’s Cipher Mining, which just landed a $5.5 billion, 15-year lease with Amazon Web Services (AWS) to supply 300 MW of AI-ready capacity by 2026 and build a 1 GW “Colchis” campus directly wired to the Texas grid.

Let’s run through that checklist again…

Crypto miner, turned AI compute power player… check

Massive hyperscaler desperate for compute, inking a fat cheque… check.

Are you seeing the trend?

These crypto miners are experienced players. But their advantage isn’t chips, its infrastructure economics, knowing how to source low-cost power, design modular, efficient cooling, and scale quickly lightning bringing online masses of AI compute power at speed.

The same playbook that once secured their bitcoin hash rate is now monetising AI compute at 10-times the return.

The quadrillion-dollar unlock

Here’s what’s really fascinating.

This isn’t just an AI story.

The beating heart of this AI revolution, quite literally the energy source keeping it alive, is still deeply rooted in crypto.

Bitcoin mining forced the build-out of high-density power hubs in Texas, Louisiana, and Alberta long before OpenAI or Anthropic existed.

Those facilities, those grid connections, and those highly efficient data centres are now being repurposed and dual-purposed to feed the GPU-hungry clusters of the AI boom.

Crypto miners built the roads and rails and now AI is lining up at the toll booths and ticket windows wanting to get on board.

What is also thrilling is this is still part of a convergence that we’re calling a quadrillion-dollar crypto megaboom.

Visa’s CEO gave a glimpse of it the other day when they released their earnings.

He said,

“We continued to invest in our Visa as a Service stack to serve as a hyperscaler across the payments ecosystem. As technologies like AI-driven commerce, real-time money movement, tokenization and stablecoins converge to reshape commerce, our focus on innovation and product development positions Visa to lead this transformation”

There, folks, is one of the biggest indicators you’ll ever see for what the future holds.

AI-driven commerce. Yes, your AI making purchasing decisions for you.

Convergence of tokenisation and stablecoins. Yes, onchain, crypto-infrastructure layers that power global digital trade and commerce.

Combined, we’re talking about AI that drives and transacts in crypto, in stablecoins, that helps you to make financial decisions and helps you to manage your money and life.

So, it’s AI, needing huge power demands, which a large part is coming from crypto miners, who are also part of decentralised networks that underpin the real-time transactions and money flow of stablecoins and digital assets.

This is one massive opportunity feeding the other and vice versa.

So, if you think this is all solely an AI story, you’re missing a massive chunk of the opportunity here.

Stablecoins, tokenisation, AI-economies and digital assets all converge and mix together.

And over time, as in, by the end of the decade, I expect that AI-driven crypto-commerce will be a normal part of global commerce and trade.

An opportunity that could unlock a quadrillion dollars in wealth and opportunity.

What’s so exciting about it is that the market is completely missing this chain of events and wealth unlock.

They can see the AI story, but they miss the speed at which crypto and digital assets is inherently intertwined with it all.

And in a matter of weeks, President Trump could be signing into law another huge part of this puzzle that accelerates the timeline on all this even further.

I think it’s clear there are several moving pieces in play here, that have come from a series of pieces falling into place over the last few years. These are converging, right now, and we’re seeing huge gains in the stock market, and what I expect to be even bigger gains in the crypto market as this all unfolds in front of the mainstream’s eyes in the next couple of years.

Positioning your wealth and portfolio now, ahead of it all is critical. And it stands to reason we are indeed on the cusp of a monumental moment in history for AI and for the crypto markets.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily