Standards are such a boring thing.

Standards are such a boring thing.

It’s like where excitement and innovation go to die.

I remember the numerous tech, crypto, banking and finance conference I’ve been to over the years will always inevitably have a “standards” panel or discussion. And of the ones I dared tempt fate with, they were all excruciatingly boring.

But…

In some instances, standards, can be good and can unlock a tsunami of opportunity because things just get easier.

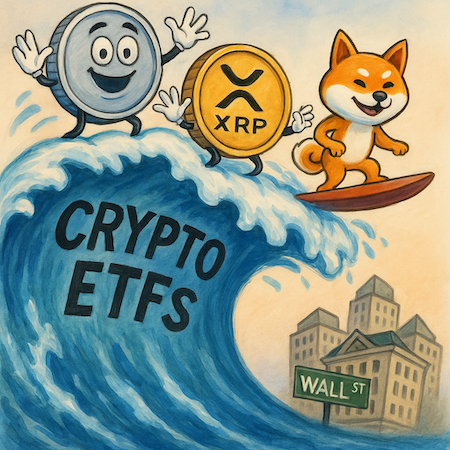

This week the SEC in the US did exactly that and made things a heck of a lot easier for ETFs… specifically, crypto ETFs.

It approved generic listing standards for commodity-based trust shares and that includes crypto (well, they call it digital assets still).

This means U.S. exchanges can now list spot crypto ETFs without filing individual rule changes with the Commission. The Section 19(b) Exchange Act bottleneck that dragged approvals out for months is gone.

The wait time drops from 240+ days to about 75.

For investors, that unlocks an entirely new market and one that’s going to surprise a lot of people.

Wall Street’s new product line

Until now, every crypto ETF was a fight. Bitcoin only got its ETF after a court battle. Ethereum followed, but not without drama, and still no staking ETF. Solana, XRP, Dogecoin and others were left waiting.

Those delays are over.

If a token trades on a regulated futures market (which currently means Coinbase’s futures market), or has an existing ETF cousin, it qualifies. That opens the door to a wide list of altcoins.

Solana and XRP ETFs could hit the market in weeks. Expect Avalanche, Chainlink, and even Shiba Inu to follow.

The SEC has removed itself as the choke point. From here, it’s on the exchanges and asset managers to build and launch.

BlackRock, Fidelity, ARK/21Shares, and VanEck battled hard to get Bitcoin and Ether ETFs live. Now they have a framework to expand into altcoins without another regulatory grind.

Expect to see single-coin ETFs, diversified baskets, and thematic crypto funds roll out. A Dogecoin ETF is already in the works, but it’s kind of a Frankenstein hybrid.

Now, just a spot Dogecoin ETF is an almost certainty.

A multi-asset crypto tracker is likely.

The irony is all this was supposed to be the antidote to Wall Street extracting value from the market and people, this was supposed to all be about DeFi.

But Wall Street doesn’t leave opportunities like this on the table. If there’s a buck to be made, they’ll try make it.

London makes its move

This shift in approach to regulated exchange traded funds and assets isn’t confined to America.

The UK is moving in the same direction (albeit slowly). For years, the FCA restricted crypto ETNs (exchange-traded notes) to professional investors, keeping retail locked out.

That changes in October. The FCA has confirmed crypto ETNs will once again be available to UK retail investors. Officials argue the market has matured, products are better understood, and access should reflect that.

Don’t know why they couldn’t have reached this conclusion a few years ago when they first allowed for them, but… there you go.

The timing matters too. Britain is aligning more with Washington than with Brussels.

Draft crypto laws already mirror U.S. language. With the SEC throwing the gates open, London trying at least to not be left behind.

There are some speedbumps still, like a purported 10,000-pound stablecoin holding limit, but when it comes to election time, and Reform has a strong pro-crypto policy, expect all that to go away and the UK to be as open door to all this as the US.

Think about the competitive angle if American pension funds can buy crypto ETFs, UK managers won’t want to miss the flows. Asset managers in the City will look for their own launches, and cross-listings of U.S. funds onto UK exchanges become realistic.

The evolution of crypto investing has been clear. First came direct exchange access. Then Bitcoin ETFs proved digital assets could sit in mainstream portfolios. Now the structure exists for altcoins, baskets, and broader exposure.

It doesn’t mean every product will succeed. Some coins will rise with spot ETF flow pumping demand, and others will fall when it’s seen that there is no demand.

But the bigger point is that crypto is now moving into the plumbing of global finance. It’s shifting from a speculative trade to an accepted asset class, it’s a takeover of TradFi by DeFi.

And that doesn’t happen overnight. It happens slowly, surely and then all at once.

It also means investors now have easier, safer, and more conventional ways to allocate capital to crypto. And I think that sends that mainstream adoption curve sharply upward and lifts the entire crypto market to higher highs.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

P.S. Most people are still caught up in recession headlines. But quietly, the SEC just opened the floodgates for crypto ETFs — and the UK is racing to follow. This shift could be the start of a new “Wealth Window”… and Britain may be right at the centre of it. Don’t miss what could come next.