You’ve heard of Lloyds.

You most likely know of ING, Citi, HSBC…these are the giants that carry the legacy financial system on their backs.

These are the banks we’re supposed to trust, worship and be ever so thankful that they keep our money “safe”.

Meanwhile, they take their clip on every penny kept with them, gouge consumers on fees, create incredible friction and frustration for the simplest of tasks, and in some instances will completely debank people solely based on their political persuasion.

We all know there is inherently something rotten with the global banking system.

But there is a solution.

And a part of that solution has just shown its hand, from Aave.

Now, I’m going to assume that unless you’re deep into the crypto markets you probably don’t know Aave.

Outside crypto circles, it’s almost completely unknown.

Yet what Aave released just over a week ago is an existential threat to the foundations of global banking.

You may think that’s a grand and hyperbolic statement. After all, surely nothing could change or defeat the world’s big banks?

But there’s a new global financial system emerging, that’s onchain, 24/7, frictionless and does away with all the frustrations and problems that traditional finance deliver.

This idea of decentralised finance is still so new and scary to some people they think it’ll never last. But once you experience it firsthand, and see just how things are changing, then maybe you’ll come around.

So… let me prove it to you.

Wait… What Is Aave?

Aave is not technically a bank by name, albeit it operates like one.

Think of Aave as the world’s first global, algorithmic bank, except it doesn’t have branches, staff, balance-sheet mismatch, or a CEO sitting in a corner office deciding who gets a loan.

It’s one of the oldest and largest decentralised lending markets in crypto. Users deposit assets like USDC into Aave’s smart contracts. Borrowers then draw liquidity by posting more collateral than they borrow. The interest paid by borrowers flows directly to depositors.

As I say, it’s algorithmic and onchain, so no intermediaries, no credit officers, no bureaucracy, just (lots of) collateral, mathematics, and code.

Since launching in 2017, Aave has handled tens of billions in deposits, survived every cycle, and built a reputation as one of crypto’s most secure and transparent financial protocols.

It currently has around $54 billion in net deposits, has seen over $116 billion in volume in just the last 30 days, handled over $3.23 trillion in cumulative deposits and paid over $1 billion in interest since its inception.

But for so long, Aave was difficult to use for non-crypto natives. The protocol has proven to be robust and, importantly, useful. However, you could have the best product or service in the world, but if it’s hard to use, then people just aren’t going to want to use it.

That’s now all changed.

Now, before I go any further, I want you to open up your internet banking app and go and have a look at the interest rate you’re getting on your savings accounts.

I just jumped into my Lloyds accounts, and I took a look at the rates for the “savings accounts” for my kids.

It’s 2.47% on the balance between £0 and £4,999. And then… it’s 1% on anything above £5,000.

Meanwhile, back in that Decentralised Finance world…

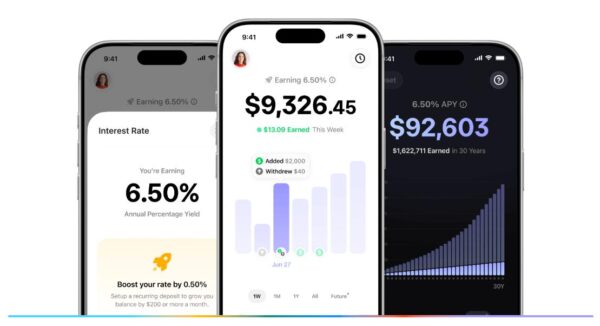

Aave just released the “Aave App”.

Source: Aave.com

Source: Aave.com

It’s a savings account that delivers a rate around 6% APY, with optional boosts starting out at up to 6.5% and Aave has posted that in the future, they’re working towards getting that rate up towards 9%.

This is the same over-collateralised lending model that has powered Aave’s markets for years, now delivered through an app that feels more polished than anything Barclays or Citi could dream up.

Now, here’s where things get really interesting, and why this is a threat to banks.

Interest accrues second-by-second. Your balance increases in real time. The second you deposit is the second you start earning.

Try getting that from an institution that still thinks clearing a payment in under 24 hours is a technological marvel.

Also, it’s worth pointing out, we’ve seen high-yield crypto savings apps before, and many of them got wiped out in the 2022 crypto “winter”.

But they weren’t protected. Aave is doing something most of those didn’t… insurance.

Aave is providing up to $1 million in user protection, built right into the product. Now, that’s not government-backed, but it is a genuine insurance fund designed for accounts on the platform.

That’s more than four times the federal protection in the US, and five-times the protection amount in the UK (which was only increased just this week).

I wonder if the lift in the UK amount had anything to do with the emerging threat from DeFi?

DeFi will eat global finance as we know it

I think once savers realise they can earn meaningful yield with instant liquidity and real transparency… why would they stay in a traditional savings account?

Sure, there’s a trust hurdle to cross. But going off the way in which traditional banking behaves, I think that’s a simple hurdle to get over.

And Aave is just the first.

More like this will emerge.

And remember, banks rely on deposits. Without deposits, their lending books vanish, and hence their profits. Whichever way you want to look at it, if the banks don’t have the deposits anymore, they don’t exist.

Deposits are their engine room. Lose the deposits… lose the engine.

Of course, it’s hard to even fathom banks could lose deposits on a scale that threatens their existence.

But I guess it was impossible to think Nokia would even lose its mantle.

I guess it was impossible to think Blockbuster wouldn’t exist.

I guess it was impossible to think we’d listen to music on anything that wasn’t a record… or a cassette… or CD.

Everything changes when the disruption is substantial enough to warrant it. Everything.

That includes banks. And my take is what Aave has delivered to market is substantial enough.

Even if you never touch the Aave App, you should understand what it represents.

A new banking model where;

- Deposits are yield-bearing by default and by the second

- Interest is transparent and market-driven and high

- Withdrawals are instant, no barriers to exit

- Insurance is embedded protecting large sums

- Borrowing is over-collateralised, baking stability into the platform

- Banks are optional… because they’re simply not needed

What Aave has shown us is not a fintech revolution. It’s a monetary system revolution.

When I bang on about the crypto markets innovating and being in “buidl” mode this is exactly what I mean.

Prices of crypto may be volatile but the fundamental structures of how money works are changing.

And that means big things long term for crypto, for the industry, for investors.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

P.S. The article shows how fast traditional finance can be blindsided by real innovation. Jim Rickards believes a similar break in the system is unfolding — and that a handful of companies are positioned to gain dramatically as it accelerates. He’ll reveal them live tomorrow. Seats are limited, so lock yours in now.

What you may have missed…

JP Morgan is crypto enemy #1 again. And that is good news

As bitcoin pulled back, Strategy (MSTR) was hit twice as hard — dropping to a valuation below the value of its own bitcoin holdings. The selloff sparked panic, conspiracy theories, and a sudden hunt for a villain. Enter JP Morgan. Read more here…

Prepare for President Trump’s Mississippi Bubble

You’ve probably heard of the 18th century South Sea Bubble. But did you know it was a scheme designed to cut the national debt? One that’s about to repeat… Read more here…

Strategic Investment

We come to what seems like a water-tight proposition: the more the feds get involved in the process of creating wealth, the less wealth is created. Read more here…

“American Birthright”: Phase II Update

Trump’s plan to open America’s federal lands for mining is more than politics — it’s a once-in-a-generation resource play. From lithium to gold, a new boom may be brewing. And for savvy UK investors, this could be the early-stage window to watch. Read more here…

The Thing AI Lacks

James Altucher sits down with bestselling author Ryan Holiday to explore the messy, human side of wisdom — the part no AI model can replicate. Their conversation dives into curiosity, pain, mistakes, and the hard-earned lessons behind every meaningful skill. Read more here…