I’ve had this feeling in my gut for a while now that something about Strategy (NASDAQ:MSTR) wasn’t quite adding up.

I’ve had this feeling in my gut for a while now that something about Strategy (NASDAQ:MSTR) wasn’t quite adding up.

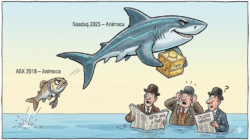

The gap between its bitcoin holdings and its market valuation kept widening, the volatility kept intensifying, and the noise around it kept building in a way I’ve seen many times before in this space.

Add to the mix that the hatred coming at Michael Saylor was intensifying to a level that felt Sam Bankman-Fried level (the founder and CEO of failed exchange FTX, who’s now serving a prison sentence).

The other week, I asked whether we’re in a crypto winter… in my view, we’re clearly not. And as I explained,

“This is a cycle behaving like a cycle, but under the hood, still building, still innovating, still marching on …”

I can say that because over the years I’ve witnessed a fair few cycles and seen plenty of love and hate come in and sail away for founders, creators, and innovators in crypto.

And what I’ve noticed about the saga with Strategy and Saylor is that it’s very much like cycles gone by. That these hero-figures are put on a pedestal when things are flying and “numbers go up” but the minute the markets turns against the investor, the investors turn against their heroes.

But then, as predictable as the volatility in the market, a villain is found, and the hero once again returns to their post.

The good news is, while crypto prices might be in the doldrums, what we’re seeing now is a very natural part of how this market operates. It’s just something to get used to, and when things are like this, when heroes turn to villains and back to heroes again, when the real villain is discovered, and that villain is the establishment, the crypto market gets its laser-eyes back and things rip higher.

I think that’s exactly what’s playing out now, and here’s what it looks like…

Back to the core of crypto

As bitcoin slipped into the mid-$80,000s, in the last two weeks, Strategy was hammered far more violently, dropping to valuations that implied the market no longer trusted the structure of the business.

In other words, as bitcoin peeled back around 30%, Strategy was smashed around 60%.

It copped such a pasting that it’s market cap is now less than the value of just its bitcoin holdings. That’s not even counting the software business or the value of anything else they do.

In short, it’s pure fear, and that mismatch is always an opportunity.

A big part of the recent slide is thanks to JPMorgan. They published a “warning note,” suggesting that MSCI might remove Strategy from several major indexes, potentially triggering billions of dollars in forced selling from passive funds.

This made the Bitcoin maxis and Strategy fanboys mad.

It felt like a targeted attack on Strategy. Then rumours appeared JP Morgan might have also been massively shorting the stock. And then more started coming to light that Chase Bank had been debanking major crypto players and blocking transactions to bitcoin exchanges like Strike.

Even Jack Mallers, the CEO of Strike (a major bitcoin exchange) showed how Chase had kicked him out of the bank.

Suddenly, JP Morgan has become public enemy number one in crypto.

And we love it.

Bitcoin and by extension, crypto, at its very core is anti-establishment.

It is the antithesis of centralised control, power and a traditional banking system that extracts wealth from many and allocates it to the few.

It is open, free and libertarian in its origins. It doesn’t matter who you are, where you’re from, what you do or don’t have… anyone can access and get bitcoin.

The same cannot be said of the traditional banking system.

So, if it takes JP Morgan and TradFi shenanigans to help the crypto market remember where it came from, the good. Let’s rally the troops and the market.

A market at a pivot point

Historically, these moments, the ones dripping with fear, frustration, blame, and conspiracy, tend to arrive right before the pendulum violently swings the other way.

When there’s something to rally around, things get tribal in crypto.

And it’s that tribal, core ethos of its origins that lead to the biggest bull run cycles higher.

If JP Morgan is the villain of this cycle, good. So, they bloody well should be.

They might talk a good game about stablecoins and blockchain networks, and all that jazz, but never forget Jamie Dimon thinks it’s all pet rocks and they were violently opposed to the whole thing up until they realised they could extract cash from the clients by taking part.

The sooner legacy institutions like JP Morgan are driven out of business, the better.

Maybe they’re not bankrupt in a year. But give it a couple of decades, and I promise you the traditional banking system is completely different. Where banks, as you know them, today are more DeFi than TradFi.

I have proof of this, and I’ll show you exactly how banking is set for a massive shake up in my next essay.

But clearly, a turning point is coming for Strategy, and for the crypto markets.

They’re annoyed, they’re realising again what bitcoin is about, and why it’s important. Then add to the mix that Strategy has clearly been grossly beaten down, and things start to become very clear about where this all heads over the next couple of years.

You think Bitcoin and Strategy are cheap? You think bitcoin long term heads to $1 million? You think the likes of JP Morgan are ripe for disruption and that’s taking place now?

If you think any of that is realistic, then we’re clearly on the same page.

Markets price the present with brutal accuracy, but they almost never price the immediate future correctly. And the immediate future for crypto is lining up for something very different to what the sentiment suggests today.

And this is all on the backdrop of regulatory certainty as to how the industry can operate and grow. Infiltration and then elimination from the inside is how this takes place. DeFi doesn’t just replace TradFi, it creeps in, exposes the weaknesses and problems, then delivers the solutions.

Remember, if bitcoin stabilises and rises again, Strategy rebounds harder.

If the CLARITY Act lands, be it this week or the next couple of weeks, Strategy becomes investable for institutions again.

If the administration hints at a tighter alignment with crypto, and maybe even takes a stake in Strategy like they did with Intel or critical metals companies, the stock could explosively rise.

And it feels like Strategy is at a point now where any day the headline could read, “Trump buys Strategy for the US”.

Even if Strategy is kicked out of the indexes, and passive outflows turn out to be less severe than feared, the stock’s current discount looks absurd.

But if that happens, it’s just more fuel for the crypto market to take aim at TradFi and tear it a new one.

The world is changing fast, global finance is being rebuilt from the inside out, and there are ways to play this market that make right now a pivotal moment not just for crypto, but for investors too.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

P.S. Markets always need a villain — and they always overcorrect before they snap back. If this week proved anything, it’s that sentiment can shift fast. This upcoming presentation will show you how to prepare for that shift and where the real advantages open up when everyone else is distracted. Don’t miss your chance to lock in your seat.