It’s 1991. I’m sitting in a computer lab, staring at a blinking cursor on a black screen.

It’s 1991. I’m sitting in a computer lab, staring at a blinking cursor on a black screen.

The “Internet” exists, technically, but there’s no web browser.

No Google. No Facebook. No TikTok with people dancing while promoting fake finance courses.

Just a few nerds, like me, connected by TCP/IP, typing commands like telnet and ftp into the void, hoping someone else is out there.

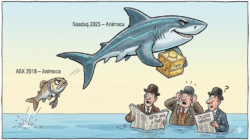

Fast forward to now. Most of the internet is now owned by about 10 companies.

AI? Same story. You want to build something?

Simple: Spend $40 billion on GPUs, suck half the grid dry, build a brain trust of ex-Googlers, and pray Elon doesn’t update Groq this week.

Or…

You could use Bittensor.

And this is why I just recorded my second podcast on it with Joseph Jacks, founder of OSS Capital—the world’s first VC firm dedicated to commercial open-source software and early-stage investor in AI and open-source tech.

Bittensor doesn’t just remind me of the early internet. It is the early internet all over again. Except this time, it comes with the right incentives baked in.

Let me break it down. (Link to the full conversation below.)

A New Kind of Internet

Did you know that salt was once a luxury? Entire economies were built around it. Rice too. Japan once measured wealth in rice.

Today, AI is the new salt, the new rice—hoarded, priced, rationed by a few mega-corps.

Bittensor makes AI a commodity. And not just a commodity—an open, decentralized, ever-evolving, permissionless ocean of intelligence.

No middleman. No API key required. No begging Google for access. Just incentives.

Imagine if Google’s search engine wasn’t created by Larry and Sergey in a Stanford dorm room.

Imagine instead that it emerged from thousands of people around the world competing to build faster, better web crawlers—getting paid based on performance, not pedigree.

That’s Bittensor.

But instead of spiders crawling the web, it’s AI models crawling data, training on it, improving with every iteration, and getting rewarded in a token called $TAO.

Just like Bitcoin rewards miners for hashing, Bittensor rewards miners for intelligence.

Why This Scares Big Tech

Right now, AI is expensive because the infrastructure is centralized. If you want to build your own large language model, you have to rent GPUs from AWS or beg Nvidia for supply.

Good luck.

But Bittensor flips the script. Miners all over the world—hobbyists, data centers, maybe even that kid in India with a GTX 1080—can lend their compute to the network and get paid.

It’s cloud computing without the cloud monopoly.

And it doesn’t stop there. It goes beyond Big Tech monopolies.

You could even build a subnet that incentivizes certain types of energy. Want to fund a solar farm? Build a subnet.

Want to incentivize compute running on otherwise wasted energy (e.g., flare gas, hydro overflow, curtailed wind). Build a subnet.

Suddenly, parts of the energy grid become a substrate for AI.

You don’t need to build the next Google. You just need to build the piece that the next Google uses.

Each subnet is like its own startup. But without the gatekeeping.

And you don’t need to convince a VC. Just the network.

My Prediction? Bittensor Will Be HUGE

Bitcoin changed how we store money. But Bittensor changes how we build intelligence.

It’s the most important platform nobody’s heard of yet.

And when you realize that the best AI model in the world might not come from Google’s HQ, but from a cluster of anonymous GPUs mining intelligence in exchange for $TAO—well, that’s when the lightbulb goes off.

So here’s what I’m doing:

- I’m learning everything I can.

- I’m buying TAO every month like it’s internet real estate in 1995.

- And I’m talking to the smartest people I can find, like Joe, every week on this podcast.

Because history has a funny way of repeating itself.

And this time, we don’t need permission.

We just need incentives.

Here’s the full conversation. Worth a watch if you want to know where crypto, AI, and everything else is headed.

Best,

James Altucher

Contributing Editor, Investor’s Daily