In 2020, it didn’t feel like the start of a bull market. It felt like the world was ending.

Markets were crashing, fear was everywhere, and the last thing anyone wanted to hear about was “risk assets,” let alone crypto.

Actually, crypto was still a dirty word. And the Financial Times had even jumped onto an interview with Nigel Farage and I talking about bitcoin and crypto, saying about my book, Crypto Revolution,

“You know when you do a £5 Secret Santa with colleagues and you end up getting someone you secretly don’t like very much! You’re welcome.”

But in 2020, there was a trifecta of factors off the back of the pandemic that lit the market and sent crypto into a mega-boom during the entirety of 2021.

The three factors were rate cuts, quantitative easing (QE), and a massive round of stimulus cheques.

That flood of cash lit the fuse under one of the greatest wealth events in modern history.

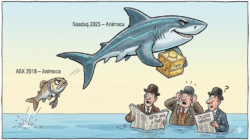

In the crypto markets at the peak of the 2021 mega boom, DOGE had climbed 36,000%. Ethereum 2,300%. Solana 43,000%. And even Bitcoin soared 1,200%.

(Past performance is not a reliable indicator of future results.)

From meme coins to major chains, it created more overnight millionaires than any tech boom before it, including the 2017 mega boom cycle.

And it was all off the back of three catalysts that took place in 2020.

Fast forward to today, and not only is that trifecta of events back on the cards, but there’s now a fourth that not only could see the market eclipse the 2021 cycle but possibly create more generational millionaires than anything else in history.

The trifecta is now the quadrella

President Trump has just announced every American (except the ultra-wealthy) will receive a (minimum) $2,000 “Tariff Dividend.”

Sounds nice. And you can call it what you want, but it’s a stimulus cheque.

And history has already shown what happens when stimulus collides with rate cuts and quantitative easing.

That’s exactly the cocktail we’re staring at right now.

- Stimulus: The “Tariff Dividend” means fresh capital in consumer hands, just like 2020. And, yes, plenty of that cash is heading straight into crypto.

- Rate Cuts: With inflation cooling and growth wobbling, the Fed has already begun trimming rates, and December could bring another.

- QE on the Horizon: Liquidity injections are creeping back into play as the U.S. shifts from “tapering” to “easing.”

Individually, each is bullish. Combined? They’re rocket fuel.

But there’s one more catalyst, maybe even bigger for crypto markets, that could be dropping in a matter of days. We had thought it might come in the next few weeks, but now it could be as soon as this week, according to some pundits online.

And when these (now four) factors are unleashed, the crypto market could be off to the races.

Sure, it might seem like that’s impossible.

But that’s exactly what it felt like in 2020.

Back in 2020, nobody believed Bitcoin could break $20,000 again, let alone march on to $69,000 the next year and then on to $100,000 in a couple of short years from there.

But it did.

Nobody thought the altcoin market would boom again like the 2017 cycle, or innovations like NFTs would become a cultural phenomenon.

But they did.

Now the same factors are aligning again, plus a fourth, on the back of a fearful and uncertain market.

And plenty of people think that crypto won’t enter a mega boom again, that 2021 was it and that’s the end of that.

Well, I’m saying it’s not over. Not only will we get another mega boom cycle, but it will put all the others to shame.

There’s now far more liquidity, far better infrastructure, and far deeper on-ramps for new investors.

The Fourth Catalyst

As I say, though, part of the reason this mega boom could be bigger and better than ever before is the fourth catalyst on the cards.

Beyond the “Tariff Dividend,” rate cuts, and QE…this fourth catalyst sets up crypto not just for one massive mega boom cycle, but to become an entrenched part of global trade and commerce…forever.

And when this fourth catalyst drops into its slot, that’s when the next Stimulus Run begins in earnest.

It will give the market the structure and certainty it’s always craved but never been afforded by the legacy institutions and power brokers… until now.

And if it all comes at once, which it looks like it’s shaping up to do – and you can stomach the high risk and volatile crypto market – then the time to get your fix and position in the crypto markets is now, as though it’s mid-2020, and you know that the 2021 mega boom is coming.

That’s why we’re positioning now, early, on cryptos that we believe can ride this potential mega boom. Five in particular that are as primed as any to rocket higher when the “stimmy cheques” hit and, then other catalysts fall into place.

These aren’t random meme plays. They’re the asymmetric, high-conviction crypto with the clearest upside in the next mega boom surge.

We’re so confident in what’s coming that we revealed one of our five top picks for free in our latest presentation.

It’s one of the most important updates we’ve shared all year and even if you’re still doubtful about crypto, I’m certain you’ll take away something valuable.

You can watch the full briefing and see the free pick here.

Because when history rhymes, it pays to listen.

And history’s rhyme right now sounds a lot like 2020.

Only louder.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

P.S. James and I recently shared what we believe could be the most important update of the year, including five cryptos we see as best positioned to lead the next major surge. One of them, we revealed in full detail for free.

If you want to see why we think this setup could rival the early stages of 2020’s rally, and where the biggest opportunities may be forming, you can catch the full briefing here.