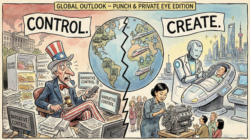

Publisher’s Note: It’s tempting to see U.S. shutdown drama, AI bubbles, and trillion-dollar deficits as a uniquely American mess. But for UK investors, this article offers a useful warning — and a framework for what’s likely to come next.

Because the UK isn’t immune to these cycles. We’re already seeing signs:

- Our own bond market wobbled in 2022 — taking down a Prime Minister.

- Inflation may be easing, but the structural debt remains.

- Political promises are piling up with no serious plan to fund them.

And just like the U.S., our markets are rallying in the face of deteriorating fundamentals. That’s a cycle worth studying.

So what’s the takeaway?

Don’t be distracted by short-term headlines. Watch the long-term patterns:

Boom → Bubble → Bust → Bailout.

Repeat.

Whether it’s AI speculation or political spending sprees, the key for UK investors is to position now for resilience later — with investments that aren’t dependent on central bank rescue plans.

This article might focus on the U.S. — but the cycle is coming for all of us.

Cycles…cycles…cycles. Cycles of debt. Cycles of inflation. Cycles of power. And cycles of corruption.

Cycles…cycles…cycles. Cycles of debt. Cycles of inflation. Cycles of power. And cycles of corruption.

Sleep cycles. Wash cycles. Motorcycles.

The US is now in the middle of a very familiar ‘shut down cycle.’ Airport traffic has slowed. And the IRS had laid off nearly half its employees.

Democrats and Republicans never bothered to pass a budget. So, they rely on continuing ‘resolutions’ to keep money flowing. According to news reports, Republicans are at least slightly embarrassed by their Big, Beautiful Budget Abomination. They want to keep the tax cuts in place but are hoping to get a little street cred with conservatives by chiseling away at Obamacare provisions.

We wish them luck. But if the past 21 shut down cycles are any guide, they will soon give up…and irresponsible spending — both on domestic programs and firepower — will resume.

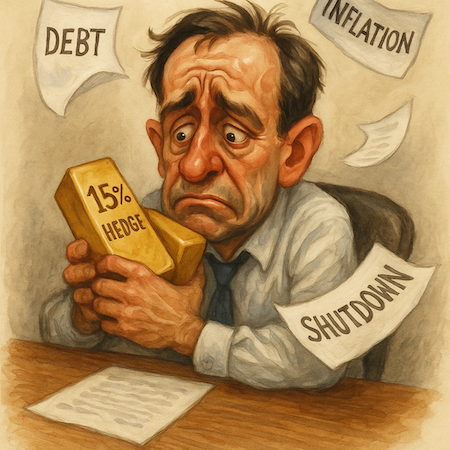

Ray Dalio sees think this presages a repeat of the cycle of the ‘70s. Fortune:

Bridgewater Associates founder Ray Dalio said investors should allocate as much as 15% of their portfolios to gold even as the precious metal surged to an all-time high above $4,000 an ounce.

“Gold is a very excellent diversifier in the portfolio,” Dalio said Tuesday at the Greenwich Economic Forum in Greenwich, Connecticut. “If you look at it just from a strategic asset allocation perspective, you would probably have something like 15% of your portfolio in gold…because it is one asset that does very well when the typical parts of the portfolio go down.”

Of course, we’ve been saying that for 26 years. Butin many respects, the early ‘70s were very different from today. Gold was cheap at t he beginning of the ‘70s. It’s not so cheap now.

Yes, some of the ‘70s cycle — over spending…borrowing… printing money…and inflation — may be repeating themselves. And we hope gold will prove to be a good antidote to the feds’ poison.

But while gold goes up — much like it did in the ‘70s — stocks are going up too, unlike the ‘70s. Says Charlie Bilello:

Markets Are Partying Like It’s 1999…

The Nasdaq crossed above 23,000 today for the first time, hitting another record high. It took just 27 days for the index to go from 22,000 to 23,000, the shortest amount of time between 1,000-point milestones on record.

The S&P and the Dow are hitting new highs…with the S&P recording 32 new highs so far in 2025. The S&P has seen earnings grow 156% over the last decade. But stock prices have gone up 248% — far outstripping the real gain in output.

Much of the excitement in the ‘70s was in the ‘Nifty Fifty’ blue chips. In the ‘90s, it was dot-coms in the Nasdaq. This time around it is in the AI world.

Open AI is a private company. But based on its funding, it has gone from a value of $28 billion to a value of half a trillion dollars today. This is despite a loss of nearly $8 billion in the first half of this year…and expected losses of $110 billion through 2029.

Here’s a company that will decrease the world’s wealth by more than $100 billion over the next four years (beyond that, who knows?)…and Wall Street says it is worth $500 billion.

It doesn’t make any sense to us either. And we suspect that the value will come down — sharply, and suddenly. That’s the way the boom-bubble-bust cycle works. That’s the way the tech cycle works too. No matter how cool the new tech is, there is always newer, cooler tech coming down the pike.

There are other, deeper, more pernicious cycles grinding away too. Yesterday, for example, we talked about the ‘corruption cycle.’

Here’s the latest on Scott Bessent’s pledge to rig the Argentine peso/US dollar trade for the benefit of his speculator friends:

New US ambassador: Firms on brink of ‘unprecedented’ investment in Argentina

Peter Lamelas, incoming US ambassador to Argentina, claims US companies and “Western world” are on the verge of investing an unprecedented amount of capital.

Get it? Rather than encourage companies to invest in the US, we green light investment at the foot of South America. America suffers from a lack of real investment and Americans, in general, get poorer. But a few Americans — Bessent, Citrone, and other insiders — get richer than ever.

In Argentina, this sort of hanky panky runs as wide and as deep as the Rio de la Plata (the silver…or ‘money’…river separating Argentina from Uruguay.) And now, the scum on the Potomac is getting thicker too.

More, tomorrow.

Regards,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily

P.S.: Britain may not have vast mineral plains to unlock—but British investors don’t need them. Because the real opportunity lies in positioning before the crowd. Before Wall Street catches up. Before London brokers catch wind. This U.S. land rush could reshape commodity markets across the globe, and savvy UK investors have a narrow window to move first. Here’s how to get ahead of the curve.