Editor’s Notes: You might be wondering what a barrage of US tariffs, deficits, and political theatre has to do with investors here in Britain.

Editor’s Notes: You might be wondering what a barrage of US tariffs, deficits, and political theatre has to do with investors here in Britain.

In a word—everything.

When America sneezes, the UK doesn’t just catch a cold. We often end up with the same fever. Markets here will feel the aftershocks of these policies—through trade disruptions, currency swings, and the ripple effects of inflation no matter what the official statistics claim.

Bill’s perspective isn’t just a critique of Washington. It’s a warning to anyone who thinks these problems stop neatly at the border.

Consider this your invitation to question what you’re being told—and to think carefully about where your wealth is truly safe.

Hearts that are broken and love that’s untrue

These go with learning the game.

–Leo Kotke

Shock…awe…confusion…bafflement…

US policies surprise…and appall.

Take away the capital by absorbing almost all our savings into federal deficits. Take away the labor by scaring away immigrants. Take away the benefits of trade by threatening absurdly high tariffs. Every major initiative reduces the only thing that might save the nation’s finances — growth. Breaking news last week, CBS:

Trump threatens 35% tariff against Canada

Another day, another tariff. And this, Money Talks News:

U.S. Trade Drops Second Straight Month As Tariff Effects Emerge

U.S. trade falls for second consecutive month as tariff uncertainty drives shifts in global commerce patterns and gold trading reaches historic levels.

But also in the news comes this from Barrons:

Inflation Is Eating the Labor Market. Gains Are a Mirage.

For much of the last three years, we have heard a reassuring story about the U.S. labor market: It was tight, hot, even historically strong. Policymakers pointed to low unemployment and high job openings as evidence that workers had healthy bargaining power. This story continued last week, after the Labor Department reported hiring in June outpaced predictions. Unemployment dropped to 4.1%.

Yet, beneath the rosy narrative lies an uncomfortable truth: Real wages have been falling. With long-term unemployment creeping up, labor-force participation slipping, and industries hemorrhaging jobs, the U.S. labor market is actually less robust than just a year ago.

How could it be true? In this ‘greatest economy ever,’ 25 years into the 21st century, is the typical working stiff really losing ground…growing poorer? What kind of game is this? What kind of trick is History playing on us?

Anyone could spend a few minutes and come up with much better federal policies. How about this:

- Quietly get rid of the violent criminals…then, set up a friendly guest-worker program for other immigrants.

- Seriously cut government programs…reduce spending…balance the budget. Let Congress waste resources any way it wants…just so long as it doesn’t spend more than it gets in revenue.

- Disband the Fed…re-establish a gold-backed dollar as America’s monetary standard…and let buyers and sellers of credit discover interest rates on their own.

Going forward, if Americans wanted to have more money, they’d have to earn it! No more giveaways. No more debt. No more ‘stimmies’ or subsidies…or tax credits…or grants…or stock market backstops.

In other words, we’d strip the claptrap out of the system entirely.

On the foreign policy front, too, the way forward is obvious. Declare victory in America’s century-long war for global domination. Bring the troops home to a spectacular victory parade…a celebration of America’s imperial greatness. Then, de-mob (de-mobilize) them all. Shut the empire down carefully and intentionally…rather than wait until it is shut down by bankruptcy and war.

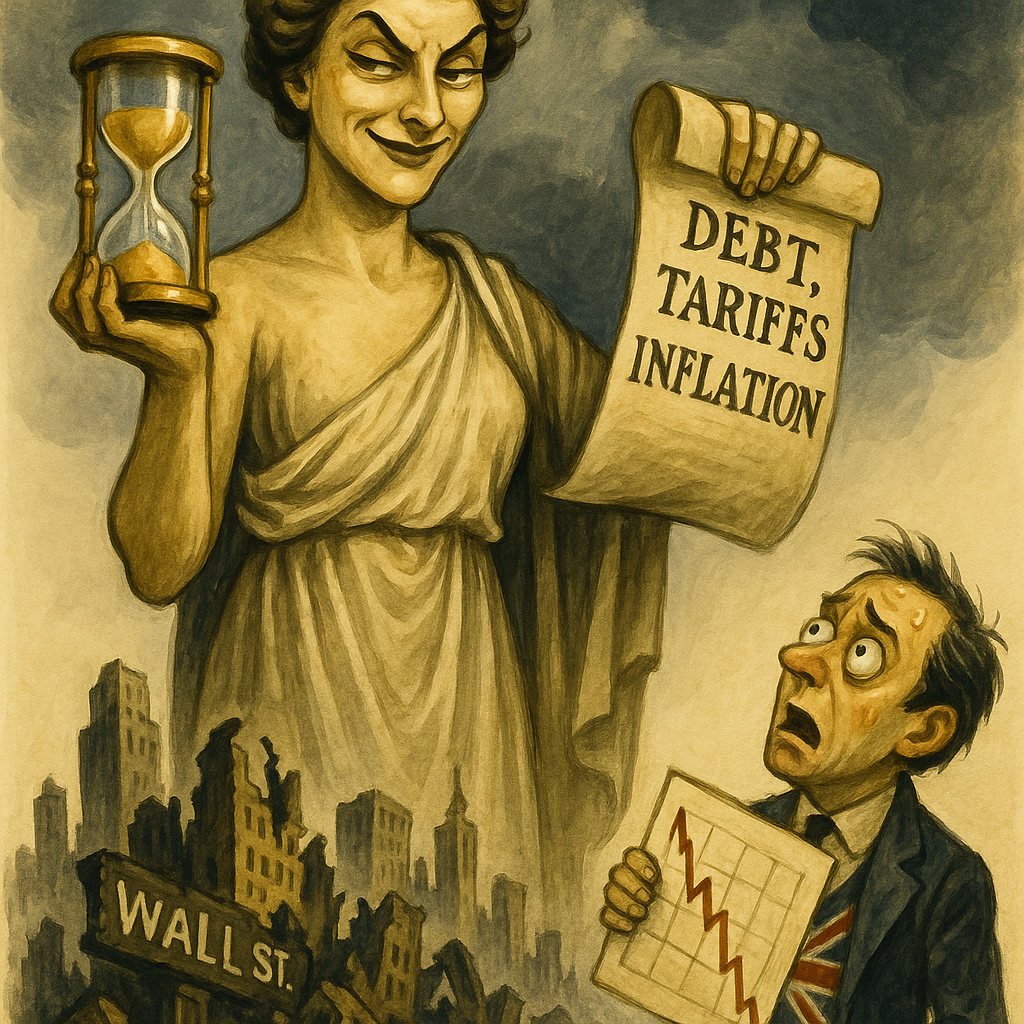

But we’re not in charge, are we? And there’s a reason. That’s not how the game is played, is it? That old temptress — History — has a say. And she is cruel and uncompromising…she is fickle and unpredictable…and she delivers her moral instruction with a sense of humor that can be almost nasty.

And while we have no idea what foolish things she will have us do day-to-day…we know, beyond a doubt, what she will do to us, eventually — she will destroy us all. The b*tch!

As the ancients might have put it, no man ever born of woman ever survives. And none ever gets through his life without making mistakes. Vanity, hatred, envy — the sins to which flesh is heir — always show up.

So dying is not enough. We also have to suffer — by inflicting pain on ourselves and others.

And in the money world, it begins with crackpot theories, jackass statistics, and monumental misunderstandings. Which is why the elites can claim wage gains…even as the average worker is falling behind.

As we’ve seen, this is not just a recent phenomenon. Real output (GDP) per worker — measured in gold — is only half what it was in 1950.

Gold was outlawed for much of that period. So Americans lived with dollars, not gold. And they lost 93% of their Eisenhower-Era purchasing power.

But wait. Suppose you had been riding that great Wall Street escalator for all those years. You’d be above the clouds by now, right?

Maybe. But as my colleague Tom reports, all of the gain in stock prices comes from inflation:

In gold terms, the stock market is currently below 1929 levels. So according to gold, there has been no real growth in stock market values over the last century. (We publish the Dow/Gold ratio every month in our Strategy Report.) In money supply terms, you get a similar result: Almost no real stock market gains.

Better keep the parachute handy.

Regards,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily