Publisher’s Note: While this piece focuses on the distortions in the American economy — phantom growth, government shutdowns that don’t really shut anything down, and an AI boom that may be more mirage than miracle — UK investors should take heed too.

Because the UK isn’t immune to these same distortions.

Artificially inflated markets, government spending no one can afford, and the blind faith in “innovation” to solve fiscal rot — these are not uniquely American phenomena. Our own FTSE, housing market, and economic data carry similar illusions of strength… even as the real economy weakens beneath the surface.

What happens when these illusions falter? When the borrowed time — and borrowed money — runs out?

That’s the question UK investors must ask now. Because we may not be at the centre of the AI frenzy, but we’re caught in the same storm of debt, distraction, and distorted incentives. Best to prepare now, before the reckoning becomes obvious to everyone.

First up…a government shutdown.

First up…a government shutdown.

Bloomberg:

US Begins Government Shutdown With Trump, Democrats at Impasse

But wait. Even as the shutdown approached, stocks rose. How could they go up while the single biggest player in the whole economy withdraws?

Maybe it doesn’t matter. Associated Press:

What happens in a shutdown?

FBI investigators, CIA officers, air traffic controllers and agents manning airport checkpoints continue to work. So do members of the Armed Forces.

Those programs that rely on mandatory spending also generally continue during a shutdown. Social Security checks continue to go out. Seniors who rely on Medicare coverage can still go see their doctors and health care providers and submit claims for payment and be reimbursed.

Veteran health care also continues during a shutdown. Veterans Affairs medical centers and outpatient clinics will be open and VA benefits will continue to be processed and delivered. Burials will continue at VA national cemeteries.

The mail still gets delivered. And federal agencies mostly stay open.

In the end, a ‘shutdown’ doesn’t do much damage and is usually soon resolved.

But so stitched up is the economic and financial world, that almost nothing you hear about it is true…or meaningful. Take, for example, the ‘good news’ that the US economy is ‘growing faster than expected.’ CNBC:

U.S. economy expanded 3.3% in Q2, with growth even stronger than initially thought

That was such ‘good news’ that it brought forth comment from POTUS, who claims paternity.

“Great Numbers came out today on the Economy (3.8%!), and the SUCCESS we are having, but our Interest Rates are too high!”

The Donald seems to believe that at present interest rates he is having great SUCCESS. But if the program is working so well…what sense does it make to change it?

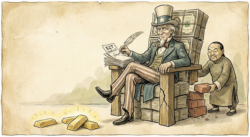

We don’t know. But it turns out that the SUCCESS is actually FAILURE and the ‘good news’ is actually ‘bad news.’ When the number crunchers calculate GDP, they subtract imports (since they are not part of US output). So, if imports go down…it is a plus to GDP.

As it turned out, Donald Trump’s trade war reduced imports by more than five percentage points (of GDP). Actual US output — all the hustle and bustle of the domestic economy — was down at more than a 1% annual rate. But adding back the fall of imports left the wonks with a 3.8% net positive growth rate.

Alas, US economic growth is a phantom…a statistical artifice caused by the fact that Americans are getting fewer products from abroad. If you look at the first two quarters of the year, you see that housing went down. Both imports and exports went down. Even government spending went down.

What went up was billions in capital investment of the strangest and least productive sort — in AI. Company A buys AI from company B. The purchase is added to GDP. And both stocks rise. Both continue to lose money (and make the world poorer).

This is perhaps the most disturbing insight of all. Both the stock market and the economy are now growing — but only because of a whirligig of ‘capex’ spending on AI…which is most likely money down the drain.

In the stock market, Yahoo! Finance:

The artificial intelligence (AI) revolution began in earnest with the introduction of ChatGPT in November 2022. The S&P 500 has advanced 72% since then despite headwinds arising from high interest rates, stubborn inflation, and sweeping tariffs.

Michael Cembalest, chairman of market and investment strategy at J.P.Morgan, recently said, “AI related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth, and 90% of capital spending growth since ChatGPT launched.”

In the economy’s first half of the year, fully three quarters of the actual GDP came not from real increases in output but from increases in AI spending.

So, what have we here?

Artificial intelligence has created an artificial bubble…with artificially high stock prices…and an artificial economy that depends on artificial investment (of borrowed, not earned, artificial money, lent at artificially low rates).

Stay tuned.

Regards,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily

The recent U.S. shutdown barely caused a ripple — markets shrugged, headlines moved on. But UK investors shouldn’t take that as reassurance. When dysfunction becomes business as usual, it’s a warning — not just for America, but for any country with mounting debt and complacent leadership. The Wealth Window exists for moments like this: when the surface looks calm, but the risks are quietly compounding. Step inside while you still can.

What you may have missed…

The only thing more Tory than unpaid property tax on a third home is a donkey field held in trust for your parents to reduce inheritance tax. Read more here…

Will OpenAI and ChatGPT kill Amazon’s eCommerce?

It’s a regular Tuesday, any other day as normal. You wake up in the morning, grab your phone to have a look at what’s on the cards for the day, maybe catch up on US markets from overnight, and generally peruse the day’s global events. Read more here…

Who can scare the UK back into austerity?

What would your family finances look like if they were run as a democracy? No doubt you’d enjoy trips to Disneyland and hot air ballooning…for a while. But at some point, there would be a reckoning. Read more here…

The real promise of gold is not just a rate cut or two…and not really ‘easier borrowing costs.’ Gold may be a good gamble now…but in the long run it is just a way not to lose money. Read more here…

Your Brain Is Catfishing You

Most people “settle down” — in love, in work, in investing. But what if the better path is to settle up? In this episode, Case Kenny explains why the right relationships (and the right investments) don’t shrink your life… they expand it. Read more here…