Publisher’s Note: As a UK investor, you might be tempted to view today’s essay as a uniquely American problem — another round of Washington interventionism with little bearing on your portfolio. But what the Trump administration is experimenting with right now goes far beyond domestic politics. It marks a structural shift in how the world’s largest economy allocates capital, picks winners and losers, and attempts to steer entire industries through state ownership.

History shows that whenever the US government steps aggressively into the private sector — whether through subsidies, tariffs, or outright equity stakes — the effects ripple outward across global markets. And Britain, with its deep links to US industry, finance, and technology supply chains, is never insulated.

For UK investors, this experiment raises two important lessons:

- Markets become distorted long before they become uninvestable.

Government-directed capital rarely flows to the most productive places. It flows to the most politically convenient ones. That creates mispricing — sometimes dangerous, sometimes profitable — but always worth understanding.

- These distortions often create opportunities abroad.

If US capital is forced into strategic metals, semiconductors, or energy firms, global competition tightens. Companies in Canada, Australia, and even here in the UK can suddenly find themselves on the receiving end of new demand, higher prices, or geopolitical tailwinds.

We’ve seen this before: during the shale boom, the green subsidy era, and the post-2008 regulatory reshuffling. Whenever Washington tries to “correct” markets, capital tends to spill over into regions that remain more efficient, more flexible, and more genuinely private.

That’s why we publish pieces like today’s…not to comment on American politics, but to help UK investors understand the deeper forces shaping global asset prices.

The lesson is simple:

When the world’s biggest economy experiments with central planning, the smartest investors position themselves where the distortions benefit them…not where they are created.

We’ll continue tracking these developments closely and highlight where the real opportunities emerge.

Long ago people discovered that private enterprise — where people have their own ‘skin in the game’ — is much more productive than a government-run economic system. Rather than take a big part of a bad system…the feds take a small part of a good one…and end up with more.

Long ago people discovered that private enterprise — where people have their own ‘skin in the game’ — is much more productive than a government-run economic system. Rather than take a big part of a bad system…the feds take a small part of a good one…and end up with more.

Art Laffer pushed the limit of this insight a little too far. In 1980, he argued that lowering tax rates would result in more tax receipts for the feds. At the extremes, it was certainly true. If the feds took 100% of citizens’ output, they could get more by reducing their tax level to, say, 90%…leaving taxpayers with at least some incentive to produce.

But when the feds take 20% of output, cutting taxes in half is not likely to pay off. Even if the lower rates stimulate the economy as advertised, the feds collect only a portion of the extra GDP. At a tax rate of just 10%, for example, output would have to go up 100%to yield the missing revenue.

Both Reagan and Trump pumped tax cuts as a way to stimulate GDP growth, claiming that growth would make up for the lost tax revenue. In neither case did it pan out; instead, deficits expanded.

At least the idea behind the tax cut experiment was headed in the right direction. And if they had followed through with spending cuts, we would have been better off.

And while Reagan was cutting taxes, the Soviet Union continued its own experiment in the wrong direction. It had a centrally-planned and government-run economy. The results were so conclusive you’d think the matter would be settled. The Soviets simply gave up in 1991.

And so we come to what seems like a water-tight proposition: the more the feds get involved in the process of creating wealth, the less wealth is created.

But despite the clarity and finality of that lesson, like a Hollywood film mogul surrounded by aspiring starlets, the feds just can’t keep their hands to themselves. The New York Times:

$10 Billion and Counting: Trump Administration Snaps Up Stakes in Private Firms

The Trump administration is trading billions of dollars of taxpayer money for ownership stakes in companies. The unusual practice shows no sign of slowing.

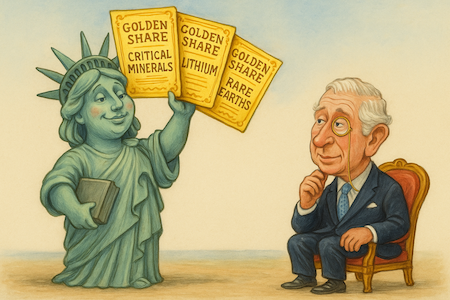

The administration took a “golden share” of US Steel.

It bargained for an option on Westinghouse Nuclear.

A share of Vulcan Elements cost it $620 million

With $400 million, it bought a 7.5% stake in MP Materials.

Another $36.5 million landed 10% of Trilogy metals Minerals

Five percent of Lithium America cost $182 million worth of ‘deferred debt payments.’

On and on. Another grand experiment. And what will we learn this time?

Daniel Kishi of American Compass:

Markets have already been significantly distorted by Chinese subsidies and Beijing’s efforts to monopolize global industries…We need an industrial policy of our own to combat the predation of our trading partners.

And maybe he’s right…it will be a first. But maybe letting the feds make the strategic investment decisions will work this time.

Maybe we’ll discover that if we label this intervention “national security driven” it will turn out better. Certainly, the Trump Team believes it is fixing something. Kush Desai, White House mouthpiece:

“If business-as-usual policies worked, America would not be reliant on foreign countries for critical minerals, semiconductors and other products that are key for our national and economic security… The administration’s targeted equity stakes ensure that taxpayers get a good bargain and that the ball meaningfully moves forward to encourage further investment by the private sector.”

Sounds like blah, blah to us. But maybe he’s right. Maybe investors, now buying ‘at the market,’ are chumps. And for perhaps the first time in history, shrewd bureaucrats will get the real bargains.

And maybe insiders won’t see an opportunity to front-run the feds…maybe they won’t rip-off the taxpayers the way they usually do.

Maybe the companies — under the influence of enlightened intervention of federal bureaucrats — will surprise us. Unlike Amtrak or the Post Office…and let’s not forget Fannie and Freddie, who caused the biggest housing crisis in US history…heck, maybe these new ventures will succeed.

Maybe today’s US public officials are smarter, and more civic minded, than those in the Soviet Union, North Korea, Cuba et al.

Maybe people with no skin in the game…no money of their own at risk…no expertise or proven competence…will turn out to be great corporate stewards.

Maybe CEOs who don’t have to answer to real owners will be able to take a longer-term view.

Maybe the visionaries in the Trump Administration will know which of the thousands of new technologies…and new companies…will succeed. Maybe they’ll know which of today’s aspiring tech geniuses will turn out to be the Jeff Bezos or Steve Jobs of the future.

Maybe this will prove to be the exception. The bureaucrats in the boardroom will prove to have the wisdom of Buffett. And this experiment with central planning will be the first one that isn’t a complete disaster.

Or, maybe not.

Best,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily

P.S. This entire article wrestles with a simple question: Can government planners really pick winners? History suggests no, yet Washington is now taking equity stakes, directing capital, and intervening in markets on a scale we haven’t seen in decades. Maybe this time will be the exception…or maybe, as always, the smartest money will position itself ahead of the bureaucrats rather than alongside them.

That’s exactly why Jim Rickards is stepping forward this Friday. According to Jim, Trump’s newest moves have quietly unlocked access to a $150 trillion mineral endowment — the same resources bureaucrats are now trying to steer. But unlike the feds, Jim isn’t guessing. He’s spent 50 years navigating government mistakes, central-planning experiments, and political distortions…which is why when he says this next phase “could dwarf the AI boom,” investors pay attention.

If you read today’s piece and thought, “There’s no way the government gets this right,” then you especially need to see what Jim will reveal. In his live briefing next Friday, he’ll name the three companies he believes are positioned to benefit the most from this new mineral rush — not because the government picked them, but because they sit where the real opportunity lies.

Reserve your spot now while you still can. The feds may be rolling the dice…but you don’t have to.