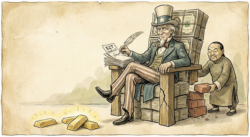

Editor’s Notes: While this story focuses on America’s illusion of endless growth, UK investors should take note: we’re caught in the same cycle. Inflated asset prices. Spiraling debt. A cost of living that defies official figures.

Editor’s Notes: While this story focuses on America’s illusion of endless growth, UK investors should take note: we’re caught in the same cycle. Inflated asset prices. Spiraling debt. A cost of living that defies official figures.

The real question isn’t whether this “fake growth” will unravel—it’s how soon, and at whose expense. If you’d rather not find out the hard way, it might be time to consider anchoring part of your wealth to something real, enduring, and proven. Our latest research shows exactly how.

“Roll out the (pork) barrel

And we’ll have a barrel of fun.”

What we know so far…

The feds can’t really deliver real growth. All they can do is get out of the way so people can pursue happiness on their own.

But getting out of the way is not a very attractive choice to the ruling class. It’s not on the agenda of either party. Not at this stage of democratic degeneration. Instead, they want to tax, spend, and regulate…

Here’s the latest. Bloomberg this morning:

Trump Threatens New Tariff Rates on Key Partners, Keeps Talks Open

President Donald Trump unveiled a wave of letters again threatening key trading partners with high tariff rates even as he delayed the increased duties until Aug. 1 and suggested that he was still open to negotiations.

Letters!

How civilized. And they are ‘sealed with a diss,’ says Bloomberg columnist John Authers.

All economies rely on trade — between people, businesses, cities, and countries. Anything the feds do — including the ‘tariff tax’ — to make trade most costly reduces real wealth.

And yesterday, we saw that the feds can also stymie growth by cutting off the supply of labor. American women don’t produce enough babies even to keep the workforce stable. Without large-scale immigration high growth rates are almost impossible.

Without substantial immigration, the only way to ‘growth’ is via homegrown productivity. But productivity increases require real capital invested in private business…and the feds are now absorbing almost all America’s savings.

So, as you see, almost all the current initiatives of the US government are anti-real growth.

But while the feds can’t produce real growth, they can inspire plenty of fake growth, by rolling out the pork barrel — ‘printing’ more money…spending more…and depressing interest rates. This fake growth produces high asset prices, increased sales and profits, and raises debt levels. It distorts the economy…uses up precious time and resources (capital!)…and actually makes us poorer.

It was ‘growth’ — both real and phony — that got us to where we are.. It raised US GDP to $28 trillion…and the Dow to 44,000. It increased US government debt to $37 trillion…and total US credit market debt to $103 trillion.

How much is real? How much is funny money? How much will go away in the inevitable reckoning?

GDP is up from only $300 billion in 1950 to the aforementioned $28 trillion today — a 90x increase. (We use very round numbers…using more specific numbers would only give the illusion of precision.)

Does that mean we are 90 times richer? Nope. The population has increased too. To figure out if we’re better off, we need to adjust the numbers to per-capita GDP, which show a 40-times increase. Does that mean we are each 40-times richer?

No again!

Because much of that is based on inflated numbers. Using the Bureau of Labor Statistics’ figures, which show that the dollar has lost about 93% of its value since 1950, we find that we are still ahead of the game…with about a 200% real gain in GDP/capita.

But even that does not seem to square with the evidence of our own lives. The cost of the basic elements of our lives — food, clothing, housing, transportation, education and medical care — seem far in excess of the BLS estimates. Instead of getting three times as much ‘stuff’ for our time on the job (as GDP/capita would imply) we actually get less.

A Ford F-series pickup — the workingman’s wheels — cost $1,390 in 1950. Adjusting to official inflation figures suggests a price today of about $17,000. Instead, the cheapest F-150 you are likely to find will be about $40,000.

Yes, it is a better truck. Thanks to tech improvements. But new materials and new tools should have made them cheaper to build, too.

So rather than rely on BLS figures, let’s look at it in terms of gold. US GDP has risen 90 times since 1950. But the price of gold is up 82 times. In other words, in gold terms, US output — including the phony output — has scarcely increased over the last 70 years.

And in terms of GDP per person — up 40 times since 1950 — it has actually fallen in half.

But it took 33 ounces of gold to buy an F-100 pickup in 1950. Today, it takes only 13 ounces. In other words, the real economy – measured in gold – cut the price of a pickup truck in half. But the fake economy made them twice as expensive.

Where does that leave us?

We’re not sure…but we’ll stick with gold until we figure it out.

More to come…

Regards,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily