Publisher’s Note: The argument you’re about to read isn’t really about American politics, nor is it about democracy versus republics. Those are surface narratives. The deeper issue, and the one that matters for investors, is money itself.

Publisher’s Note: The argument you’re about to read isn’t really about American politics, nor is it about democracy versus republics. Those are surface narratives. The deeper issue, and the one that matters for investors, is money itself.

When money works properly, it acts as an honest measuring tool. It tells us what things are worth, how scarce capital is, and where it should be allocated. When it stops working properly, prices stop guiding behaviour — and markets stop rewarding prudence.

That problem is not uniquely American. The UK faces the same structural pressures:

high public debt, persistent deficits, political promises that exceed productive capacity, and a monetary system increasingly asked to paper over fiscal reality.

For UK investors, this has several important implications.

First, policy volatility becomes a feature, not a bug. When governments run out of room to manoeuvre, priorities change quickly. Subsidies appear and disappear. Regulations tighten, then loosen. Entire sectors can move from favoured to abandoned in short order. This increases risk for industries that depend on government spending or political causes rather than genuine cash flow.

Second, asset prices become less reliable signals. Easy money and intervention distort valuations. Capital flows toward leverage and speculation, not necessarily productivity. This makes long-term investing harder — but not impossible — if you know where to look.

Third, real assets and real earnings matter more than narratives. In an environment where money is stretched, investors are better served focusing on businesses, resources, and structures that generate value independent of government largesse or financial engineering.

The purpose of this piece is not to provoke fear. It’s to encourage clarity.

Periods like this are uncomfortable because they force adjustments — political, fiscal, and financial. But they also create opportunity for investors who understand the direction of travel and position accordingly.

We encourage you to read this article not as commentary on today’s headlines, but as a framework for thinking about what comes next and how to protect and grow capital in a world where money itself is under strain.

All we have to go on is the past. The future hasn’t happened yet. So, all we can do is to try to match up what we know from the past with the patterns of today.

One of the outlier patterns we’ve been looking out this week is ‘democracy.’ The headlines tell us it is in danger.

Reuters:

Americans worry democracy in danger amid gerrymandering fights, Reuters/Ipsos poll finds

Demos.org:

Molly, You in Danger, Girl

Chicago Tribune:

Pete Buttigieg says democracy is ‘in danger’ as Republicans consider mid-census redistricting

But for all the caterwauling and moaning…America was never meant to be a democracy…and a democracy is not a stable form of government anyhow. As soon as the foxes figure out how to vote themselves a rack of lamb for dinner, the sheep are doomed.

A ‘republic’ seems to be transitory too. France has had five of them since 1789…each one reached for perfection, followed by a clumsy flop.

No matter what you call it, the elite and their jefes do what they can to 1) shift more and more wealth power to themselves…and 2) keep the masses happy with lies, loaves, and sentimental diversions. How else to explain the latest ‘war’ with Venezuela?

And here’s another one. Newsweek:

Donald Trump’s “Warrior Dividend” checks will cost more than $2.5 billion

President Donald Trump has announced that he plans to issue $1,776 checks to U.S. military service members.

Of course, it is no ‘dividend.’ There is no income source from which to take real earnings. It will be just more money borrowed and spent to secure the support of the lumpenproletariat.

Much has been written about this process. The feds spend too much. Then, they go broke.

But the money itself rarely draws the attention it deserves. Almost all instances of imperial decline are accompanied by monetary decline, manifesting itself as inflation, corruption, and/or bankruptcy. But the real process — the underlying malady — is profound and mostly invisible.

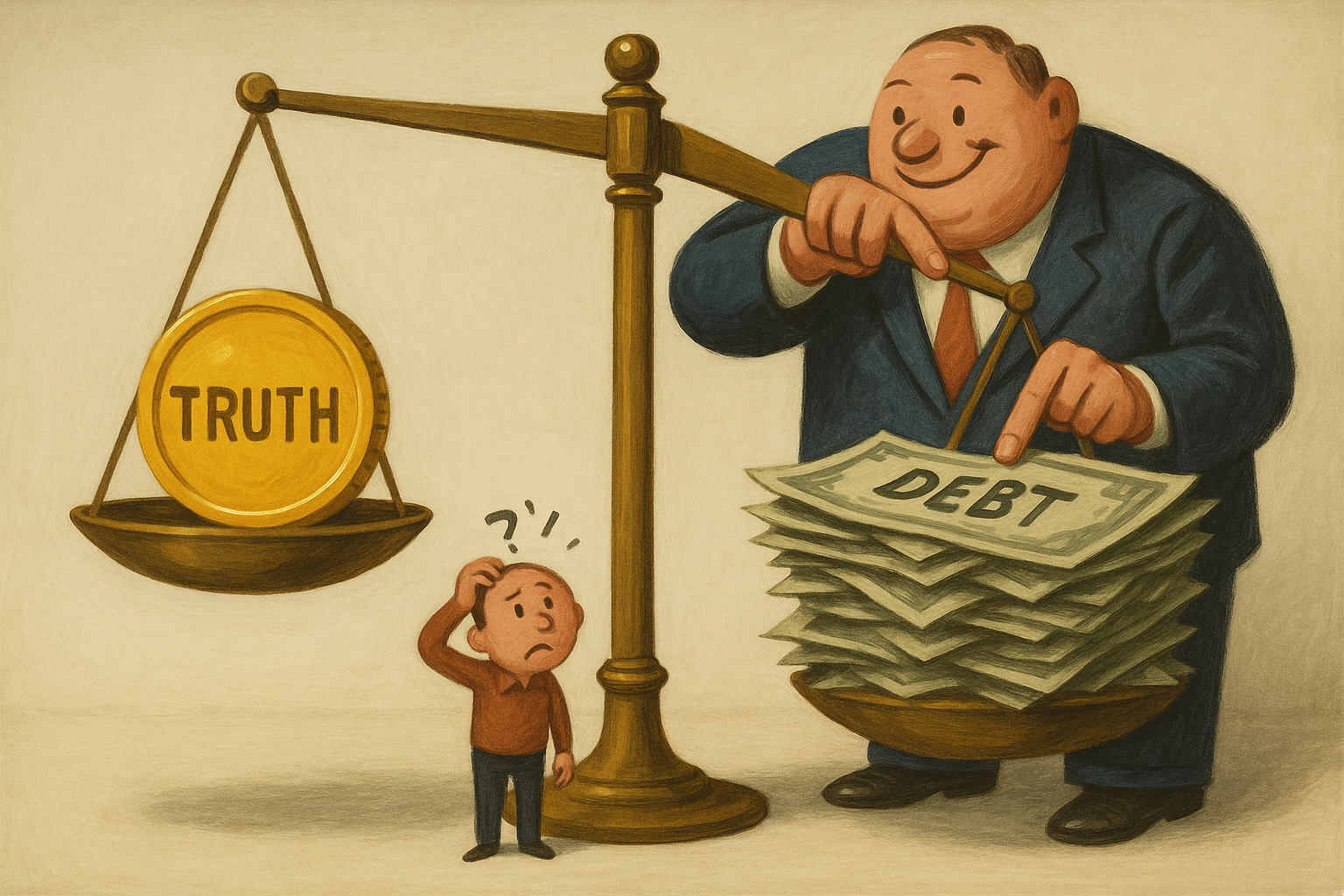

Real money keeps people honest and keeps them free. Because it honestly ciphers the crucial relationships…between a pound of ham and a pound of butter…between an hour of work and an hour’s pay…between capitalist and laborer…between creditor and debtor. Without real money, and free markets, you have no way of knowing where you stand…and whether you are going or coming.

Each person’s private calculation — about whether to buy beans or meat…whether to hire someone or do the work himself…whether to be a borrower or a lender depends on a true measure. Neither high. Nor low. Just honest. Proverbs:

Differing weights are detestable to the LORD, and dishonest scales are unfair.

America had real money for nearly 200 years. Gold-backed money. And consumer prices were more or less stable. In those first 2 centuries, the US grew to be the most powerful country on earth. And its government accumulated a total of $4 trillion in debt. Over the following 54 years, it added 8 times as much debt, with another $1 trillion added in the last two and a half months.

The new, post-1971 money, conjured up by the Nixon Administration, and welcomed by almost all economists of the time, was essentially dishonest. The stock market, for example, gradually failed to measure the real worth of America’s leading companies. Investors stopped trying to calculate the value of each company’s expected earnings discounted by a genuine interest rate.

How could they; they didn’t know what the real interest rate was? Instead, they began wasting capital by gambling on the Fed’s interest rate policies….on political moves…and leveraged speculations on memes, tokens, and cryptos.

And by artificially making more credit available, the Fed skewed the entire economy and everyone in it. It tilted people away from saving…and towards borrowing. The two are very different. A saver looks ahead, to his earnings. He is naturally ‘conservative,’ master of himself, and eager to protect what he has earned.

But a borrower, deep in debt, is a slave to the credit industry. He depends on the government to keep interest rates low and fears the future…when he will have to pay up. As he accumulates more debt, he becomes more desperate. Soon, he has no real wealth…but only monthly credit obligations, expressed in shifting terms.

And then what kind of government does he really have…a democracy? A republic? Forget about it. He is gripped by a system he can neither understand nor control. He may go through the motions of self-government, but he is ruled; he is not the ruler.

Regards,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily