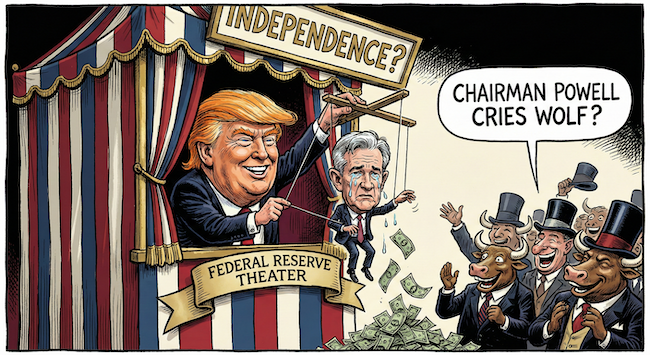

- Chairman Powell cries wolf, but is he lying?

- Central bank independence goes from charade to panto

- Prepare for higher volatility by profiting from it

I’ve been warning about it for years. US President Donald Trump relies on the Federal Reserve to keep the bond market in check. But whether the Fed’s Chair Jerome Powell will do his bidding is an open question. They don’t much like each other.

That tension matters less as political theatre than for what it implies for bond markets, volatility, and investor positioning. With so much at stake, it was only a matter of time before the standoff moved beyond rhetoric.

Sunday, both Trump and Powell made their move.

The Department of Justice served the Fed with subpoenas over its rather expensive renovations. A whopping dose of irony given the White House is undergoing its own facelift.

Prosecutors say the indictment stems from Powell’s testimony to Congress a few months ago about the cost of the renovations. But in a video Powell says the move aims to influence monetary policy Some might call it blackmail gone gory.

This shifts the conflict between the President and Federal Reserve Chair into the open in a way we haven’t seen in the US for many decades.

Trump wants lower interest rates.

The Fed doesn’t want to be told what to do.

Trump hurling insults and accusations didn’t change Powell’s mind. So the administration has brought legal pressure to bear. Again, highly ironic given Trump has faced the same type of attacks.

At hand is an age-old debate that’s also playing out in the UK:

Should governments control monetary policy? Or should “independent” central banks do it?

Who is in charge?

When governments are in a manageable amount of debt, the question is academic. Unless you lived through the 70s. In which case you probably don’t trust politicians to run monetary policy.

Indeed, I cannot imagine recent Chancellors doing a very good job of it!

But are independent central bankers really better? Or have we chosen the greater of two evils?

The experiment with independent central banks hasn’t been travelling so well lately. Inflation ran too low, then too high.

Central bankers also played a central role in inflating the mid-2000s housing bubble that culminated in the 2008 crisis.

More importantly, central bankers have directly interfered in politics since the European Sovereign Debt Crisis.

The discussion is far from academic anymore.

These days, governments are in so much debt that they rely on central bankers to keep a lid on bond yields. That gives central banks the power to defund governments. Or at least discredit them. They just have to withdraw their support in the bond market and wait for investors there to panic.

The European Central Bank used this power to subvert Greece and Italy. The Bank of England used it to get rid of Liz Truss. And now the battle between the Fed and Trump is playing out in public.

Suddenly, independent central banks look like a nefarious subversion of democracy. The monied interests are pulling the puppet strings of the politicians they fund with the printing press. Who, ultimately, put them in charge?

In theory, central banks are only supposed to manage inflation and the economy. But with sovereign debt at these levels, every monetary policy decision has a vast impact on the government’s budget as well. Merely announcing a bond selling program the day before a mini-budget comes out can send bond markets into a tailspin.

Personally, I’m not sure who has the moral upper hand. Politicians only got us into this mess because they couldn’t balance the books. I doubt central bankers want to be political targets. They don’t have a choice but to decide whether to fund a government or not. It’s no surprise they support the mainstream candidate and defund radicals.

Which begs the question…

Why now?

So far, events are unfolding broadly as we anticipated in The Fleet Street Letter. The conflict between Trump and Powell has moved beyond rhetoric into legal confrontation. It can no longer be dismissed as speculation.

What worries me is the timing.

Why can’t Trump wait until May, when he appoints Powell’s successor? At that point, his yes-man can deliver whatever monetary policy Trump demands.

Why take action now?

Why risk destabilising the central bank at a critical moment?

And why would the Fed Chair argue that the indictment has little to do with his testimony, and instead represents an attempt to influence monetary policy?

Liz Truss and Bank of England Governor Andrew Bailey made the same mistake. She took on the Bank of England while releasing her mini-budget. A dangerous combination akin to protesting about debanking while simultaneously refinancing your mortgage.

The Bank of England’s response was so brutal that it almost blew up the UK pension system, let alone the government.

Do Trump and Powell really want to risk doing the same?

Trump needs to roll over a whopping amount of debt in coming months. He also faces roughly half a trillion dollars in additional borrowing in the first three months of 2026.

Going into the weekend’s sudden bust-up, things were going well.

US GDP is growing fast. Stocks are flying. Especially in the sector of the economy Trump has been focusing on – commodities. Tariffs are bringing in revenue. Inflation is low. The Fed is expected to loosen monetary policy, while other central banks tighten.

It was all looking so good.

Why disrupt that balance?

I can only think of two reasons.

One is to find a scapegoat for some sort of upcoming economic or financial problem.

The other is that Trump believes the Fed may be preparing its own Liz Truss–style test of market discipline.

What to do now

I can’t pretend to know what President Trump is thinking. But he certainly likes having villains to blame when things go wrong.

By framing the indictment as an attempt to influence monetary policy, Powell has pushed the dispute firmly into the public arena.

But influence cuts both ways.

If Trump is attempting to pressure the Fed, the Fed can exert pressure on the government as well.

So, what happens next?

On the one hand, those warning about the consequences of the very public battle to come may be disappointed. Trump was always expected to appoint a more compliant Fed chair in May. Markets should therefore already be pricing in greater political pressure on monetary policy.

Indeed, I suspect that’s behind the recent stock market rally.

On the other hand, elements of the US political establishment may have only months left to test Trump’s credibility in bond markets.. From May, they would lose control of their final institutional lever — the Federal Reserve.

If Trump can keep a lid on bond markets, he could try to goose the mid-term elections.

Either way, volatility is about to surge.

Who stands to benefit from that shift? Find out here.

Until next time,

Nick Hubble

Editor at Large, Investor’s Daily

P.S. When markets start testing institutions, volatility becomes a feature, not a bug. The briefing walks through how that process unfolds — and how investors can position before the pressure shows up fully in prices.