- How gold thrashed the stock market

- The pound is half the equation

- Can you cure my curse?

For as long as I can remember, our publishing company Southbank Investment Research and our sister publications have recommended owning gold.

It has earned us plenty of scorn. The idea that a “pet rock” could outperform a proper investment seems impossible.

When we launched newsletters with Nigel Farage, it was our gold stance that the media seized to prove we were mad.

I was once accosted by an airport customs official in Melbourne after a spot check revealed a few ounces of gold I’d bought in Canada. She outright refused to believe that gold could be an investment.

She confiscated the one-ounce bars and told me I’d have to fill out import declaration forms for “commercial goods.” — or pay £250 for someone else to do it.

She must’ve thought I was a jeweller smuggling in inventory. In the end, I got an apology from her boss and picked up my gold from the airport. But the point is this: gold’s potential to deliver investment returns was considered downright impossible.

Nobody in the media has mentioned Nigel’s obsession with gold lately…

How has the precious metal fared?

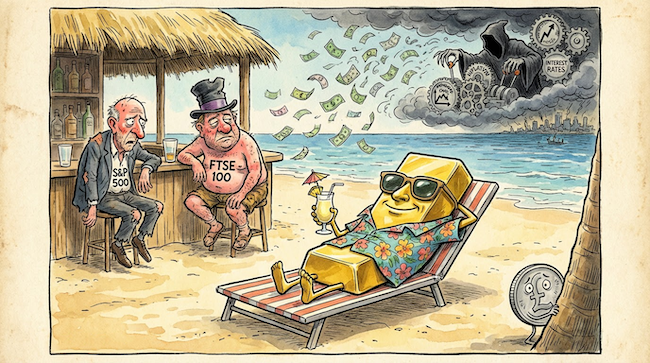

Here’s a comparison of the total return (including dividends reinvested) for holding gold versus the US’ S&P 500 and the UK’s FTSE 100 stock market indices.

| Period | Gold | S&P 500 (TR) | FTSE 100 (TR) |

|---|---|---|---|

| 1 year | +64% | +16% | +7% |

| 2 years | +95% | +36% | +20% |

| 3 years | +126% | +86% | +25% |

| 5 years | +176% | +73% | +36% |

| 10 years | +299% | +265% | +85% |

| 15 years | +190% | +667% | +120% |

| 25 years | +745% | +465% | +260% |

Gold vs S&P 500 vs FTSE 100 — local-currency total returns

As you can see, gold outperformed stocks handsomely over almost all timeframes.

The only exception was the last 15 years. The US stock market outperformed by a large margin if you bought back in 2011.

That’s because the gold price peaked in 2011 and failed to break out higher until April 2024.

That’s a long time to wait!

However, the price performed much better in currencies other than the US dollar during that time. You could argue it was a US dollar bull market, not gold weakness.

What does this mean?

You might conclude that gold is just better than stocks. But that’s a terrible mistake.

Every investment has its day in the sun.

The real challenge is to buy the one that’s in the shade but overdue a holiday in Ibiza. Then you just have to wait for the party to start.

Equally important is to avoid the assets that are about to experience a sunburnt hangover after spending too long basking at the pool bar. They look enticing. But by then, it’s usually too late.

Let’s apply that to gold.

Buyers who avoided buying gold during spikes would’ve sat out in 2011— then accumulate at far lower prices in the years that followed.And so they would’ve outperformed stocks even more comfortably in the long run.

Why did this happen?

How can an inanimate object outperform the might of the stock market’s most glorious companies?

Well, gold’s spectacular outperformance came during the age of monetary manipulation. We’re living in an era where central banks control the price and quantity of money. At least, they try to.

Every industry the government gets involved in experiences chaos. Usually in the form of surpluses and shortages. It’s no different in the monetary realm. And so we’ve had deflation and inflation, QE and QT, high rates and low rates, housing bubbles and busts, stock bubbles and busts, commodity bubbles and busts, and so on…

Gold is the way to opt out of this monetary chaos. That’s why it has performed so well.

Now let me ask you this: Is the age of monetary chaos coming to an end?

Are governments about to abolish central banks and let the free market decide the appropriate interest rate and money supply?

I doubt it.

In fact, most people probably think that’s not even possible. Just as North Koreans can’t conceive of a supermarket company controlling their food supply.

And so I suspect gold’s bull market has barely started. It will most likely continue to outperform.

But doesn’t that clash with the analysis I just gave about avoiding gold after spikes?

After all, it has spent the last five years thrashing the stock market. It can’t get much better, can it?

Gold may well outperform over the next 25 years. But there is a high risk we’re now at a 2011 style peak right now after truly exceptional outperformance.

It’s time to hold your gold, not buy more.

Unless, of course, you’re using pounds…

The pound is half the story for UK gold investors

For UK investors, the exchange rate is half the equation when investing in gold. That’s because it’s priced in US dollars and then converted to your local currency.

If you’re worried about the value of the pound in coming years, gold remains a way to dodge the carnage. If the pound falls, the value of your gold will rise. That’s what happened between 2011 and 2024, when gold was flat in US dollar terms.

I don’t know about you, but I can certainly think of a few reasons to be worried about the pound…

Before you go, I have a quick request.

Cure my curse

There is a terrible curse that plagues all financial newsletter editors. And I suffer more severely than most.

This may seem irrelevant to you. But it’s actually the secret to achieving superior returns in financial markets over time. So, you should pay close attention to my whining…

The curse is simple.

People only want to hear about investments after they’ve gone up. And they don’t want to hear about investments that haven’t gone up yet.

The irony is obvious.

The best investments are those that are flying under the radar after years of poor returns. And the worst investments to buy are those that have shot up so fast they’ve even made it into the public consciousness.

By the time an investment graces front covers, it’s good for only one thing: selling magazines.

The investments that nobody wants to write about are the ones you should be buying. They’re undervalued and overdue their own day in the sun.

Of course, this is a simplification. The real question is when an asset class is about to stage its comeback. And when to sell back out again. The clamour for bitcoin and silver has shown things can go pretty darn far!

But, for a moment, I want to focus on me. Think about what all this means for my job…

It makes being a financial newsletter editor impossible. How do we direct our subscribers into the investments they don’t want to hear about?

And how do we steer them clear of the investments they want to buy because they’re fashionable after doubling or tripling?

It’s a nightmare equation.

Let me know your cure: mailbox@southbankresearch.com

Until next time,

Nick Hubble

Editor at Large, Investor’s Daily

PS After 25 years of outperformance, gold isn’t the contrarian play it once was.

Which is exactly why I’m turning my attention to something far less exciting… and far less loved.

While everyone debates whether gold has peaked, we’ve identified a resource stock that barely makes headlines, yet sits right at the centre of the same monetary forces driving gold higher.

It’s not glamorous. It’s not fashionable. And that’s precisely the point.

You can see the full details — including the name — here.