Publisher’s Note: Gold may be making headlines in America right now… but UK investors shouldn’t dismiss the signal.

The economic picture here in Britain is hardly better — persistently high inflation, stagnant growth, and a currency losing its purchasing power over time. Meanwhile, central banks (including the Bank of England) are slowly shifting toward a more dovish stance. That spells one thing: monetary debasement.

Bonner’s Dow/Gold model isn’t just for American portfolios. His core message — that gold is not a growth play, but a preserver of real wealth — may be even more relevant on this side of the Atlantic.

If you’re a UK investor worried about stagflation, overvalued equities, or rising debt burdens, gold could be your insurance policy too.

What’s more, with gold priced in pounds, sterling weakness could add an additional tailwind that US investors don’t get. Something to think about while the rest of the crowd piles into what could be short-term fads.

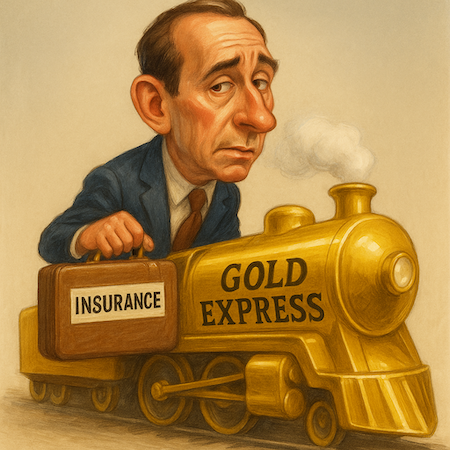

More and more investors are jumping on the Gold Express. MarketWatch:

More and more investors are jumping on the Gold Express. MarketWatch:

Last week, something interesting happened on CNBC. Host Scott Wapner was interviewing Jeffrey Gundlach — they call him the Bond King. Wapner lobbed him a softball about portfolio allocation.

“Really? One quarter of one’s portfolio in gold?”

“Yeah,” Gundlach said. Then he called it insurance and predicted $4,000 by year-end.

When the dealer starts betting against his own game, smart players head for the exit.

But where does this ‘exit’ lead? Today, we return to a key question: If we buy gold at today’s prices, aren’t we risking another Death Valley…a45-year period in which we gain nothing?

‘Yes’ is the answer. The risk is there. And if you will need your money in the next couple of years, you might want to think twice.

But we count our wealth in gold. And even if it took a generation-long dip, we wouldn’t rend our garments or tear our hair out. Because our real wealth would remain intact, undiminished. We would have exactly as much gold as we started with.

And we feel confident that we can depend on our public officials to make sure gold doesn’t stay down for too long. They will eventually inflate away America’s debt; what other choice do they have?

The Dow/Gold ratio went under 5 in 1974. In January 1980, it was 1.29. If we’d had our Dow/Gold Trading Strategy (DGTS) back then, it would have directed us to sell our gold in 1974 and buy stocks. The next eight years would have been rough; stock prices were steady, but inflation greatly reduced real values.

Even so, we should have taken it with good grace. We owned good companies making good money — that was the real value, not the prices quoted in the new, fake dollars. And so it was that we would have gone into the bull market beginning in 1982 with stocks, not gold. And our DGTS model would have kept us in stocks for at least the next 14 years, depending on where we set our stop loss, and multiplied our gold (our real wealth) by at least three times.

But let’s look at what is likely to happen now. The Dow/Gold ratio can change, either by inflation — taking the price of gold in dollars way up. Or by way of deflation — taking the price of stocks way down.

Either way, we will watch the news and cross ourselves.

Yesterday, we saw what might happen in a deflationary scenario. Stocks could go down without much movement in the gold market. Gold at $4,000, for example, would need a 20,000 Dow in order to hit our “5” target. Very plausible.

We seem to be in a period of stagflation. There’s no way to know whether the ‘stag’ or the ‘flation’ part will dominate. But since we looked at the ‘stag’ hypothesis yesterday, today we’ll take the other side of the trade. That is, we’ll look at what might happen if the gold promoters turn out to be right.

A few quarters with rising inflation numbers could propel the price of gold much higher. Most people still don’t own any gold. When Mom and Pop climb aboard, the train is going to become crowded. But not with ‘gold bugs’ and fuddy duddy investors. Instead, the bar car will be packed with amateur speculators. That is the source of our caution: these late comers can jump off the gold rush train as quickly as they got on.

Just to remind ourselves, our DGTS calls for us to buy stocks when we can get the 30 Dow stocks for five, or fewer, ounces of gold. Then, we sell our stocks for gold when the price of the Dow rises to over 15, using a stop loss to keep us in them as long as they are rising, but making sure we get out above 15.

This is not ‘technical,’ ‘smart’ or ‘sophisticated.’ Nor does it pretend to know anything about which direction prices are going. Or what the Fed will do. Or how tariffs will affect the economy. Or who will win the White House. Or anything else. It’s just a simple model that protects against the risk of the Big Loss and allows us to buy wealth-producing stocks when the risk is low.

At today’s stock prices, gold would have to go to around $9,000 to bring us to our target — where we trade our gold for stocks. Is it realistic to think that gold could go to $9,000?

In the ‘70s, the price of an ounce went from $35 to over $800 — almost a 25x gain. To get to $9,000 today, gold would only have to go up less than three times. Or taking it from the beginning of the decade, when gold was trading around $1,700, it would still only have to go up five times to hit the $9,000 mark. Even if you were to go back 25 years, when gold was trading around $300, you’d only need a 30x increase to get to $9,000.

These are easy goals. Not unimaginable ones. And a big run-up in gold already seems to be underway. The press is promoting it. Ordinary people are beginning to think about it. And Wall Street hopes to sell a lot of ‘paper gold’ to investors who are desperate to join the gold rush.

But in all the hoopla, it’s easy to forget what we are really doing. Gold is not an investment; it’s a place to put your money while you wait for a good investment to come along. It’s not a wealth creator; it’s a wealth preserver.

Is it the best place for your money now? We don’t know. We’re on the train already…and we’ll stay on until we reach our destination.

But if we were still standing on the platform, we’d feel better about hopping on if there were more vacant seats aboard.

Regards,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily

P.S. Gold is a proven shield — a way to preserve wealth when inflation runs hot and trust in government policy runs cold. But if you’re looking to build wealth, not just protect it, you need to look beyond gold. One millionaire investor believes Britain is at the centre of a rare Wealth Window… a chance to move from protection to profit. Before the crowd catches on, see what’s coming.