There’s an unexpected hot topic in my household at the moment.

There’s an unexpected hot topic in my household at the moment.

Not the kids, the house, politics, or the state of the economy.

Well, sort of a bit of that, but I’ll get to that in a minute.

Typically in my household, my four-year-old wanders into my office and asks, “Dad, are you writing about bitcoin again? Or AI?”

Those are usually the things running through my head on a day-to-day basis.

So, for silver to be the hot topic is slightly…unusual.

That’s right. The hot topic is silver.

My wife is a jeweller. She designs and hand-makes her own pieces. And right now, her industry is grappling with the fact that one of its most-used metals has gone parabolic.

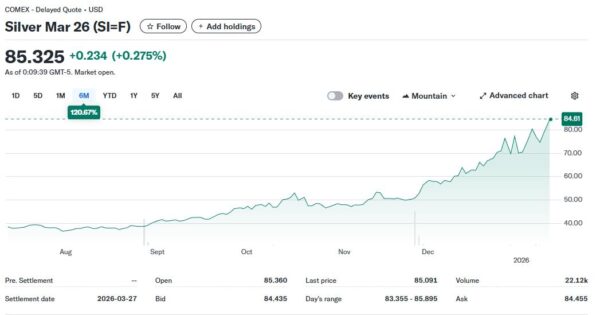

A 120% move in just six months for a commodity like silver is flat-out bonkers.

That’s great for silver investors. But for an industry like jewellery, it’s not a cost you can simply pass on. You can’t expect someone on High Street to understand why a pair of earrings was £200 last month and £400 today.

What that does is massively impacts retail spending on jewellery, and that knock on effect can be brutal.

People in the High St. tend to have a vague understanding that the price of gold is at record highs, so they expect gold jewellery to move accordingly.

But silver?

Silver’s always the second-place finisher to gold, isn’t it?

Reliable. Boring. Affordable. Widely used.

Except now it’s exactly why a lot of jewellers are trying to figure out what the heck to do next.

My wife asks me, “Is the price of silver going to come back down, or is this it now? Do we just have to expect this forever?”

And of course it means repricing, reconsidering materials, and finding ways to adapt. . But the simple matter of fact is one of the main materials now costs two-and-a-half times what it did six months ago.

It is unsustainable on all counts.

So is this the new normal? Or will this prove to be an unsustainable move and snap back to reality?

My answer?

Silver will come back down.

And here’s why…

This time is not different

Silver has been on a monster run for a year.

At the start of 2025, silver traded around $30 per ounce. Respectable, but unremarkable. Roughly where it had traded for the previous four and a half years.

But after April’s market wide-rout, silver started climbing. Slowly at first. Then faster. By August and September it was going vertical.

By December, silver had surged roughly 135% on the year.

As I write, silver has briefly broken $86 an ounce and is trading around $85.

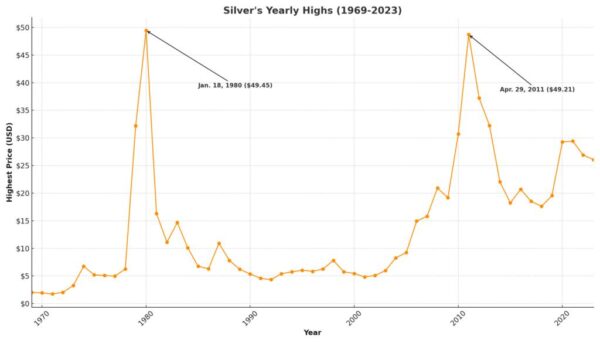

For context, silver’s previous highs were near $50 in 1980 and again in 2011. This wasn’t just a new high, it was a “god candle” higher.

Silver was comfortably one of the best-performing assets of 2025. It beat Bitcoin, gold, and major equity indices. There’s very little it didn’t outperform.

Now, by no means is silver my usual jam. That much I think you’re well aware of. But I’ve been in markets long enough to recognise why this move occurred.

First, geopolitics.

In late 2025, geopolitical tensions escalated. The Middle East, the war in Ukraine, China’s sabre-rattling over Taiwan, and U.S. pressure in South America all contributed.

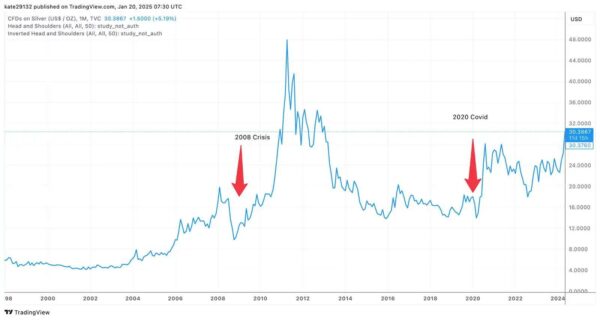

As usual investors did what they always do in moments like this, they ran for perceived safety. Gold benefited first. But with gold already trading at all-time highs, investors looked elsewhere.

Silver, riding shotgun as gold’s high-beta cousin, benefited even more.

Second, monetary policy.

The U.S. Federal Reserve was sitting on the proverbial Lazy Susan.

After years of “higher for longer” rhetoric, rate cuts arrived in the second half of 2025. The dollar continued its weakness. Inflation expectations crept back into the conversation. Suddenly, hard, non-yielding assets looked attractive again.

Third, industrial demand.

Silver isn’t just a shiny rock you put in a vault. And as important as it is to the jewellery industry, it’s also essential for solar panels, electronics, EVs and a whole range of medical equipment.

Demand continued to rise in 2025, while supply remained tight. New silver mines are rare, and most silver is mined as a by-product of other metals, but there is a lot of it globally that can be mined and processed. You can’t just flick a switch and produce more.

Finally, and most importantly, a big, healthy dose of FOMO (fear of missing out) and rampant speculation.

Once silver broke through $50, a psychologically important level, momentum traders piled in. Algorithms and AI agents followed. Physical buyers started demanding delivery and short sellers got squeezed.

In a self-fulfilling cycle, the market started going parabolic. And when that happens… it never lasts.

Ever.

Parabolic moves don’t continue forever. They just don’t.

As much as it can feel like higher prices are the new normal, they never are.

Now, I’m not suggesting silver can’t sustain prices above $80 per ounce. But it can’t sustain that speed. Markets, industry and consumers need time to adapt to that kind of pricing.

That’s the real point. This isn’t just a story about silver. It’s a story about how markets behave.

And silver has done this before. More than once.

In 1979–1980, silver exploded from around $6 to nearly $50 as the Hunt brothers attempted to corner the market. Inflation fears, geopolitical stress, and leverage drove it higher. Regulators stepped in and changed margin rules. Silver collapsed to under $11 in months.

In 2010–2011, silver ran from the teens to almost $50 again. This move followed zero rates, quantitative easing, and fears of monetary debasement. Easy money everywhere.

Then the exchange raised margins five times in nine days. Silver fell more than 30% in a week and spent years grinding lower.

Even in 2021, retail traders tried a “silver squeeze”. It jumped nearly 20% in days. Margins rose, enthusiasm faded and prices reverted.

The pattern repeats across decades. Every spike ends. Prices revert. Then silver resumes its long, uneven grind.

This time is not different.

Don’t look at the price and assume this time is different. Look at the charts and ask yourself: is “up-only” sustainable for another year? Do we reach January 2027 with silver near $200 an ounce?

I doubt it.

Don’t round trip your gains

Silver’s long-term story is real. Industrial demand matters. Supply constraints matter. But parabolic price action never lasts for any asset. Not tech stocks. Not crypto. Not housing. Not silver.

If prices stay this high, industry will innovate its way out of the problem and reduce its reliance on silver. Demand will correct if prices remain unstable and elevated.

As that unfolds, market corrections kick in. If they haven’t already, the downside compounds quickly.

When price outruns reality, it always comes back to meet it.

So, my point is that if you’ve done well on silver, kudos to you, just don’t forget to lock away some profits. Nothing worse than round tripping a big winner back to square one.

That doesn’t help jewellers or medical suppliers in the short term.

But you know what happens, right? Industry looks elsewhere. It innovates, adapts, and demand corrects.

Eventually, the market realises silver’s move isn’t about the metal itself. It’s about speculation and FOMO.

That’s when short sellers return, prices fall, conviction breaks, and the move feeds on itself.

In my view the silver story will become boring to traders as they look to the next big thing. Momentum and sentiment reverse. Prices drift back toward $30 an ounce.

When?

Well, I can see $30 an ounce back on the cards by September.

And if I’m right, that creates opportunity on the way down. One where silver becomes cheaper, sanity returns, and short exposure here may prove a profitable hedge.

History doesn’t repeat exactly. But it rhymes — relentlessly, often, and brutally.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

PS One of the lessons from silver’s surge is that the biggest gains tend to come before a story becomes crowded and speculative. That same principle applies elsewhere in markets right now. We’ve just released details on a potential IPO opportunity where positioning early matters far more than chasing momentum later. If you want to see where long-term capital could move next, you can find the briefing here.