- Martin Luther would’ve made a cracking hedge fund manager

- Communication technology always outpaces censorship

- How to turn the latest IT revolution into bankable profits

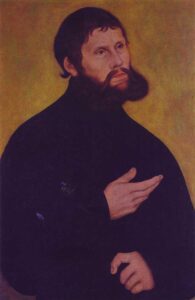

507 years ago, Martin Luther nailed his ninety-five theses to the door of All Saints’ Church in Wittenberg. As you probably know, he got into quite a bit of trouble as a result. And eventually split a largely unified Catholic Europe into many pieces.

Whoops.

But there’s a particular part of Luther’s story I want to focus on. Think of it as the true story of the Reformation. It involves the unfortunately named Diet of Worms and Wartburg Castle.

The Diet of Worms was the imperial general assembly of the estates of the Holy Roman Empire. The European Parliament of its day. It was held in Worms, Germany in April 1521.

Luther was ordered to appear and answer for his banned theses and other writings. The Diet decided on Luther’s fate as an outcast after he refused to recant.

But the attempt to censor Luther failed in spectacular fashion. On his way back from the Diet of Worms, Luther was kidnapped as planned. But not by his enemies.

Frederick the III, Elector of Saxony, was behind the plot. His horsemen put on masks and pretended to be highwaymen. Or a band of knights, depending on who is telling the story (I’m not sure you could tell the difference in Germany at the time).

The gang disguised Luther as one of them under the alias Junker Jorg. They took him to the safety of Wartburg Castle, from where Luther continued his work. He famously translated parts of the bible into German there.

Now we get to the controversial part of my own theses. The history of the Reformation is not really about religion. At least, that is not the key to understanding what happened.

Now we get to the controversial part of my own theses. The history of the Reformation is not really about religion. At least, that is not the key to understanding what happened.

Europe’s Reformation of the 1500s was about communications technology. About the printing press. About the ability of information to spread faster than the authorities could contain it

I’ll prove it to you in a moment. But first, why should you care?

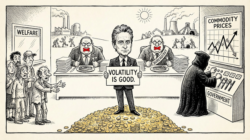

Well, it turns out that sudden and rapid change in communications technology makes things happen in financial markets too. They create profits so large that the investors who capture them become legends.

James Altucher would know. He’s a rare breed of investor who managed to capture not just one such wave, but several. First, the tech bubble. Then cryptocurrencies. Then Artificial Intelligence (AI).

Each tech revolution created billions in wealth. And Altucher got far more than his fair share.

Now he reckons we’re right on the cusp of the next big tech revolution in investing. And just as he guided investors like you through the crypto and AI booms in the past, he’s inviting you along this time too. The project launches on 7 August. Have you signed up to find out what it is?

Profitable tech revolutions are nothing new

Altucher may be special for capturing a series of information tech booms in a single career. But I suppose technology accelerates fast these days. There are more opportunities for people like him.

Still, the same investment principle applied hundreds of years ago too…

The world’s most famous family dynasties were born out of changes in communication tech. We’re talking names like the Medici, Rothschilds and the Augsburg Fuggers of Luther’s day (who had to change their name from a different spelling about 600 years ago).

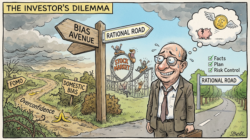

You might think of these families as bankers. But it was their ability to send and receive information faster than their competitors that made them successful.

We’re talking communications technology revolutions like homing pigeons and the telegraph. Whoever set up their network first could trade information for profit.

Legend has it that the Rothschilds found out about the battle of Waterloo via a carefully established homing pigeon network. They spread a rumour that Wellington had lost, causing a crash in the UK bond market. And then bought up as much gilts as they could on the cheap. Once the truth got out about Waterloo, the bonds soared in value.

My favourite story is about the traders who figured out that they could front-run stock market order flows by transmitting their own trades via radio waves instead of the slightly slower fibre-optic network everyone else used.

The traders literally built a bunch of transmitting towers across New York to transmit their orders to the stock exchange a fraction of a second faster than the competition. This allowed them to predict price moves and position themselves accordingly.

They key in most of these investment success stories is timing. It was for Luther too. And the secret weapon that gave the Reformation its speed advantage was…the printing press.

Until Luther, printing was a miserable business. Many printers had gone bust over the six decades since Gutenberg invented the press. The moment the printing industry met Luther was the moment it boomed.

Printers across Europe turned Luther into the all-time most published author in Europe. Within just five years of his theses being nailed to the church door, too. That’s how the Reformation began. It’s also what made the Reformation possible.

But what made printing so powerful?

There are plenty of obvious answers. Like the cost savings printing created. My point here is much more simple and specific. It’s all about speed. Relative speed. They called Luther’s pamphlets Flugschriften for a reason – ‘flight-scripts’. They spread across Europe so fast it was as if they could fly.

Luther’s success rode on the back of an invention that enabled faster communication and dissemination of information than the authorities could keep up with. This gap in speed is central to the story of the 1500s.

Luther was able to churn out many pamphlets that were printed and reprinted across central Europe before the authorities were even able to figure out what to do about him.

By the time they’d decided, the German population, and especially their leaders, were in a position to dictate terms. The Reformation had passed the Catholic authorities by before they even knew it was on.

Will you make the same mistake today? Will you let tech’s impact on investing pass you by?

James Altucher’s investment edge involves speed too. But it’s the combination of speed and analytical power that makes his new idea work. Find out more, on 7 August, if you sign up now.

Until next time,

Nick Hubble

Editor, Investor’s Daily

P.S. Just like the printing press reshaped Europe—and made fortunes for those who moved quickly—James Altucher believes tech could give you the opportunity to transform your investing. The event goes live on 7 August. If you haven’t signed up yet, now’s the time. Don’t get left behind while the next Reformation of finance unfolds. Click here to reserve your place.