The craziest thing on Wall Street in 2023 didn’t come from Silicon Valley or the Fed.

The craziest thing on Wall Street in 2023 didn’t come from Silicon Valley or the Fed.

It came from a plastic bowl. The same one that’s sitting in every cupboard in America and has outlasted three microwaves and two marriages.

In 2023, Tupperware Brands basically told investors it was done for.

The SEC filing said, and I quote, “There is substantial doubt about its ability to continue as a going concern.”

Translation? Put a fork in us.

Sales falling. Debt climbing. Analysts agreed and declared it over.

That should’ve been the end of the story.

But markets, like stars, don’t always die quietly.

A few days later, Tupperware stock did the unthinkable: it exploded 700%.

No news. No buyout . No miracle turnaround.

Just—boom.

Barron’s called it “a rally that largely has gone unexplained.”

A finance professor told reporters it was “not based on anything rational.”

CNBC called it baffling.

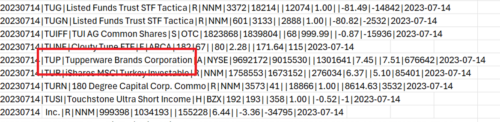

But my friend (you might know him) saw exactly what happened. Because, shortly before this run, Tupperware’s stock showed up in an obscure FINRA report.

Most people have never even heard of this report.

But buried inside this dry list of letters and numbers is one of the strangest market anomalies I’ve ever seen.

It doesn’t tell you WHY a stock will go up.

But it does reveal when market mechanics have gone out of balance. Where fear or greed have pushed prices too far in one direction.

Let me explain.

Why They Don’t Want You to Know This

FINRA stands for the Financial Industry Regulatory Authority.

It’s not technically part of the government, but it’s what some call a “self-regulatory body.”

Put simply, it’s the referee that polices brokerages—the group that keeps firms honest, makes sure trades settle, and tracks who’s trading what.

But here’s what most people don’t realize:

FINRA collects and publishes some of the most detailed raw market data in existence.

To the untrained eye, a typical FINRA file looks like gibberish: hundreds of columns of ticker codes, settlement dates, and cryptic identifiers.

It’s not meant for retail eyes. It’s a raw data dump designed for compliance officers and high-paid quants.

BUT…

To the few who know what to look for, it’s like spotting seismic tremors before an earthquake.

The Tupperware trade was one example. But I could give you hundreds.

Like this one…

Remember When HIMS Skyrocketed?

Last year, Hims & Hers (HIMS) looked like a patient on life support.

The FDA had just banned sales of its obesity drug. Analysts were calling it overvalued—trading at nearly three times the industry average.

Insiders were heading for the exits.

And the final blow came when the CEO unloaded $6.2 million of his own stock.

On paper, the message was clear: get out while you still can.

Then—suddenly—its ticker appeared inside a FINRA report early this year. A week later, the stock went insane.

Anyone who knew how to read that report could have turned $5,000 into $25,000 in a week.

It happened again with SunPower, a solar firm on the brink of bankruptcy. The data flashed mid-April.

Two days later, shares ripped higher—3,200% in less than a month.

It happens all the time, actually.

And here’s the part most people get wrong.

When they see a stock collapse…or explode…or behave in a way that “makes no sense,” they panic. They assume the market is broken. Or rigged. Or that they’ve already missed their chance.

But panic is almost never the right response.

I’ve been investing long enough to know this: markets don’t reward certainty. They reward positioning.

Tupperware wasn’t a miracle. HIMS wasn’t luck. SunPower wasn’t a fluke.

Those moves didn’t happen because the businesses suddenly became great. They happened because fear pushed prices so far out of balance that the mechanics of the market snapped back.

That’s what most investors miss. They obsess over narratives, headlines, and opinions… while the real signals are buried in places that look boring, technical, or unreadable.

Fear doesn’t mean “get out.” Fear means pay attention.

The biggest opportunities I’ve ever seen didn’t arrive when everything felt safe. They showed up when the story looked ugly, the experts sounded confident, and the crowd had already given up.

So don’t panic when things feel irrational. Don’t assume chaos means danger.

Sometimes, chaos is just the market telling you it’s about to hand money from the impatient to the prepared.

And the people who understand that?

They don’t need predictions. They just need to recognize when fear has gone too far.

Best,

James Altucher

Contributing Editor, Investor’s Daily

What you may have missed…

What does the rise of the “far-right” mean for financial markets?

The “far-right” now leads in an extraordinary share of the world’s major economies. Chile is only the latest example. But what does this mean for investors? Read more here…

The Irony of China Killing Net Zero in the Auto Industry

Ford’s retreat from all-electric trucks isn’t an isolated decision. It’s a signal that Western carmakers are quietly admitting what policymakers won’t: Net Zero policies weakened domestic industry just as China perfected scale, speed, and cost. As Europe and the U.S. scramble to reverse course, the global auto industry is being reshaped in real time — and the winners may not look like car companies at all. Read more here…

Chicken Feed

Tariffs feel powerful. Their costs are invisible — until they aren’t. Read more here…

Hollywood is Freaking Out About AI

Hollywood isn’t panicking because of headlines. It’s panicking because the tools it once controlled are slipping into everyone else’s hands. After speaking at a major AI conference — and sitting down with the founders behind a company that slashed VFX costs by 90% — James Altucher explains why AI isn’t killing Hollywood, who really gets disrupted first, and why this moment may be the industry’s most creative reset yet. Read more here…

Is AI a ‘Super Sell’?

Of the entire GDP gain for last year — $174 billion — fully three quarters of it were from capital investment in the AI/high tech industry. Take it away…and most of the ‘growth’ vanishes. Read more here…