In today’s issue:

- Are taxes too high or is government spending too much?

- Rachel Reeves’ Wiley E Coyote Moment on the Laffer Curve

- How pensions threaten to sink the government

What’s Sir Keir Starmer’s real problem? Is he spending too much, or taxing too much?

Economists have long debated this question. Milton Friedman famously recommended the following:

“Keep your eye on one thing and one thing only: how much government is spending. Because that’s the true tax. If you’re not paying for it in the form of explicit taxes, you’re paying for it in the form of inflation or borrowing.”

The inference is awkward: if we weren’t paying for Labour’s spending with higher taxes, we’d face inflation or a debt crisis instead…

Over the past two weeks, I’ve interviewed the Adam Smith Institute’s Maxwell Marlow twice. The idea was to tackle each side of the equation – government spending and tax.

We came to a shocking conclusion: the government cannot raise more taxes. Cutting spending is the only path left.

Find out why, in these two videos…

(Your browser might be blocking you from seeing this video. Please visit cookie settings and enable cookies to see the video on this site, or click here to watch it on YouTube.)

(Your browser might be blocking you from seeing this video. Please visit cookie settings and enable cookies to see the video on this site, or click here to watch it on YouTube.)

Until next time,

Nick Hubble

Contributing Editor, Investor’s Daily

Real Money Tells the Tale

Bill Bonner, writing from Baltimore, Maryland

First, the latest news. As expected, Democrats and Republicans colluded to go deeper in debt! Senator Schumer (on why he went along with the Republicans’ continuing resolution):

“If we go into a shutdown, and I told my caucus this, there’s no off-ramp… They could keep us in a shutdown for months and months and months.”

Contrary to popular opinion, the late, degenerate empire is a means of shifting wealth and power from the people who earn it to the people with good lobbyists, connections, status, etc. That’s politics, and it gets dirtier, and more costly, as time goes by. ‘The People’ who pay the bills don’t have time for it. But the insiders who get the loot work at it full time.

It’s the road to imperial decline. And the only ‘off ramps’ are disasters — bankruptcy, hyperinflation, (a losing) war, revolution, or plague.

But the final crisis is probably years in the future. No point in worrying about it.

Meanwhile, from academia, (as reported in the Wall Street Journal) comes more evidence that you don’t rich just by holding stocks ‘for the long run.’ Professor Edward McQuarrie has buried himself in trading records going back to 1792. McQuarrie’s number crunching shows long periods when stocks lose money. They lost a total of 37.4% in the 10-year span leading to 2009, for example. So were they losers in the 10 years before September ’74, August ’39, June ’21, October 1857, and April 1842.

Stocks can also lose money for 20-year periods. McQuarrie names a couple of them. And it’s not just a US phenomenon. Italian stocks lost money for 20 years. So did those of Japan, Norway, Germany, and Switzerland.

What’s worse…the typical stock has “negative cumulative returns during the period of [its] existence within the 1925- 2023 period.”

This is a shocking disclosure. It tells us that not only might you fall into a 10- or 20-year period in which you lose money…the odds are better than 50-50 that the stocks you buy will never make you any money. Statistically, more than half your investments will be losers. Whether you hold them for the short run or the long term…you’ll be wasting your time.

The key insight from this is that you don’t want to own the ‘average’ stock…and you don’t want to be heavily invested in stocks during a period when they are going down.

As to the second point, our trading system might help. If you look back at McQuarrie’s numbers, you will notice that those 10-year periods of negative returns didn’t show up randomly. In the 10 years up to 2009, for example, investors lost 37% of their money. But what did they expect?

That 10-year stretch began in 1999. What do we know about 1999? It was a year in which stocks were outrageously overpriced…screaming to all who would listen: Get Out! We remember the period; we were among the screamers.

Likewise, the ’74 trough followed the mid-60s stock peak…and the 1939 washout came after the 1929 stock market high. So, in retrospect it is pretty easy to avoid getting caught in a stock market down-swirl; just make sure you don’t own stocks when they are too expensive. And don’t think that however bad they perform in one of these sell-offs, they’ll still be profitable ‘over the long run.’

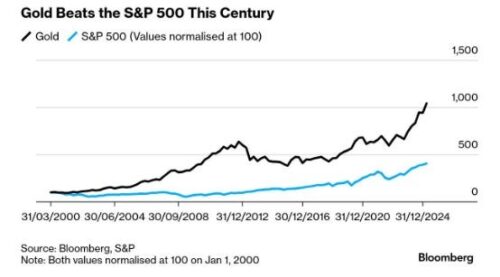

In the last half century, the deteriorating dollar disguised what was really going on…and a huge increase in debt flatters GDP, corporate sales and profits. But real money tells the tale. You could buy the 30 Dow stocks for 13 ounces of gold in 1929. And now, 96 years later, the price is about the same. The very long run provided investors with no real capital gains.

And now it appears that the price of the Dow, in gold, is continuing a long sweep downward. It began in 1999 at 40 ounces of gold to the Dow…since then, stocks have lost 2/3rds of their value. And just over the last few weeks, we’ve watched the ratio sink from 16 to 15, 14…and now 13.7.

Over-simplifying, whenever the Dow stocks go over 15 ounces to the Dow…we are generally out of stocks and in gold. This discipline would have avoided all McQuarrie’s drawdowns of the 20th and 21st centuries.

Then, when most of the risk has been squeezed out of stocks, that is…when you can buy the Dow for 5 ounces of gold or less…we get back in.

When will that happen?

We don’t know. But it won’t be pretty. If the price of gold stays around $3,000, it would mean the Dow would have to fall to 15,000…another two-thirds drop. Or if gold were to go to $5,000, we’d be looking at Dow 25,000 to reach our trigger point.

Whatever. We’ll wait. And when (and if) we get a Dow priced at 5 ounces…we’ll sell gold and buy every quality stock we can find.

Do we get rich this way? It depends. More importantly, we don’t expect to get poor.

Regards,

Bill Bonner

Contributing Editor, Investor’s Daily

For more from Bill Bonner, visit www.bonnerprivateresearch.com