In today’s issue:

- Government finances are deteriorating

- Reeves will seek to deflect blame in today’s statement

- Guess who she’ll blame instead?

Today, Chancellor Rachel Reeves presents her Spring Statement on government finances.

It might read more like a confession of sorts, if not a full admission of guilt.

Why? Well, the nation’s coffers are in nowhere near the state she had predicted when she presented her “Halloween” budget at the end of October.

They’re deteriorating rapidly, for a number of reasons. While many of these can trace their roots back to the long years of “Conservative” rule, some are closely associated with Labour’s chosen policy set.

Consider the wave of tax hikes set to take effect imminently – measures introduced with the hope of boosting government revenue.

But available figures show that thousands of high earners – who pay the bulk of all taxes – have already packed their bags for sunnier, lower-tax climes. No doubt others are preparing to do so.

Then there are the reports of two-income households with children caught in the high-tax-bracket trap, where they no longer qualify for child benefit payments. They now see greater economic logic in one parent leaving the workforce to replace expensive private childcare, and to pocket the child benefit payments their lower net household income now provides.

Every time one of those marginal workers leaves the workforce, not only is less tax coming in; there are also higher child benefit outlays.

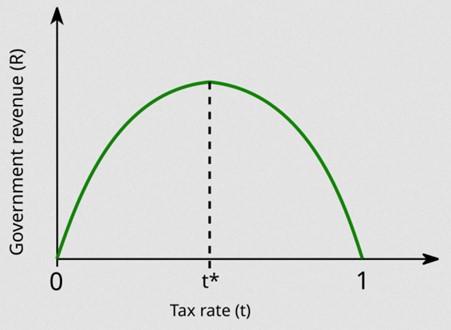

The idea that higher taxes can be a lose-lose for both the private and public sectors is hardly new. Economist Arthur Laffer first proposed his eponymous curve back in the 1970s showing how, beyond a certain point, tax increases reduce rather than raise additional revenue.

We’ve trotted out Laffer’s curve on multiple occasions. Here’s what it looks like:

What the chart shows is that, at low levels, small increases in marginal tax rates can give a boost to government revenue. Beyond a certain point, however, higher rates become a drag on economic growth. Not far beyond that, due both to weaker growth and rising tax avoidance, tax revenue peaks.

From there, even higher marginal rates are both negative for growth and for future revenue. Taxes become a lose-lose proposition.

Naturally, there is a huge dispute within the economics profession regarding where precisely the growth- and revenue-maximising points lie. Some argue at around 15-25%. Others would place them higher.

But that these points do exist is not seriously disputed. Hence Laffer’s framework is a useful one for a high-tax country such as the UK.

Using that framework, following Labour’s first budget I made some specific predictions:

Because this is not a pro-growth budget, it will not do anything to pull Britain out of its current stagnation. In fact, it might make it worse. And if growth disappoints going forward, then these tax increases might not raise much additional revenue, if any.

If tax revenue disappoints alongside spending increases, then the government’s budget situation is going to deteriorate over the next few years, rather than improve.

This may be what has spooked the bond market. Following the announcement, UK bond yields rose both outright and relative to other countries. They are now nearly as high as they were following the Truss-Kwarteng “mini-budget”. This is all the more worrying given that this budget was supposedly intended to improve, not worsen, public finances.

Well guess what? Not only have government finances already deteriorated, rather than improved, the rate of deterioration has increased due to the ongoing rise in bond yields.

Reeves’ first budget assumed that yields would continue declining, thereby reducing government debt servicing costs. But the opposite has happened instead.

In February, borrowing reached £10.7 billion, fully £4.2 billion above budget assumptions. That’s a huge, 40% miss.

It’s also a huge problem. Debt servicing costs themselves are now a massive budget item, greater than the education budget and more than half of total NHS funding.

Now, having found herself surrounded by the bond market vigilantes, what is the chancellor to do?

Why, deflect blame of course. It looks increasingly as if Ms Reeves and her colleagues are going to continue to follow Machiavelli’s key principles of successful governance, as I laid out last summer:

The first thing to do once in power is to consolidate. Pay off your key lieutenants. Solidify your base. There will be further battles to fight so ensure that everyone who helped you win the last one feels adequately rewarded.

Check.

Second, try to win over marginal supporters. Seek to blame the old prince for whatever ails the nation. Dig up all the dirt you can and throw it at him, before anyone attempts to throw it at you instead.

Check.

Third, find new bogeymen. Blaming the old prince only buys time. The reality of power is that new challenges will always arise. If there is not a convenient enemy available, create a new one.

This is especially true if you plan to increase taxes.

Well, she did, and now here we are.

But, by a convenience of fate, Reeves has been presented with an ideal bogeyman to blame for everything that’s going wrong with the UK economy generally and government finances specifically.

President Trump!

Yes, that’s right, it’s all the orange man’s fault.

I can’t know just what she’s going to say today, but I’m confident that Trump is going to receive a mention or two. Tariffs, trade wars, inflation, interest rates, the stock market selloff… Reeves will point the finger at Trump.

Then, when she confirms that the only way to save UK government finances from Trump’s policies is to cut spending, he’ll be to blame.

So, the £5 billion cuts to welfare and disability payments: Trump’s doing.

The £6 billion of cuts to the foreign aid budget: Trump’s doing

All those civil service workers to be axed: Trump’s doing.

Whatever promises she’s unable to keep: Trump’s doing.

How convenient!

But what do you think? Will the British public find that at all convincing?

Some will, some won’t. But everyone is going to start feeling the pinch of higher taxes before long. The Trump bogeyman effect may help the chancellor to deflect public scrutiny for a little while longer yet.

But the bond market vigilantes will pay no heed. They don’t even notice the bogeymen, only the real target. And if they continue to push UK borrowing costs higher, Reeves’ and her colleagues’ desperation will keep growing.

As I mentioned yesterday, desperate governments do the most expedient things. In the current instance, that would appear to be Labour backing away from their ambitious unrealistic and economically destructive net zero plans.

One possibility I regard as increasingly likely is that they are going to actually take a leaf out of Trump’s book and “drill, baby, drill!”.

Royalties from oil and gas production came to the rescue of Thatcher’s government, enabling her to cut taxes and get growth going again.

But how would Labour go about that? And how could investors take advantage?

I’ve recently written several reports that answer these questions. They also mention six specific companies I’m currently recommending. If you’d like to learn more, you can do so here.

Until next time,

John Butler

Investment Director, Investor’s Daily

Fools Rush In

Bill Bonner, writing from Baltimore, Maryland

In the news on Monday, Cryptopolitan:

President Donald Trump is now backing off plans to announce new industry-specific tariffs on April 2, according to a Monday report from the Wall Street Journal, which said the White House is still moving forward with reciprocal tariffs, but is now leaving out the broader measures on automobiles, pharmaceuticals, and semiconductors that were expected.

Mr. Trump may be delusional, but he’s not crazy. Faced with the reality of ‘reciprocal tariffs,’ he hesitates. Bloomberg:

President Donald Trump’s coming wave of tariffs is poised to be more targeted than the barrage he has occasionally threatened, aides and allies say, a potential relief for markets gripped by anxiety about an all-out tariff war.

But wait. The trade war just got screwier. USA Today tells us that his moment of sanity passed like a sneeze. Now, Captain Confusion is taking tariffs to a whole new level:

President Donald Trump on Monday said the U.S. will impose a 25% tariff on imports from any country that purchases oil or gasoline from Venezuela, targeting the South American nation for what he called “purposefully and deceitfully” sending criminals into the United States.

Like ‘second hand smoke,’ secondary tariffs are now a danger to a nation’s economic health.

Every major government program since WWII – Korea, the Vietnam War, the wars against poverty, drugs, Iraq, Afghanistan, Covid, the Ukraine…Gaza… not to mention scores of campaigns against other imagined foes – was a flop, often a very expensive, disgraceful and deadly flop.

And now, with this sad history so tight against its rear bumper, and realizing that it might lose control of the House or the Senate in just two years, you’d think Team Trump would forswear silly distractions and focus on things that really matter. It is not really any fret of ours whether or not Peru buys Venezuelan oil. But a fast-approaching debt crisis is. Bothering with anything else is not only a waste of time… but likely a death sentence to the empire.

But instead of an iron discipline and relentless determination to tackle the Number One threat facing the USA, the administration plunges further into what the Wall Street Journal aptly called ‘the dumbest trade war ever.’

We saw on Monday that the actual trade-weighted average tariffs paid by the US and its major trading partners are small and similar… generally below 2%. Making them ‘reciprocal’ will make little difference to anyone. It is only when you dig into the soft tissue of NTBs – non-tariff barriers – that you strike the raw nerves. But that is also where the confusion multiplies.

Let’s say we make shoes in one town and sell them in another town for $100 a pair. The shoemaker in the other town has to pay his workers more…so he has to charge $110 a pair for his shoes. He says we are unfair competition; the lower wages in our town are an NTB to trade.

But wait, then we notice that the other shoemaker’s workshop is in a building owned by the municipality, where he got a lease at a preferential rate.

Unfair! Another NTB! He’s being subsidized by the feds.

‘Hold on’… says the other shoemaker. His town is serious about the fight against global warming. It requires him to use solar power… which is more expensive than the coal we burn. Another NTB… this one in his favor.

What a mess!

The neighboring town is now ready to impose a ‘reciprocal’ tariff… meant to take into account all the many NTBs it believes it has discovered. And now the town’s mayor is upset because some hooligans – allegedly from our town – sprayed obscene graffiti on his office wall. He says he’ll retaliate with a tariff against anyone who does business with us.

Of course, this is politics. And it gets worse. We’ll hire an ex-mayor as a ‘consultant.’ He’ll be expensive. But he’ll talk to the members of the town council privately… maybe he can get them to see it our way.

Poor Treasury Secretary Scott Bessent is heading up America’s attempt at reciprocal tariffs. He’s meant to be weighing this against that… environmental protections against labor costs… subsidies against tax breaks. Spare a prayer for the man; he must know he’s on a fool’s errand. The apples of lower energy costs really can’t be balanced, in any meaningful way, against the peaches of a better educated workforce (educated at government expense!)

And what about national security!? If our town allows another town to make its shoes, what will we put on our feet when we go to war with it?

At the end of the day… or whenever future historians get around to looking at it… odds are good that they will see another comically dismal failure.

Regards,

Bill Bonner

Contributing Editor, Investor’s Daily