In today’s issue:

- The Royal Navy has been downsizing for decades

- This is true of European military forces generally

- Rearmament will take years and cost billions

Although we’re living in an era of “big data”, artificial intelligence (AI) and supercomputing capabilities, sometimes a simple, anecdotal statistic captures everything one needs to know about a topic.

When it comes to the present capabilities of the Royal Navy, all one needs to know is that it has more admirals than warships.

As the empire declined in size, so did Britain’s naval requirements. During the Cold War, European NATO members worked with the Royal Navy to provide for the defence of NATO territorial waters.

Elsewhere, the US Navy stepped in to fill the gaps left in key international seaways, such as the Straits of Hormuz, Bab-al-Mandab, Malacca, Formosa and Gibraltar.

Such became the norm under Pax Americana. Once the Cold War ended, European NATO members including the UK reduced military spending dramatically.

But now the US is openly threatening to at least partially withdraw its military commitment to NATO, leaving Europe in something of a panic.

And so, at an emergency European NATO members’ summit held last Monday in Paris it was quickly decided that everyone had to stop messing around and get serious about rearmament.

Get serious with serious money, that is. They now appear determined to significantly increase their defence budgets.

European defence stocks rose sharply on the news. Industry leaders BAE Systems and Rheinmetall were up more than 10%.

We’ve been pushing European rearmament as an investment theme for several years. Although we’ve been hopeful the Ukraine war would wind down, the bigger story is Europe’s growing recognition that it now needs to provide for its own defence. This I wrote in late 2023:

One investment theme we here at Southbank Investment Research have been pushing all year is that of defence. Could it be that, with the end of hostilities in Ukraine, defence stocks are in for a correction?

While that might indeed be the knee-jerk reaction, I would look to jump in and buy on any major dip. Why? Do I think that a peace settlement won’t hold?

No, I think it will. But it will hold in part because of what I believe is likely to be a general European rearmament following the largest conflict on the continent for nearly 80 years.

Europeans have just relearned a lesson in classic balance-of-power politics. Large imbalances lead to conflict and, once balance is restored, peace becomes sustainable.

So, I’m not at all surprised by recent developments, including the rally in European defence stocks. It’s a reflection of the new reality.

But there is another, potentially far more surprising possibility to consider here: how will Europe go about strengthening its defences?

There might be many angles. But there’s a shocking one that was raised by none other than former German Foreign Minister Joschka Fischer in late 2023:

“We have to restore our deterrence capability,” Fischer told Zeit Online. Although he doesn’t like the idea of it “at all,” he says, there is no way around it: “As long as we have a neighbour Russia that follows Putin’s imperial ideology, we cannot refrain from deterring this Russia.”

Asked whether deterrence also included Germany acquiring its own nuclear weapons, he said: “That is indeed the most difficult question. Should the Federal Republic of Germany possess nuclear weapons? No. Europe? Yes. The EU needs its own nuclear deterrent.” After all, the world has changed, and Russian President Vladimir Putin is “also working with nuclear blackmail.”

How probable is it that German and its European allies decide that, in the post Pax Americana world, Europe needs its own nuclear deterrent?

In a way, they already do in France. But is the current French deterrent alone a sufficient umbrella for all of the EU? Probably not. If the EU decides to go down the nuclear road, some expansion beyond France’s current capabilities is almost certainly necessary.

Fortunately, Europe already has a modern defence industry capable of building delivery systems for a variety of nuclear weapons. And the plutonium for those weapons can be produced from French and other EU members’ nuclear reactors.

However, it takes a great deal of uranium to produce plutonium. The ratio by weight is about 4,000:1. If the EU is about to start on a bomb-building programme, demand for uranium is only going to increase.

My colleague, James Allen, sees tremendous potential in the nuclear industry. From fuel production to reactor construction, and in particular, new small modular reactor (SMR) technology. In fact, he is currently recommending several companies to his readers on this theme. If you’re interested in learning more about his work in this area you can do so here.

It will be interesting to see what the new German governing coalition decides to do. At a minimum, it’s likely to be far more nuclear power friendly than the one it replaces. But will it support the development of an EU nuclear deterrent?

Mr. Fischer clearly hopes so.

Regardless, European demand for nuclear power, whether for peaceful or deterrence purposes, is only going to increase from here.

Whether it goes nuclear or not, Europe urgently needs to address the de facto ending of any possible “free riding” under a Pax Americana. The first step is to address the severe imbalance of military power vis-à-vis Russia. A nuclear deterrent would be perhaps the most effective means of doing so.

“Si vis pacem, para bellum,” a classical Roman saying, translates as “If you desire peace, prepare for war.”

There is some ancient wisdom there. Whether nuclear or no, rearmament needn’t be destabilising. It needn’t lead to war. It could well do the opposite.

All countries share borders: land, maritime or both. Some of these are better defined and more clearly recognised than others. If some additional defence spending today helps to deter aggression tomorrow, that’s no bad thing.

“Good fences make good neighbours”, wrote the US poet and Nobel Laureate Robert Frost. He may have been thinking along similar lines.

It’s not pleasant to think of defence, including nuclear deterrence, as a growth industry. But with the US now focused on putting its own house in order, Europe’s military shortcomings are unlikely to change – at least not until it rebuilds its own capabilities and global tensions, from border disputes to broader conflicts find some resolution.

Until next time,

John Butler

Investment Director, Fortune & Freedom

Not Cheaper by the Dozen

Bill Bonner, writing from Baltimore, Maryland

“I will very quickly deflate. We are going to take inflation, and we are going to deflate it. We are going to deflate inflation. We are going to defeat inflation. We’re going to knock the hell out of inflation.”

– Donald Trump, on the campaign trail

“Inflation is back… I had nothing to do with it.”

– Donald Trump, last week

Today’s inflation weather report:

Three percent CPI… feels like 10%.

On the radio, a call-in show:

“I went to the grocery store to buy eggs. I couldn’t believe it; they were $8 a dozen.”

“That was cheap,” answered another caller. “I had to pay $12… that was a dollar an egg.“

“Heck,” began a third, “I couldn’t find any eggs. The store was out of them.”

Eggs have become precious. Our chickens still produce them. But now they are all golden.

This morning, we took a bag with three dozen eggs to our son who lives in the city. Street value: as much as $36 dollars.

“Psst… here they are,” we said in hushed tones, opening the bag so he could see the cartons.

“Not too loud, Dad… I don’t want to get robbed on the way back to the office.”

Eggs are shooting up in price because of a ‘supply shortage.’ The bird flu has cut output. The price (at $5/doz.) has gone up 238% over the last four years.

Inflation is on the march. We saw last week that the feds’ inflation calculation substantially understates the real impact of inflation on household budgets. Everyday items – such as eggs – cost more than the official CPI suggests. This means that ordinary families, buying ordinary things, are getting ordinarily poorer.

And the Producer Price Index is rising at a 3.5% rate – the fastest in two years.

Even by the feds’ own figures, prices are edging up more quickly. Last Wednesday’s report showed the CPI rising at a 3% rate. Take out the outliers, in what economists call the ‘trimmed mean,’ and you get a more accurate picture. It shows inflation rising at a 5% rate.

Or if you used the statistical methods of the 1980s (before the BLS changed the formula) you’d get an inflation reading of about 10%.

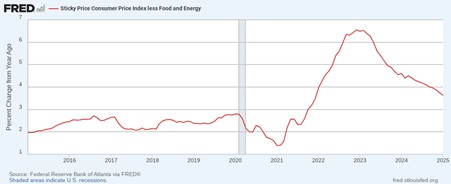

‘Sticky’ inflation, which excludes rising food and energy costs, is stuck at around 3.6% growth, year-over-year, according to the Atlanta Fed

‘Sticky’ inflation, which excludes rising food and energy costs, is stuck at around 3.6% growth, year-over-year, according to the Atlanta Fed

These ‘inflation’ figures – whichever ones you choose – clock the decline of the US dollar. Post-1971, America’s money has been unreliable. You could buy a dozen eggs in 1971… and a dozen today. Same eggs. Not noticeably better or worse. But the price has changed. They were 45 cents a dozen back then. Today, given all the innovations, tech improvements, etc… they should be much cheaper; instead, they’re at least ten times as much – in dollars.

Gold has historically been a more reliable measure of wealth. But it too is giving us a very different reading today, as opposed to 50 years ago. In 1971, an ounce of gold would have bought 44 dozen eggs. Today, it buys about 550 – if you can find them.

Naturally, if people have a choice, they will spend the depreciating currency (the dollar) and hold onto the appreciating one (gold). And once this notion gains traction, gold rises even more (meaning, other things go down faster).

Reuters:

Goldman Sachs raises year-end gold price forecast to $3,100

Goldman Sachs on Monday raised its year-end 2025 gold price forecast to $3,100 per ounce, up from $2,890, citing sustained central bank demand.

The bank estimates that “structurally higher central bank demand will add 9% to the gold price by year-end, which combined with a gradual boost to ETF holdings as the funds rate declines.”

However, if policy uncertainty, including tariff concerns, remains high, Goldman sees the potential for gold to surge to $3,300 per ounce by year-end due to prolonged speculative positioning.

Policy uncertainty seems like a certainty.

So does more inflation.

More next time… why the price of eggs, in terms of gold, shouldn’t change. Neither should the price of stocks.

Regards,

Bill Bonner

Contributing Editor, Fortune & Freedom

For more from Bill Bonner, visit www.bonnerprivateresearch.com