In today’s issue:

- Banks were the best performing FTSE 100 sector last year

- The property market is now flashing a warning signal

- A sharp correction may now be imminent

In recent months I’ve written frequently about how US “Big Tech” is vulnerable to a major market correction. That may now be playing out.

But there is another market sector – one that is more out of the spotlight yet quite close to home – that is vulnerable, in my opinion, to a sharp correction over the coming months: UK banks.

Over the past year, banks were the best performers in the FTSE 100 index, and by a wide margin. Rising by 67%, they’ve outperformed the broader market by over four times.

That might seem surprising. After all, the Bank of England began to lower interest rates last year. This would normally reduce banks’ net interest margins between deposits and loans.

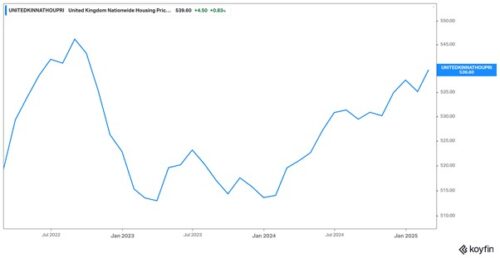

Moreover, house prices haven’t risen by much of late. In fact, they’ve failed to keep pace with inflation and remain below their level from several years prior, when interest rates were lower.

Source: Koyfin

Source: Koyfin

Mortgage originations (the process to complete a mortgage transaction) have seen only weak growth too. This should not be surprising given the stagnant state of the economy overall.

So, how does one explain their stellar performance?

Part of the explanation has to do with valuations. The banks had never really recovered from the global financial crisis of 2008-9. Due to the impaired legacy assets carried on their balance sheets, investors weren’t willing to pay high multiples for their earnings.

Those earnings, however, have held up rather well over the past year. The Bank of England may have cut rates, but the banks are still enjoying historically high interest rate margins, supporting earnings.

Why should that be? Isn’t there competition in banking?

Some, but not a great deal, and less than there was there was prior to the global financial crisis, which resulted in much consolidation.

Consolidation normally favours the consolidators. They have more market power to maintain interest rate margins than ever before.

But there is a limit to how much banks can grow earnings in a stagnant economy, one that has tipped in and out of recession in recent years.

In my opinion, it is only a matter of time, perhaps a short time, before one or more major banks post a quarter of poor earnings. Not necessarily due to reduced margins, but surprisingly weak volume of new lending activity.

When that happens, banks might be in for a sharp correction. How sharp?

Well, historically, in economic downturns, the worst performing market sectors including the banks and real estate investment trusts (REITs).

Naturally, they’re normally highly correlated with one another, given how much bank earnings are dependent on mortgage lending for growth.

And yet, over the past year, in sharp contrast to the norm, the banks have performed extremely well even as the REITs have outright declined amidst a weak property market.

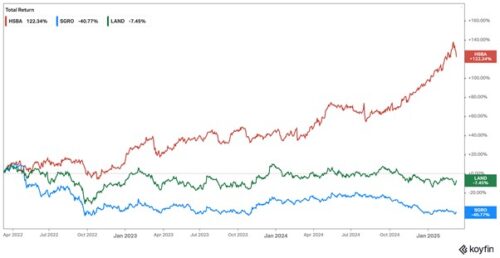

Here is a chart of bank bellwether HSBC and the two largest UK REITs, SEGRO and Land Securities:

Source: Koyfin

Source: Koyfin

Notice the correlation back in 2022 and much of 2023. But in 2024, HSBC broke into a strong, exponential uptrend while the REITs declined.

The relative gap in performance has been huge. One of these two market sectors may thus be wrong about the state of the economy and the state of the property market specifically.

Given what I can see, I trust the REITs more than the banks. They’ve been riding high on the tailwinds of high interest rate margins and consolidation. Such factors can support earnings growth for a time, but that time eventually runs out.

As mentioned above, if history is any guide, both sectors are likely to do poorly if the UK remains mired in recession this year. I’d avoid both. But the banks are probably in for a harder fall, given the starting point.

Fortunately there are several market sectors that not only tend to hold their value in recessions, but can actually outperform. If you’d like to know which I recommend you hold at present, you can find out how to discover those here.

Until next time,

John Butler

Investment Director, Investor’s Daily

The Last Temptation of Musk

Bill Bonner, writing from Baltimore, Maryland

Live happily. Live hidden.

– French proverb

Poor Elon. Such a genius. Such a fool.

Bullied as a child. Somewhere ‘on the spectrum.’ Elon set out to prove that he was the greatest human being who ever lived. He would make more money than anyone… start more businesses… develop more technology… and even put humans on Mars… the first ever extra-terrestrial colonization by our species. Or, maybe any species.

A polymath. A tech rock star. Inventor. Investor. Innovator…and now… in over his head.

The public is turning against his cars. Investors are selling his stock. His net worth is collapsing. His influence is waning. His popularity is plummeting. Newsweek:

Elon Musk, the world’s richest man, saw his net worth plummet by more than $100 billion in 2025, according to the Bloomberg Billionaires Index. The decline is largely tied to Tesla’s struggling stock price, broader investor concerns about the increased competition in the electric vehicle (EV) market, and the knock-on impacts of Musk’s political activities on his business ventures.

USA Today:

Tesla stock was the biggest S&P 500 loser on Monday and for 2025 as Musk’s politics according to Investors Business Daily reports, having dropped 45% so far this year and 54.5% from the record high of $488.54 set on Dec. 18.

Today, we shed a tear of sympathy for the nation’s most successful African-American immigrant. LA Times:

‘I’ve been betrayed.’ Tesla drivers are pushing back on Elon Musk

In late February, Culver City resident David Andreone posted a photo of his black Model 3 Tesla on Facebook and Instagram and offered it for sale for $35,000. Though the posts received dozens of comments, no buyers emerged. Andreone, 59, said he loves driving the car, but made the decision to sell after the brand’s association with founder Elon Musk became too much to bear.

Poor Elon. It was just a couple days ago when the DOGE champion was going to be a hero in outer space… The New York Post:

Elon Musk says SpaceX capsule will bring home stranded ISS astronauts ‘in a few weeks’

And then… hardly a day later. The Daily Beast:

SpaceX Mission to Rescue NASA Astronauts Stranded in Space Ditched Last Minute

It might have been enough for most men…

… getting into the electronic payments business early… and selling Paypal for $1.5 billion…

… or starting a company whose mission is to colonize Mars…

… or founding a global, satellite- based communications system at a cost of $10 billion…

… or building a whole new car company… worldwide… with a value of more than $1.5 trillion at its peak…

… or developing an AI company… or one that links the brain to computers… or owning the most influential social media company… or founding a recording company and putting up lyrics and voice of his own…

… or being selected as TIME’s ‘Person of the Year.’

… or being the world’s richest person ever… or fathering 14 children.

Merely reciting his achievements is exhausting.

But all of this was not enough for Elon. Like Christ, tempted by Satan, he was offered political power; unlike Christ, he went for it.

Elon was not the first to imagine that government ‘waste’ could be eliminated… and that the feds could operate ‘efficiently.’

Indignation over wasteful spending has been a staple of the National Enquirer for decades. A half-century ago, your editor was a ‘source’ for the National Enquirer’s research and a regular voice for its outrage.

But with a surfeit of naivete… a shortage of cynicalism… and an excess of vanity… Elon got involved in politics. He’d been so successful at so many businesses… now he set out to be the most powerful private citizen in world history.

But politics and business don’t follow the same rules. Eliminate ‘waste’ in a business and you increase profits. But eliminate ‘waste’ in government and who cares? The taxpayers won’t remember… while the parasites won’t forget.

‘Waste’ is someone’s income; they’re not going to be too happy to give it up. And they’re going to use politics to a) get the money back and b) crucify the cost cutters.

The US spending machine is set up to waste trillions of dollars. And as Musk probes more deeply into the fat – especially in Social Security, Medicare, and the Pentagon – more and more political power will howl against him. It is only a matter of time before his patron – Donald Trump – begins to see him as a liability.

Regards,

Bill Bonner

Contributing Editor, Investor’s Daily

For more from Bill Bonner, visit www.bonnerprivateresearch.com