In today’s issue:

- Why it’s time to consider Australian coal stocks

- The currency gains alone could be enormous

- 3 ASX coal stocks to put on your watchlist

Two weeks ago, I lined up an interview with my mentor Greg Canavan. We discussed what I regard as the best investment opportunity for UK investors right now:

(Your browser might be blocking you from seeing this video. Please visit cookie settings and enable cookies to see the video on this site, or click here to watch it on YouTube.)

Today, I’d like to offer you a follow-up which puts a little more meat on the bone of that interview…

Why UK investors should consider Australian coal stocks

There are several compelling reasons for UK investors specifically to consider buying ASX-listed coal miners…

1. Coal demand remains strong despite green energy transitions

Despite ambitious carbon reduction targets, global coal consumption has remained remarkably resilient. In 2023, global coal use increased to a record 8.5 billion tonnes, according to the International Energy Agency.

China and India, the world’s most populous nations, continue to build new coal-fired power plants as they prioritize economic growth and energy security.

Australian coal producers benefit from their proximity to these Asian markets, with high-quality thermal and metallurgical coal ideally suited to meet this demand.

2. The Australian dollar’s weakness creates a favourable entry point

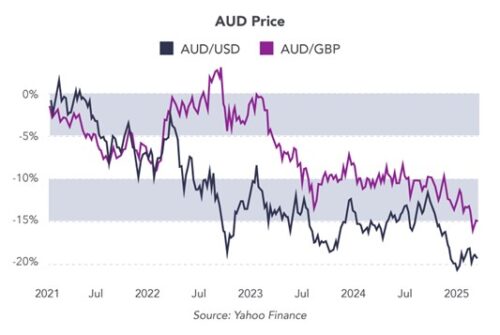

Because of weakness in the Chinese economy, and a record-breaking per capita recession, the Australian dollar has crashed over the past two years.

This currency trend creates an advantageous entry point for UK investors looking to gain exposure to Australian assets. Their valuable foreign currency buys them more Australian stocks.

Should the Australian dollar reverse these losses and return to higher long-term levels, foreign investors will profit from the exchange rate.

Alternatively, should the British pound fall on foreign exchange markets, investors’ Australian stocks will escape the devaluation.

3. Premium coal quality commands premium prices

Australian coal is among the highest quality in the world, with high energy content and relatively low impurities. This allows Australian producers to command premium prices, especially for metallurgical coal used in steel production, which has fewer substitutes than thermal coal used in power generation.

4. Stable regulatory environment compared to other mining jurisdictions

Unlike many resource-rich regions, Australia offers political stability, transparent regulations and strong rule of law. This reduces the risk of sudden policy changes, nationalisation or corruption that can plague mining operations in other countries.

5. Discounted valuations due to ESG pressure

Environmental, social and governance (ESG) investing trends have pushed many institutional investors away from coal, regardless of the economic fundamentals. This has created artificially depressed valuations for many coal producers, potentially setting the stage for significant upside as market realities force a reassessment.

Who are Australia’s Coal Champions?

If you’re going to invest in the Australian coal sector, the next question is which stocks to buy. Here are the three ASX-listed thermal coal companies to watch that we believe offer the strongest combination of value, growth potential and resilience in a challenging market.

Remember that you should always do full due diligence and make sure you’re comfortable with any associated risks before making any investments.

1. Whitehaven Coal (ASX:WHC) – Australia’s coal pure play

Whitehaven Coal stands as Australia’s premier independent coal producer, focusing exclusively on high-quality coal from the Gunnedah Basin in New South Wales. This single-minded focus makes Whitehaven a pure play on coal, without the diversification that dilutes exposure to coal prices at larger mining conglomerates.

The company boasts an impressive portfolio of both open-cut and underground mines, producing some of the highest quality, low-impurity coal in the world. This premium product commands top dollar in export markets, especially from Asian buyers seeking cleaner-burning coal for both power generation and steel production.

Whitehaven’s strategic advantage lies in its proximity to key Asian markets and its well-established export infrastructure. With a market capitalisation of approximately AU$5.5 billion, the company has the scale to weather market volatility while maintaining relatively low production costs.

Despite generating record profits in recent years and returning substantial capital to shareholders through dividends and buybacks, Whitehaven trades at a modest price-to-earnings ratio compared to broader market indices. This valuation gap reflects ESG-related market biases rather than operational fundamentals, creating a potential opportunity for value-focused investors.

2. Yancoal Australia (ASX:YAL) – scale and efficiency leader

Yancoal has emerged as one of Australia’s largest coal producers following its acquisition of Coal & Allied from Rio Tinto in 2017. The company operates multiple mines across New South Wales and Queensland, producing both thermal and metallurgical coal.

What sets Yancoal apart is its scale and operating efficiency. The company has consistently reduced its per-tonne production costs while maintaining output levels, allowing it to remain profitable even during periods of lower coal prices. This cost discipline positions Yancoal well for sustained profitability as coal prices stabilize at higher levels.

Yancoal maintains a strong balance sheet with relatively low debt levels following aggressive deleveraging in recent years. This financial strength gives the company flexibility to weather market volatility while continuing to pay attractive dividends to shareholders.

The company’s majority ownership by Yanzhou Coal Mining Company, one of China’s largest coal miners, provides strategic advantages in accessing Asian markets. This connection offers insights into Chinese demand patterns and potential preferential access to the world’s largest coal consumer.

Despite these strengths, Yancoal trades at a significant discount to its net asset value, reflecting market scepticism about coal’s long-term prospects rather than any company-specific concerns. For investors willing to look beyond conventional ESG narratives, this presents a compelling value proposition.

3. New Hope Corporation (ASX:NHC) – the diversified coal specialist

New Hope Corporation offers a slightly different investment proposition within the Australian coal sector. While primarily focused on coal production from its operations in Queensland’s Bowen Basin, the company has wisely diversified into other areas, including agricultural land holdings and strategic port investments.

This diversification provides a degree of downside protection while still offering substantial exposure to coal’s upside potential. New Hope’s flagship Bengalla mine is particularly notable for its low-cost production and long reserve life, providing a stable foundation for the company’s operations.

New Hope has distinguished itself through disciplined capital allocation and shareholder returns. The company maintains a policy of returning at least 50% of net profit after tax to shareholders through dividends, resulting in yields that have frequently exceeded 10% in recent years.

Management’s conservative approach to balance sheet management means New Hope operates with minimal debt, giving it significant financial flexibility. This strong financial position enables the company to consider opportunistic acquisitions when they arise, potentially adding further value for shareholders.

Despite these strengths and a track record of delivering shareholder value, New Hope trades at a significant discount to broader market valuations. This creates an attractive entry point for investors seeking both income and potential capital appreciation.

The last word on coal

While environmental concerns and the energy transition narrative have pushed many investors away from coal, market realities tell a different story. Global coal demand remains robust, prices have stabilised at high levels, and quality producers continue to generate substantial cash flows.

The three ASX-listed coal companies profiled here represent different approaches to capitalising on this disconnection between narrative and reality when it comes to the energy transition. These companies offer UK investors exposure to a sector that continues to play a crucial role in the global economy despite being written off by many.

The combination of strong operational performance, attractive valuations and potential Australian dollar appreciation creates a compelling investment case.

Until next time,

Nick Hubble

Contributing Editor, Investor’s Daily

Let’s Not Make a Deal

Bill Bonner, writing from Baltimore, Maryland

“To all Houthi terrorists, YOUR TIME IS UP, AND YOUR ATTACKS MUST STOP, STARTING TODAY. IF THEY DON’T, HELL WILL RAIN DOWN UPON YOU LIKE NOTHING YOU HAVE EVER SEEN BEFORE!”

– Donald Trump

The Houthis have seen a lot.

Whether they will be cowed as easily as America’s university students, we don’t know.

But when it comes to foreign policy, the less you know about a place, its history, its people…the easier it is to offer a solution to its problems. In this respect too, Mr. Trump is perhaps uniquely equipped to lead the empire.

Trump has brought ‘Big Man’ government to the US. That might be a good thing…the Big Man can do what more conventional leaders cannot. He could use his remarkable power to clean house, for example.

Or he could just make a mess messier, with more chaos and corruption.

Many are the interpretations of the Trump phenomenon. He is ‘setting things right.’ He is ‘destroying our democracy.’ He’s ‘saving America from the lib-tards.’ He’s creating ‘an oligarchy.’ He’s a ‘Russian asset.’ He’s a ‘populist.’ He’s an ‘authoritarian.’ Etc.

We prefer our own: That Mr. Trump has an historic mission of which he is unaware.

Fish gotta swim. Birds gotta fly. And late, degenerate empires gotta act like late, degenerate empires.

A wise and sensible leader would insist that the budget be balanced…and unnecessary wars brought to a swift close.

But that’s not what a late, degenerate empire does. Typically, it relies more and more on brute force and less on gentle commerce. And it finds a leader who is up the challenge. He has to keep the empire on course…to its own denouement.

The invincible Spanish Armada proved very vincible. Napoleon had to retreat from Moscow. The sun set on the British Empire. The Blitzkrieg bogged down in Stalingrad. Almost all great empires meet their Waterloo in a combination of debt and foreign policy. The Austro-Hungarians invaded Serbia, and set off WWI. By 1918 the Austro-Hungarian army was still in the field, but without ammunition or food…fighting for a starving empire that soon disappeared.

The original United States were famously not interested in foreign policies. They generally eschewed ‘foreign entanglements,’ treaties, international organizations, coalitions of the willing, nation building, defending democracy and all the other claptrap of today’s empire. Besides, they were fully occupied by dispossessing the Indian tribes who stood in their way, from sea to shining sea.

The first major break with the live-and-let-live tradition was the War Between the States in which the North insisted that the South do as it was told. A generation later, by the 1880s, the US had the world’s biggest economy. The temptation to empire was irresistible, led by Teddy Roosevelt, William McKinley and Woodrow Wilson.

And today, the US has more foreign entanglements than you can shake a stick at, with some 800 bases around the world ready to exert ‘full spectrum dominance’ over whatever hapless locals get in the way.

But nothing lasts forever. And already at the edges of the spectrum, the deep reds and violets are beginning to fade. The Financial Times:

Since 2017, Trump’s first year in office, trade has held more or less steady at just under 60 per cent of global GDP. But there’s been a decline in the US share of trade flows offset by an increase in other regions, particularly the nations of Asia, Europe and the Middle East. Trump 2.0 seems likely to bring more of the same: trade without America.

Nations get rich like individuals, by offering goods and services to others. As you’d expect, most developed and developing nations have increased the importance of trade over the last ten years. The one big exception is the US, where trade as a percentage of GDP has dipped to around 25%. The Financial Times:

America may be increasingly dominant as a financial and economic superpower but not so much as a trading power. Its share of global equity indices has exploded to almost 70 per cent. Its share of global GDP has inched up to more than 25 per cent. Yet its share of global trade is under 15 per cent, and has declined significantly in the last eight years.

A timber company executive in British Columbia described the light in his neck of the woods:

“It is impossible to replace the US in the short-term, but in the long-term, we are building up our contacts with China and Japan.”

And what about America’s leading industry — high tech? Fortune:

The U.S. may have the brains in leading AI chip development globally, but China will continue to have the brawn to manufacture applications for those chips, and that won’t change anytime soon, billionaire investor Ray Dalio says. “We do not have manufacturing, and we’re not going to go back and be competitive in manufacturing with China in our lifetimes, I don’t believe.”

As a trading partner, the US lost ground over the last ten years. Now it is an aim of US foreign policy — to reduce its trade with the rest of the world, making it less dependent on foreign imports.

The Big Man threatens, bullies, sanctions, tariffs, bombs — whatever it takes to make a deal. Trade slows. And the empire shuffles to its fate.

Regards,

Bill Bonner

Contributing Editor, Investor’s Daily

For more from Bill Bonner, visit www.bonnerprivateresearch.com