Editor’s Notes: It’s tempting to read stories like this—about America’s debt, tariffs, and political chaos—and dismiss them as someone else’s problem. After all, we have our own issues to sort out here in the UK. But whether we like it or not, the pound, our stock market, and even the price of our groceries are tethered to the health—and the recklessness—of the US economy.

Editor’s Notes: It’s tempting to read stories like this—about America’s debt, tariffs, and political chaos—and dismiss them as someone else’s problem. After all, we have our own issues to sort out here in the UK. But whether we like it or not, the pound, our stock market, and even the price of our groceries are tethered to the health—and the recklessness—of the US economy.

When the United States threatens to weaponise its currency or slap 100% tariffs on major trading blocs, it doesn’t just punish its rivals. It pushes up costs, disrupts supply chains, and injects volatility into every corner of global finance. The same goes for America’s rising debt burden, which has a way of driving up yields everywhere—yields that influence your mortgage, your investments, and your pension fund.

This isn’t about watching the spectacle from a safe distance. It’s about understanding how decisions made in Washington can—and will—shape your financial future here at home. That’s why we share perspectives like this: to help you see the dominoes before they fall.

Consider this an early warning, not just about America’s trajectory—but about what happens when an entire system convinces itself that the bill will never come due.

Men plan. Fate laughs.

—Jim Butcher

First thing this morning, comes this from CNN:

US President Donald Trump on Wednesday threatened Brazil with a crippling tariff of 50% starting August 1, according to a letter he sent to the country’s president, Luiz Inácio Lula da Silva.

In the letter posted on Truth Social, Trump alleged Lula is undertaking a “Witch Hunt that should end IMMEDIATELY!” over charges against its right-wing former president, Jair Bolsonaro.

And then from the president of all Americans himself…

The idea that the BRICS Countries are trying to move away from the Dollar while we stand by and watch is OVER. We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. Dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful U.S. Economy. They can go find another “sucker!” There is no chance that the BRICS will replace the U.S. Dollar in International Trade, and any Country that tries should wave goodbye to America.

Whatever else can be said about it, it’s a novel way to conduct foreign policy/trade policy/monetary policy…or whatever policy it is.

In his message to the BRICs, a group that includes major trading partners…and about a third of the whole world’s population, foreign nations were warned not to use anything but the dollar for international trade…

Or else!

Or else what? Or else Americans will have to pay a 100% tariff tax!

What sense does this make? And why is the US president meddling in Brazil’s internal affairs? In the absence of any other explanation, we wink at the reader and fall back on historical determinism.

What is our role, after all…but to do as History commands? In Salem we burned the witches. In WWI, we died in the trenches, just as we were meant to do. In the Great Depression, we went broke and stood in food lines. History – that tart – always gets what she wants. So what do we do now?

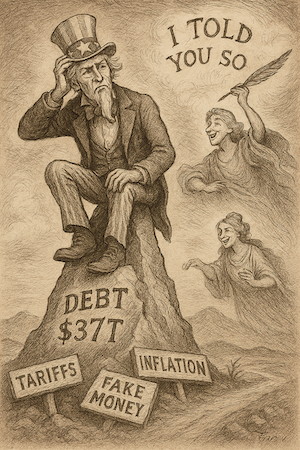

Here’s the context. The feds have just passed a huge new tax-borrow-print-spend program. Today’s debt — at $37 trillion — is now programmed to reach over $60 trillion in ten years. And the interest — already over $1 trillion annually — will soon reach $2 trillion annually.

The only possible relief could come from faster GDP growth to offset the rising debt. If deficits were to hold steady in the 6-7% range, for example, we’d need growth of 6-7% to stay even with it.

Currently, Deloitte projects 1.4% growth for 2025…and 1.5% for 2026. In other words, growth would have to quadruple to reach the target. And to make matters worse, every major initiative of public policy is now anti-growth.

- The aforementioned stifling of trade with (uncertain and arbitrary…almost whimsical)..

- The growing debt itself requires us to take money out of the ‘growth’ of tomorrow to pay the interest on money we borrowed to grow yesterday…as the debt grows, so does the anti-growth effect of it.

- Harpooning immigration and tourism…like Ahab, the feds have lashed themselves to the ICE-y whale; they are going down with it.

Back to History…that coquettish, mischievous tale of where we came from and where we are going…

The US has climbed the imperial mountain. Now, if it wanted to get down — which must be its ultimate destination — what would it do differently?

Undermine the economy and the dollar with deficits, debt, inflation and fake money? Check.

Drive away friends with arbitrary and unreasonable demands? Check.

Convince potential enemies that the only way to protect themselves is to ‘gun up?’ Check.

Make an impenetrable hash of all financial data…with funny money and fake interest rates? Check.

Strangle trade with constantly shifting tariff threats? Check.

Send the immigrants home, thereby reducing the labor portion of GDP growth? Check.

Spend more than we can afford? Check.

Put masked enforcers on the streets of America? Check.

Elect a leader who doesn’t know up from down? Check.

Dame History chuckles to herself…

“With you I am well pleased; you dumb SOBs.”

Regards,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily