In today’s Issue:

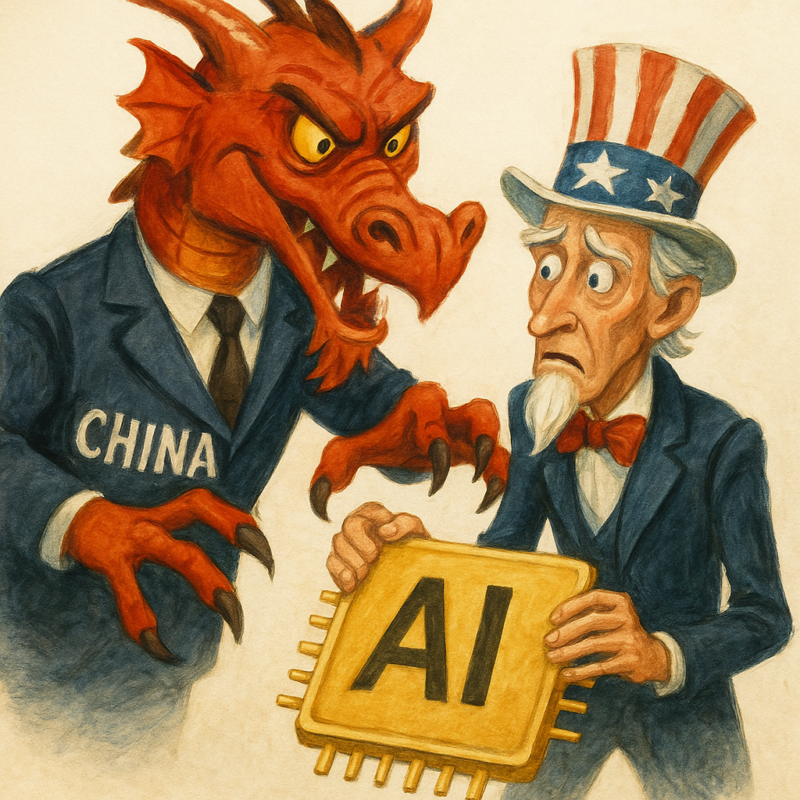

- Undercut, outmuscled and dependent on China

- AI is the latest target

- A China-proof AI investment

It’s the one issue that EU Commission President von der Leyen and President Trump can agree on: “On this point, Donald is right — there is a serious problem,” Ursula admitted back in June. China has hijacked the global economy.

First, it hollowed out our manufacturing. It replaced our textile industries. It has a chokehold on strategic minerals and their refining. It undercut the West on labour. Cars, steel, military grade electronics…you name it, China dominates us.

You might’ve noticed the pace of China’s ability to outcompete is accelerating too. How long did it take them to out-muscle Tesla in the EV space?

Even the crown jewel in America’s economy is under threat. Back in January, China revealed its own Artificial Intelligence program, DeepSeek.

They claimed it was far more energy efficient to train and run than the Western AI programs. The news triggered a trillion-dollar meltdown in US AI stocks in a single day. It wiped $600 billion off Nvidia alone. That’s the largest one-day loss for a single stock ever.

Since then, the story has gone a bit fuzzy. It’s not clear the claims made about DeepSeek were entirely truthful. It may have used Western computer chips in a way that can easily be mimicked by American AI companies, for example.

But what if DeepSeek was just the beginning of China’s ambitions?

I don’t mean the tech itself. What if the Chinese are on the cusp of a far bigger attack on Western tech dominance than DeepSeek?

Not to mention robbing the US stock market of the only sector that has actually performed well over the past few years. If the Magnificent 7 bubble pops, the US stock market would plunge.

The DeepSeek drama proved the potential, if only for a day. But it might’ve been a mere “proof of concept”. Once China decides to decimate a Western industry, it tends to leave little alive.

And the AI industry China has chosen as its next victim is computer chips.

You don’t need to invade Taiwan if you undercut its economy

For years, geopolitical strategists have warned about what a Chinese invasion of Taiwan would mean for the global computer chip supply. The country produces about 90% of advanced semiconductors.

What if the real threat is a Chinese plan to outcompete the island instead?

Recent news is chilling. China may have developed computer chips capable of outpacing NVIDIA’s. And they may have developed superior manufacturing techniques too.

All this puts the dominance of US companies in the sector at risk. And that means trouble for the US stock market too.

Computer chip maker NVIDIA is the darling of the Mag7, let alone the broader stock market. It has a decent stranglehold on the AI chip market. The company agreed to set up manufacturing in the US to secure supply.

But if the media stories about new Chinese competition are confirmed, the stock market leaders of the past few years are about to go the way of so many Western companies that China undercut. Not out, but definitely down.

US tech will be the Nokia and Kodak of the future.

And history tells us that stock market bubbles like the Mag7 don’t pop slowly or mildly.

Of course, the speculation about China’s chips could prove to be questionable. Just as the DeepSeek story was, in the end.

But it’s very noticeable that China is targeting the one sector of the US economy and stock market that is actually performing well. And the sector that makes Taiwan so valuable to the West.

We’re about to find out the hard way whether China can outcompete in computer chips. There won’t be much left to invest in. Except…

The last way to profit from the AI boom

What Western investors miss in the China story is how it impacts overall demand. By undercutting Western companies, the Chinese also engineer truly vast expansions of consumption.

Chinese companies haven’t just stolen market share off Tesla. They’ve also increased the size of the EV market dramatically.

Not only that, a lot of the tech which overregulation kills in the West is already commonplace in China. Drone food delivery, robots and self-driving cars are all up and running there.

The point is that China doesn’t just steal. It also rolls out tech at scale much faster.

Therein lies the opportunity…

Not many investments are robust to China’s desire to eat capitalism. If they want to undercut you, look out!

But there is one industry that China won’t be able to outcompete on. Despite voracious global demand, China only provides a small chunk of new supply today. In fact, Western nations have vast de-facto supplies of it hidden underground, waiting to be used if the price is right.

That means China can’t engineer a shortage or control supply, like so many other inputs needed to keep the AI boom going. But it can trigger a boom in demand.

On August 27th I’ll reveal what this investment is.

Until next time,

Nick Hubble

Editor, Investor’s Daily

P.S. China may dominate production—but it can’t control everything. On August 27th, we’re revealing the one critical investment China can’t undercut, control, or replace… but that it could help send soaring. If you want to know what it is—and why it could be the most overlooked play of the AI boom—don’t miss this.