- Andrew Marr discovers commentator’s curse

- The lifeblood of politics is taxpayers’ money

- Democracy is about to have a heart attack

It wasn’t supposed to be like this. In July 2024, Journalist Andrew Marr was celebrating Labour’s decisive election victory on BBC Question Time:

“I think, just having a stable government that will be there for five, maybe ten years, who knows, but with sort of ordinary down to earth serious people talking like the rest of us, in charge of the government, and a plan that doesn’t shift very much for investment, is going to mean a wall of money coming into this country from around the world.

[…]

For the first time in many of our lives, actually Britain looks like a little haven of peace and stability. And that in itself is going to draw money into this country.”

Isn’t that precisely what journalists were saying about Boris Johnson’s majority in 2019?

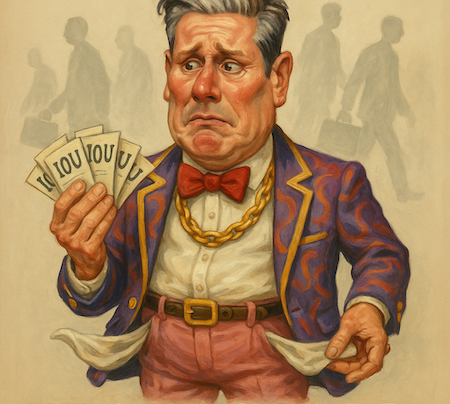

Labour has been anything but stable. They don’t speak like anyone I know, and behave like the worst Tory landlord stereotype.

Less than a year after Marr’s election analysis, his headline in The New Statesman was a bit different: “Keir Starmer faces war on all fronts.” And far from ten years, the Prime Minister may not make it past Autumn, he told LBC.

Why? None of the reasons should come as a surprise…

What went so wrong so fast for Labour?

Did we have another pandemic? Was there a financial crisis? Did stocks crash? Did we have a recession? Did unemployment or inflation surge? Did Brexit happen again?

Nope. And yet, it feels like there’s been rather a lot of grief…

The bond market comes top of the list. “Gilts sell-off pushes UK borrowing costs to 27-year high,” reported the Sunday Times last week.

At this rate, the only “wall of money” that’ll hit the UK is one from the IMF or Bank of England.

Back in January, things were especially dire. The New York Times reported: “In global market rout, Britain is the ‘Weakest Link’. And “Investors are demanding sharply higher yields on government bonds, threatening to upend the Labour Party’s plans to reinvigorate a stagnant British economy.”

Nobody ever ponders whether the economy is stagnant because of the government’s plans to reinvigorate it. Reagan said it best: “A big businessman is what a small businessman would be if only the government would get out of the way and leave him alone.”

The “wall of money” Marr predicted may actually be heading in the other direction. Yahoo Finance:

The UK is expected to suffer the largest outflow of millionaires globally in 2025, according to data from Henley & Partners, marking a bleak reversal for a country once seen as a magnet for global wealth.

The Henley Private Wealth Migration Report 2025 forecasts a net loss of 16,500 high-net-worth individuals (HNWIs) from the UK this year, the highest such outflow ever recorded by the firm in the past decade of tracking global wealth migration trends. For the first time, Britain surpasses China, which has consistently topped the list for millionaire departures over the past 10 years.

Critics were of course quick to report that this was wrong. The data doesn’t suggest an exodus is happening at all. Which is an odd way to criticise a prediction about what will happen in the future.

Marr’s monologue also assumed that raising taxes would raise more revenue to fix budget black holes. Which was laughable at the outset.

But here’s the thing about the Laffer Curve, which explains why higher taxes result in less revenue. It is only a question of time before it comes true. That’s because higher taxes mean lower economic growth over time.

So, tax hikes will raise progressively less tax revenue over time because they slow the economy. And tax cuts will raise progressively more because they allow the economy to grow faster.

But if tax hikes are already failing to raise revenue months after they were imposed, that is only the beginning of their failure. Things will only get worse for Labour’s chosen crackdowns.

And that spells a crisis for politicians, not just the economy.

The lifeblood of politics is tax revenue

“The problem with socialism is that you eventually run out of other people’s money,” pointed out Margaret Thatcher.

Alexander Fraser Tytler, Lord Woodhouselee, explained that democracy isn’t much better, back in Robert Burns’ day:

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the public treasury with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship.”

Yikes!

Back in February, a study for Channel 4 claimed 52% of 13- to 27-year-olds agree that “the UK would be a better place if a strong leader was in charge who does not have to bother with parliament and elections.”

The point is that taxpayer money is the lifeblood of democracy. And Labour politicians are running out of it. Which is causing a crisis of confidence.

I mean, what’s the point of politicians if they don’t legitimise taking other people’s cash?

Bolt before they shut the gates

What happens next?

In Thursday’s Investor Daily I’ll explain why I’m expecting a combination of austerity, inflation and defaults.

Economists will tell you it’s impossible to have austerity, inflation and defaults at the same time. But they’ll be the same economists who said inflation can’t happen in 2021, that it’ll be transitory in 2022 and that it was a national emergency they resolved in 2023.

Even economists’ false sense of security is something we have a quote about, from a time when we learned not to heed it. James Callaghan, Labour’s leader and Prime Minister, in 1976:

We used to think that you could spend your way out of a recession, and increase employment by cutting taxes and boosting Government spending. I tell you in all candour that that option no longer exists, and that in so far as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inflation into the economy, followed by a higher level of unemployment as the next step. Higher inflation followed by higher unemployment. We have just escaped from the highest rate of inflation this country has known; we have not yet escaped from the consequences: high unemployment…that is the history of the last 20 years.

Strangely enough, it’s also the history of the last 20 years!

By the way, the price of one investment went up twentyfold during that era. If you think history is rhyming like I do, check this out.

Until next time,

Nick Hubble

Editor at Large

P.S. I’ve been tracking this story for months now — the collision of AI ambition, collapsing government credibility, and a desperate need for rate cuts. And I think 17 September could be a line in the sand. That’s when the Fed is expected to move. If they do, one obscure $38 investment — what I call the “AI Master Key” — could be the biggest winner. I’m not talking about Nvidia or some hyped-up small cap. This is different. And you can still get in ahead of the move. Here’s what you need to know.